The BOTTOM LINE

- Innovation is key

- Portion-controlled options are popular

- Restructuring companies due to the pandemic

Comfortably convenient

Consumers look for tasty sweet goods, but also seek portion-controlled options.

Liz Parker, Managing Editor

The sweet goods category, which includes everything from brownies to doughnuts to Danishes, overall experienced growth from 2021 to 2022.

Sweet Goods

STATE of the INDUSTRY

SPONSORED BY

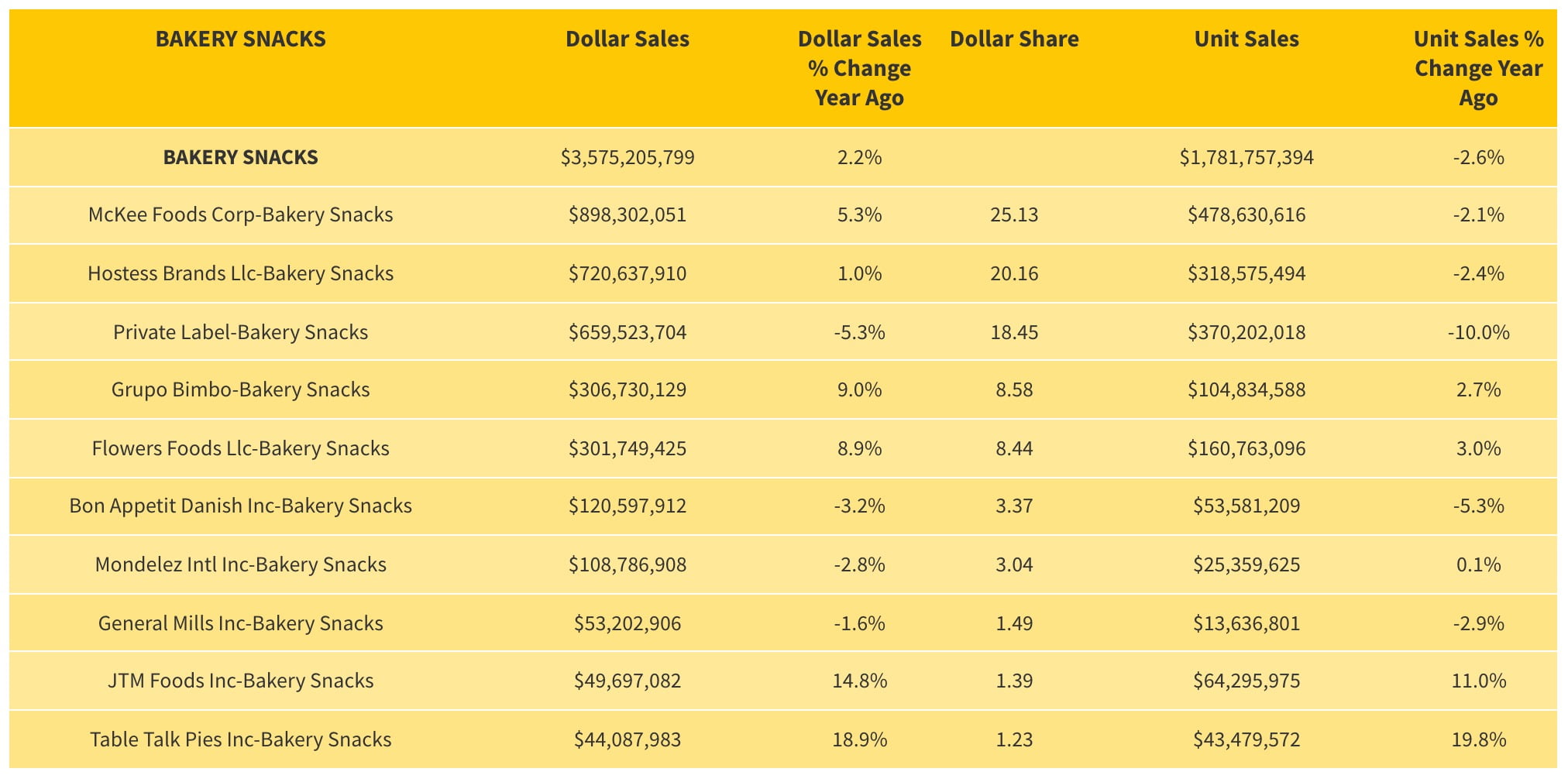

Market data

According to IRI (Chicago) data from the past 52 weeks, which ended on March 30, 2022, the “center store doughnuts” category was up 7.8%, with total sales of $1.834 billion.

The full-size doughnuts category accounted for $1.7 billion of that, and it increased 7.3%. Hostess Brands LLC took the lead spot, with $559 million in sales and a nice 24.1% increase, and Grupo Bimbo followed, with $353 million in sales and a 2.6% increase. McKee Foods followed that, with $236 million in sales and a slight decline of 0.4% from 2021.

The “perimeter doughnuts” category brought in $1.095 billion in sales, with an 18.4% increase from last year. The “perimeter full-size doughnuts” category brought in $555 million in sales with a 7.5% increase. Private label led the category, with $536 million in sales, and rose 6.7% from last year. LY Brothers Corp. brought in $9.384 million, with a 36.1% increase. Also of note is Bill Knapps, which brought in $509,000 in sales and experienced a 135.1% increase.

HOVER OVER CHART TO SCROLL DOWN

Source: IRI Market Advantage, Integrated Fresh, Total U.S. - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers), 52 Weeks Ending 03-20-22

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

The “perimeter pastry/Danish/coffee cakes” category brought in $1.620 billion sales, with a 15.1% increase from 2021, and the “perimeter sweet rolls” category accounted for $406 million of that, with a 14.6% increase. Private label brought in $240 million, with a 19.9% increase, and Grupo Bimbo brought in $39.2 million, with a slight decrease of 1.7%.

In the “perimeter Danish” subcategory, which brought in $334 million and experienced a 17.9% increase in sales, private label brought in $252 million, with a 31.1% increase in sales. Grupo Bimbo brought in $28.8 million, but with a 31.7% decrease from last year, and The James Skinner Baking Co. brought in $15.6 million, with a 2.5% dip from last year. It’s worth noting Starbucks Coffee Co., as well, which brought in $4.9 million in sales and had a large 56.8% increase from 2021.

The “perimeter pastries” subcategory brought in $297 million in sales, with a 20.1% increase from last year, and private label brought in $177 million of that, with an 18.5% increase. The Simply Good Foods Co. followed, with $20.6 million in sales and an astonishing 127.3% increase, and Mondelēz International brought in $15.7 million, with a 9.3% increase.

The “perimeter coffee/crumb cakes” subcategory brought in $211 million, with a 14.3% increase, and private label accounted for $164 million of that, with a 21.9% increase. Grupo Bimbo brought in $9 million, with a 21.9% increase.

The “center store pastry/Danish/coffee cakes” category brought in $1.188 billon, with a 9.7% increase, and “center store sweet rolls” in that category brought in $590 million, with a 6.3% increase. McKee Foods was the leader there, with $259 million in sales and a 3.5% increase. The “center store coffee/crumb cakes” subcategory brought in $135 million, with a 10.5% increase from last year, and Hostess Brands LLC was the winner, with $89.8 million in sales and a 15.4% increase.

The “center store pastries” subcategory brought in $105.5 million, with an 18.6% increase in sales, and Bon Appetit Danish brought in $29.57 million of that, with a 17.8% increase. Grupo Bimbo brought in $26 million in sales, as well, with a 19.3% increase, and Hostess Brands rose by 73.3%, with $10 million in sales.

Finally, the “perimeter brownies/squares/bars” category brought in $330 million in sales, with a 10.5% increase. The “perimeter brownies” subcategory brought in $316 million of that, with an 11.4% increase, and private label led the pack with $236 million and a 13.6% increase. Mondelēz International brought in $36.6 million, with a 3.5% increase. Kohlberg & Co. should also be noted, with $2 million in sales but a 103.9% increase from last year.

Looking back

Christine Prociv, senior vice president, marketing, innovation, and R&D, Aspire Bakeries, Los Angeles, says that consumers have been prioritizing convenience and comfort when it comes to sweet treats, especially as they’re returning to the office.

“IW (individually wrapped) brownies are also growing since consumers are looking for a sweet, portion-controlled, and safely packaged indulgence.”

— Christine Prociv, senior vice president, marketing, innovation, and R&D, Aspire Bakeries

“Otis Spunkmeyer’s individually wrapped (IW) offerings deliver on this desire for grab-and-go options, without compromising on freshness or taste. IW brownies are also growing since consumers are looking for a sweet, portion-controlled, and safely packaged indulgence.”

David Skinner, marketing manager, James Skinner Baking Co., Omaha, NE, says that trends aren’t coming to shelves as quickly as they were before the pandemic—and that many consumers may even see a trimming down of available options in the in-store bakery [ISB] due to supply chain issues.

Despite all of the challenges of the past couple of years, one bright area Skinner noticed is that foot traffic from less traditional ISB demographics, namely older Gen Z and younger millennials, increased significantly.

Courtesy of Aspire Bakeries

“In the past, this consumer has shied away from ISB because of the large packaging sizes and perceived quality of the products. These demographics have a different approach to baked sweet goods—they’re not looking for products that are adequate for everyone but perfect for someone. Because of this, you’re noticing smaller pack sizes/counts and more premium and unique offerings from the ISB,” he explains.

“Also, regarding the ingredients panel, the ISB affords more forgiveness from the consumer since it falls into a more indulgent realm. By carving out market segments and generating consumer personas, we can make products that are tailored to this underserved demographic,” Skinner adds.

He says that due to the pandemic, the James Skinner Baking Co. had to restructure a lot of its business in the past two years to continue to work in this social and economic environment.

“We had to pivot some of our growth strategies and focus more on the ISB vs foodservice accounts. The business has certainly changed over the past two years and continues to change at a rapid pace. So many uncontrollable variables that are pillars of the business are in an uncertain area right now. Because of this, our speed to market with new and innovative products has been lagging. While we continue to innovate in our R&D center, it’s much more difficult to get concepts to the store shelves,” he shares.

“In addition, our product portfolio has been trimmed due to the availability of certain unique ingredients we use. Despite these challenges, we’re continuing to grow the company with our core products and look forward to some degree of normalcy.”

Tina Lambert, vice president of innovation and growth, Hostess Brands, Lenexa, KS, says that to address external and internal challenges over the past several years, Hostess has had to become more agile.

Courtesy of Hostess Brands

“During this time, we’ve worked to create a best-in class business model and clear strategy to sustain our business momentum and capitalize on opportunities in the fast-growing snacking space. From an external standpoint, our size and agility have helped us consistently overcome supply-chain challenges,” she notes.

“In addition, we’ve been able to successfully leverage the increase in at-home snacking to grow our sales and market share. We’re also investing more in innovation and marketing, which is helping to drive growth. In fact, over the past three years, our new product sales have exceeded our target to have 15% of our annual revenue come from new products launched in the past three years,” continues Lambert.

“We also have been able to successfully integrate Voortman Cookies’ better-for-you wafers business into the Hostess Brands portfolio and in the process, have increased Voortman Cookies sales in the U.S. by over 20% since our acquisition of the brand,” she says.[EAP1]

“At Hostess Brands, we are driving innovation in the sweet baked goods category. Our product innovation contributed 27% to the Hostess brand’s growth and 12% to its category growth over the past year,” Lambert finishes.

Looking forward

Anything pumpkin-flavored will continue to trend in 2022, with brands releasing autumn-themed pumpkin sweet goods even earlier than in the past. For example, in August 2021, Dunkin’ released its pumpkin donuts and Munchkins, and that same month, Entenmann’s also released its pumpkin collection.

Foodservice operators also continue to innovate to appeal to various consumer groups, such as Gen Z and millennials. In September 2021, US Foods released new products catered to these two groups, including a Chef’s Line Iced Pumpkin Swirl Loaf Cake and a Chef’s Line Salted Caramel Chocolate Brownie.

“We’re bringing fresh ideas to our operators that provide the labor savings and versatility they need today with the innovation they’ll need moving forward as they cater to the next generation of diners,” said Stacey Kinkaid, vice president, product development and innovation, US Foods.

[EAP1]I know wafers are generally considered cookies not sweet goods, so feel free to take this paragraph out.

Lambert says that Hostess has introduced new snacks to appeal to millennial parents and their families, including Hostess Cr!spy Minis, which are crunchy, crispy, poppable snacks that feature two layers of creamy filling between crisp wafers. They come in a resealable stand-up pouch for on-the-go snacking and sharing, and are available in three flavors: Mint Chocolate, Cookies and Crème, and Strawberries and Crème.

The brand has also introduced on-the-go snacks for consumers who frequent convenience stores, including Hostess Boost Jumbo Donettes, which contain slightly less caffeine (50-70 milligrams) than one cup of coffee, and are available in two flavors, Chocolate Mocha and Caramel Macchiato. The Jumbo Donettes are three times bigger than original Hostess Donettes mini doughnuts, and are caffeinated with coffee bean extract.

In addition, the brand released its Devil’s Food Cake Jumbo Honey bun, which is glazed and made with real cocoa.

“This fall, we are introducing our biggest innovation of the year, Hostess Bouncers, which are poppable, bite-sized versions of popular Hostess snacks and are a perfect lunchbox snack. They come in three varieties, including Cinnamon Donettes,” Lambert shares.

Skinner says that although the James Skinner Co. hasn’t had a new product in its branded line, it has developed a great number of new products while partnering with its private label customers.

“Unfortunately, I’m not privy to say which items we developed, but I can share that many of them involve chocolate in multiple forms,” he reveals. “Once this challenging environment shakes out a bit, we’re going full force in experimenting with baked sweet goods that use a lot of chocolate.”

Prociv says that in January 2022, Otis Spunkmeyer launched a multi-serve, 8” chocolate chip “pizza cookie” for the foodservice industry.

“This concept was an extension of a similar item we sell to pizza chains, which has been very successful especially as people have been ordering more takeout and delivery than ever before. Now, foodservice establishments can offer the Otis Spunkmeyer cookie brand in a new format on their dessert menu,” she notes. “We recommend it warmed up and topped with ice cream for an indulgent sharing experience.” SF&WB