The BOTTOM LINE

- Category is up 13.3% from last year

- There is opportunity for innovation

- Ethnic flavors, premiumization, and nostalgic flavors are trending

Hitting the sweet spot

Category shows continued growth, offering comfort and convenience to consumers.

Joyce Friedberg, Contributing Writer

Consumers still have a sweet tooth for desserts. In fact, 53% of consumers said that they had dessert within the past day based on a recent survey from Datassentials. Even as we emerge from the pandemic, desserts are still very relevant as consumers look to indulge a sweet craving, with a treat that can offer familiarity, comfort, or nostalgia.

Desserts

STATE of the INDUSTRY

SPONSORED BY

Mike Mitchell, senior brand manager, retail marketing, Sara Lee has observed: “In retail (frozen desserts/frozen section only), the total category is positive for both sales and volume. Distribution is up slightly but it’s a velocity story. Even after a record breaking 2020, not only are more consumers entering the category, they are also buying more.”

Market data

Consumers turned to desserts at the height of the pandemic for an indulgent treat or as a way to help navigate the stress and uncertainty. Based on the latest market data, the dessert category is continuing to experience growth.

The cake category grew 13.3% to $1.59 billion based on the latest 52-week period ending March 20, 2022, per IRI Chicago. Private label, which accounts for almost 89% market share, grew 13.8% to $1.41 billion. Additional bright spots in the category were:

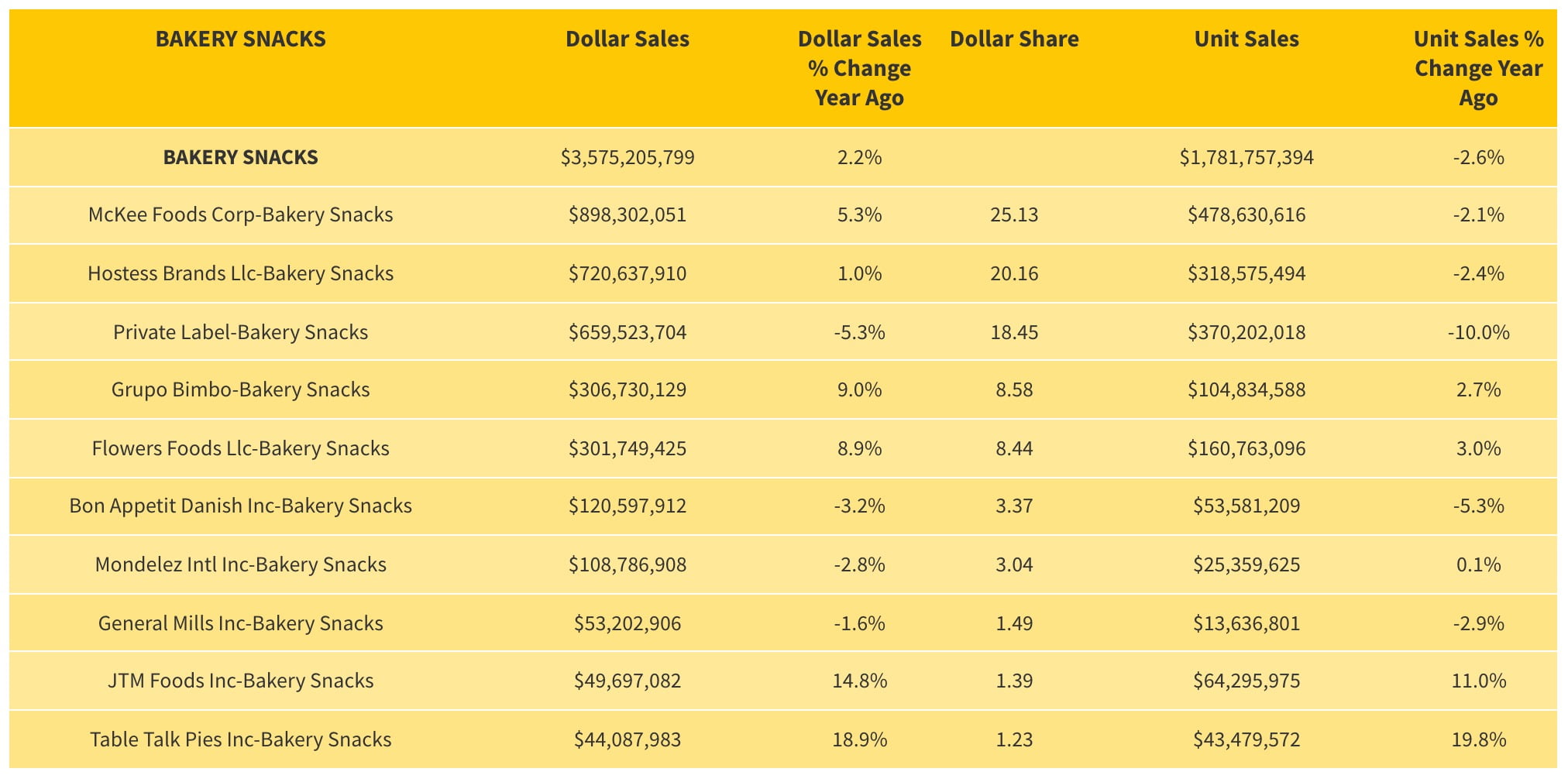

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

- The Original Cakerie LTD saw another year of strong performance with double digit growth of 24.2% leading to $21.9 million

- CMS Bakery Products North America grew an impressive 23.1% to $12.1 million

The pie category had another solid year, increasing 4.0%, resulting in $795.6 million. Private label, which accounts for 75% of the category grew 4.5% to $600.4 million. Four B Corp, Cyrus O Leary and Rocky Mountain Pies all experienced growth at 13.4%, 51.4% and 5.3% respectively.

The frozen pie category growth slowed this year, 0.6% resulting in $582.9 million. While the top player in the category, Marie Callendars demonstrated strong growth of 11.9% increasing to $240.8 million; this was offset by losses from several other brands in the category.

The refrigerated cheesecake category continued to show strong performance; achieving another consecutive year of double-digit growth. The category grew 14.3% to $593.2 million. Private label, which accounts for almost 73% of the category drove the growth increasing 16.2% to $432.0 million. Additional bright spots in the category were:

- Chuckanut Bay Foods grew an impressive 45.2% to $16.6 million

- Juniors achieved double digit growth of 27.4% resulting in $12.5 million

- The Cheesecake Factory increased 21.2% to $6.7 million

HOVER OVER CHART TO SCROLL DOWN

Source: IRI Market Advantage, Integrated Fresh, Total U.S. - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers), 52 Weeks Ending 03-20-22

Looking back

Companies study the trends from a total market perspective including both retail and foodservice to help identify strategic platforms and areas of opportunity for innovation. Susan W. Allen, senior vice president marketing, Dessert Holdings, shares the new product innovation that is based on several key consumer driven platforms:

- Globally inspired desserts: have been in demand as consumers seek to explore new tastes, unique ingredients and a way to experience the world without leaving their home. Tres Leches is one of the fastest growing cake varieties, up 16% based on 4-year menu growth

- Dessert Holdings has recently launched a globally inspired soaked cake platform of Tres Leches, which is differentiated from many of the single layer cakes in the market with two layers of a premium three-soak cake that doesn’t get messy on the plate, and real whipped cream. The product is sold as a blank canvas for operators or bakeries to decorate with real fruit, real chocolate, or caramel drizzle

- Dessert Holdings has recently launched a globally inspired soaked cake platform of Tres Leches, which is differentiated from many of the single layer cakes in the market with two layers of a premium three-soak cake that doesn’t get messy on the plate, and real whipped cream. The product is sold as a blank canvas for operators or bakeries to decorate with real fruit, real chocolate, or caramel drizzle

- Single-serve desserts and snacking: has been a trend as consumers demand smaller portion sizes where they can indulge with no guilt. We see a range of single serve options that are great for enjoying solo or as a treat to share. Millennials have the most interest in this dessert mega-trend.

- Dessert Holdings takes their high-quality cakes made with the best ingredients and figures out how to fit those into smaller servings and still create the wow factor. We also see consumer demand for this rise from a food safety standpoint coming out of the pandemic, with items freshly made and pre-packaged from our facility to a grocer’s bakery without anyone touching the cakes directly.” Bakeries like these offerings as they do not need to finish the products in-store.

- The company has developed solutions in snackable dessert bars and brownies which provide indulgence in just a few bites, such as mash-up recipes or in nostalgic flavors such as cookies and cream.

- Premiumization: has been a trend occurring throughout the store and we see it in premium desserts, growing several points faster than mainstream. This demand is driven by the consumers need for real and clean ingredients, the ability to impress guests and serve desserts not easy to make at home. At Dessert Holdings, we use only real ingredients and clean labels for our products.

- Nostalgia: is a dessert mega-trend. These desserts provide comfort and familiarity, such as profiles like cookies and cream, or OREO, growing +16.5% on menus.

Courtesy of Dessert Holdings

Debbie Marchok, vice president of marketing, The Eli’s Cheesecake Company, Chicago, IL. talks about the trends within both retail and foodservice. “Foodservice continues to focus on traditional desserts like cheesecake, layer cakes and dessert bars, with an emphasis on menu selection and meals-to-go. Retail demand for pre-packaged cheesecakes continues to be strong in the in-store bakery.” The company was inspired by ‘free-from’ ingredient statements as part of the clean label trend and this May will be launching their NEW Eli’s Chi-Town Single Serve Cheesecakes made with no artificial flavors, colors or preservatives. The products are individually wrapped in a custom container and ready to sell. It comes in five flavors: Original Plain, Chocolate Chip, Strawberry Swirl, Cookies & Cream, and Blueberry Swirl, and will be available in both foodservice and retail.

Courtesy of Eli's Cheesecake Co.

“The mix of the top selling pie varieties in retail has relatively remained the same with Chocolate Cream Pie, Apple, and Key Lime varieties at the top with seasonal pies over indexing during the holidays. Cheesecake and Cream Pie growth over-indexes and is driving consumption outside of the traditional holiday season. Consumers are looking to the category for more every-day dessert solutions which was a trend that started at the early stage of the pandemic and has proven to be sticky. For Sara Lee, our core cheesecakes have benefitted because they deliver the price-value, variety, and versatility consumers seek as they enjoy more frozen desserts at home. In foodservice, there has been a significant shift towards products that are individually wrapped. That shift, seems to have stuck even as we passed through the worst of COVID,” states Mitchell.

Courtesy of Sara Lee

Foodservice is really a tale of two segments, while commercial restaurants have returned to pre-covid levels, non-commercial segments, including business industry, hospitality and healthcare are still lagging. However, noncommercial business has picked up since January as the Omicron risks have waned, shares Mitchell.

The majority of the companies have spent the past two years really focusing on the needs of the customers and the needs of the business. Dessert Holding made significant capital investments to expand their plant capacity and also acquired Steven Charles to expand their premium dessert platform. The Eli’s Cheesecake Company focused on the needs to their customers and adjusted their offering accordingly. “For example, our customers’ need for pre-packaged desserts during the pandemic for both in-store self-service cases and the expansion of operator take-out menus inspired us to develop a new line of individually wrapped single serve cheesecakes to better serve these businesses,” explains Marchok.

Looking forward

Coming soon, in time for the holidays, The Eli’s Cheesecake Company will be introducing a new 8” Seasonal Sampler Cheesecake with flavors including Cinnamon Roll, Hot Chocolate, Cranberry Crumble, and Original Plain. The product will be showcased at the upcoming June IDDBA show and ready to ship in September.

Allen notes that, looking forward, Dessert Holdings will be focused on continuing to drive innovation around packaging, smaller sizes and portability to address the need for a variety of serving sizes and the needs for portion control and reducing waste.

“Consumers continue to crave desserts in snacking and portion control; therefore the company will work on smaller size desserts to address this need.”

— Susan W. Allen, senior vice president marketing, Dessert Holdings

“Consumers continue to crave desserts in snacking and portion control; therefore the company will work on smaller size desserts to address this need. As the cake category continues to grow, the company will raise the bar and look to create the next level of visually exciting cakes that break the mold and delight our consumers and customers.” SF&WB