The BOTTOM LINE

- The category is up in sales from 2021

- Trends like keto are on the rise

- Consumers still crave indulgent bar flavors

Don’t call it a comeback

The nutrition/snack bars category rose in sales as consumers start to return to “on-the-go” lifestyles.

Liz Parker, Managing Editor

During the COVID-19 pandemic, consumers have been staying home more often, and searching for familiar snacks. Cookies fill that void, and brands have taken note of what is trending.

BARS

STATE of the INDUSTRY

SPONSORED BY

Market data

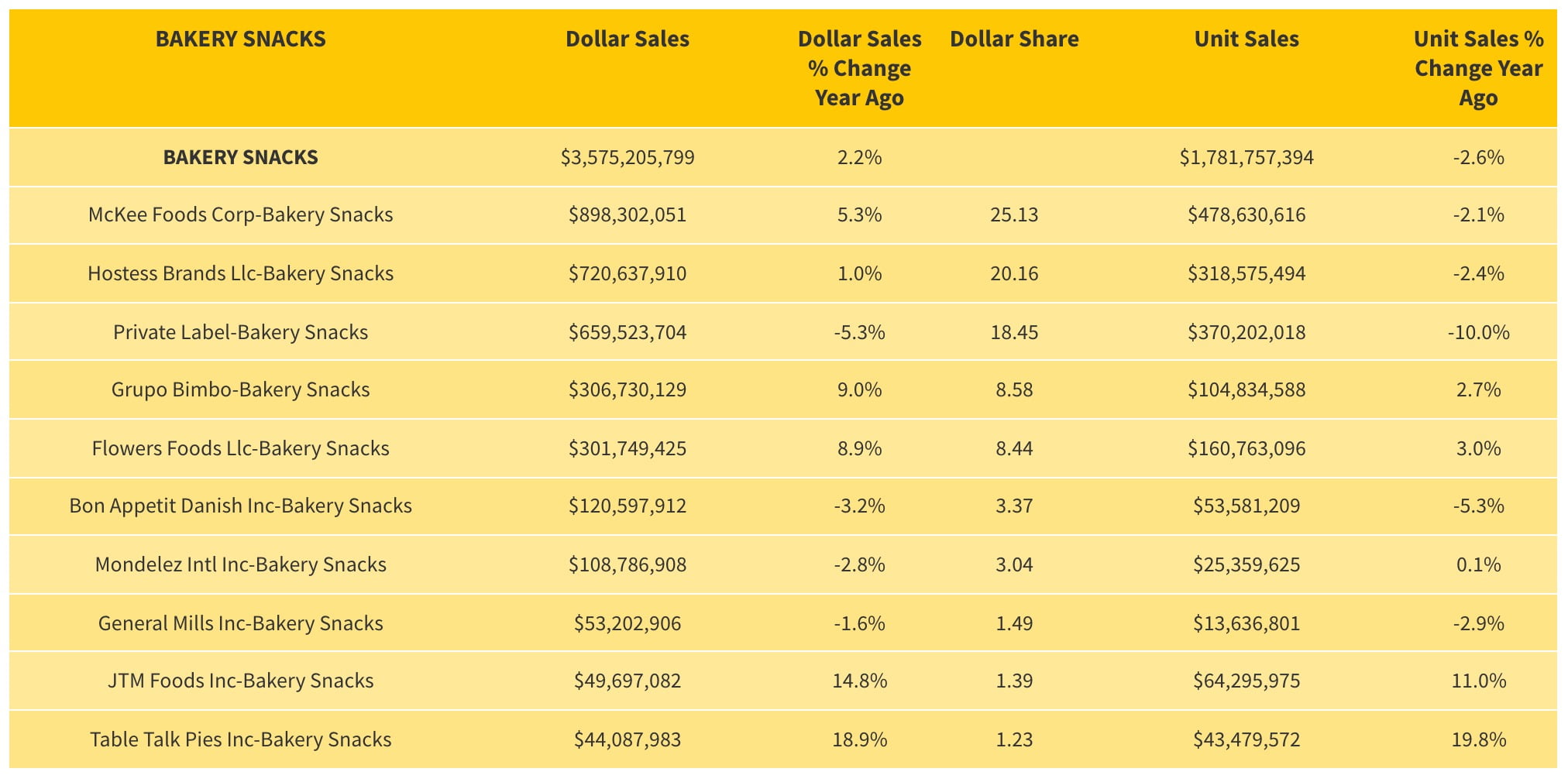

According to IRI (Chicago) data from the past 52 weeks, which ended on March 30, 2022, the “snack bars/granola bars” category was up 17%, with total sales of $9.629 billion.

The “nutritional/intrinsic health value bars” category accounted for $3.4 billion of that share, with 16.2% in growth. Major category leaders included Clif ($801 million in sales, and up 24.5%); Atkins ($302M in sales, up 4.3% from last year); and KIND ($296 million in sales, up 13.3%).

In the “breakfast/cereal/snack bars” category, which accounted for $2 billion in sales, the category itself was up 24.6%. Kellogg brought in $745 million of that total amount, with a 16.2% rise in sales, and KIND brought in $282 million, with 35.4% rise in sales. Also to note is Quest, which brought in $46 million in sales but rose an astonishing 263.3%.

HOVER OVER CHART TO SCROLL DOWN

Source: IRI Market Advantage, Integrated Fresh, Total U.S. - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers), 52 Weeks Ending 03-20-22

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

The “granola bars” category brought in $1.468 billion in sales, with a modest 8.9% increase from last year, and was led by Nature Valley, which brought in $616 million in sales and experienced an 8.0% increase. Quaker was not far behind, with $404 million in sales and a 14.9% increase, with Sunbelt coming in third, with $110 million in sales and a 2.5% increase.

In the “AO [All Other] Snack/Granola Bars” category, the category brought in $48 million in sales, with a large 52.3% increase from last year, and the category leader were private label brands, with $13 million in sales and 102.5% increase. Munk Pack brought in $6.34 million in sales, with a 420.5% increase, and Core Bar brought in $5.691 million in sales, with a 103.4% increase.

Looking back

“There are long-term tailwinds in low-sugar and plant-based, and currently keto-friendly products are driving category growth more than protein, energy, or general nutrition,” says Tobias Glienke, co-founder, Munk Pack, Greenwich, CT.

“Historically, consumers buying products with these attributes were forced to sacrifice on taste. Innovation has now enabled products to have both these strong nutritional attributes and great taste, and consumers are increasingly buying these products to meet their dietary lifestyles. In addition, products with added functional benefits (e.g., immunity) are experiencing strong growth. From a flavor standpoint, there continues to be demand for indulgent flavors,” he notes.

Glienke says that at this time two years ago, Munk Pack was adapting to working from home and figuring out how to overcome the challenges the pandemic brought to the industry.

“We’re now a fully remote team, which has also more than doubled in size, so we’re really proud of the growth and culture that has been able to thrive in this setting. Though retail expansion in the industry was initially put on hold for a portion of 2020, since then we’ve been thrilled to gain national distribution in Walmart and Sprouts while also more recently bringing our keto-friendly, low-sugar bars to Kroger and Meijer shoppers throughout the country,” he shares.

“In tandem with those efforts we’ve put more support into our e-commerce business, which has seen 380% Year over Year growth from just our DTC channel from 2020–2021,” Glienke finishes.

Linda Zink, chief marketing officer, Simply Good Foods Company (comprised of Atkins and Quest nutritional brands), Denver, says that more consumers are learning about the health and wellness benefits of limiting carbs and sugar.

“With this education, we’re continuing to focus on awareness of the Atkins lifestyle and our variety of products, including our on-the-go bars and shakes, as well as indulgent options that fit into our consumers’ lifestyle and support their nutritional or health goals,” she says.

Courtesy of Clif Bar & Company

Zink notes that the past two years have caused many people to reflect and decide to make positive changes to improve their health.

“As a result, in October 2021, we launched #AtkinsSmallWins, a five-week campaign that celebrates small wins—the simple steps or attainable goals that can help people improve overall health and wellness,” she adds.

“[Although] during the peak of stay-at-home we saw the bar category decline, we’ve found that as people return to their normal routines, they are looking for better nutrition on-the-go, including in the form of bars, and the category has rebounded and returned to growth.”

In March 2022, CLIF Bar & Co., Emeryville, CA, released its new Thins snack bars nationwide, allowing consumers to enjoy their favorite CLIF flavors during those “everyday snacking” moments.

“Our research shows that the return of office commutes and travel is on the rise. In fact, 75% of Americans plan to travel in 2022, and half of those admit they snack more when on the move. Meanwhile, 43% of employed Americans are working in hybrid environments and need snacks that can adapt to their changing work settings,” says Liz Watson, CLIF brand manager. “CLIF Thins are lightweight and easily stored in purses, carry-ons, and desks, [consumers can] always have a quick and easy pick-me-up in [their] hectic schedules.”

“We’ve found that as people return to their normal routines, they are looking for better nutrition on-the-go, including in the form of bars, and the category has rebounded and returned to growth.”

— Linda Zink, chief marketing officer, Simply Good Foods Company (Atkins and Quest nutritional brands)

Looking forward

Nellson, LLC recently released a new infographic titled “Consumers are raising the bar.” This new resource examines the nutrition and snack bar category highlighting key market data, consumer trends, and how function and format can drive sales.

In addition, Mintel recently reported that 40% of US adults who anticipated eating more bars in 2021 cited new health goals.

“Prior to the pandemic, the nutrition bar market was thriving as consumers desired for bars that provided functional health and wellness benefits,” says Bart Child, chief commercial officer, Nellson.

“Today, more and more consumers are looking for foods to support their wellness journey, helping expedite the emerging trend of products formulated to deliver functionally specific health benefits. This creates an opportunity for bar brands to build a bar that promotes well-being. For some consumers that might mean treating oneself to a bar formulated to deliver an indulgent eating experience or a bar formulated with a blend of ingredients designed to relieve stress or provide a mental boost,” he finishes.

Zink says that with the low-carb lifestyle section in retail, we will see consumer needs continue to evolve, as consumers become increasingly aware of carbs and sugar, and want to make smarter choices.

Courtesy of Atkins

“To meet the consumers nesed for variety, Atkins launched several new bars including new Protein Meal Bars: Vanilla Caramel Pretzel and Chocolate Almond Butter. These new flavors give our consumers even more options with 2g of sugar and 4g net carbs. Atkins also introduced the new Endulge Dulce de Leche Dessert Bar that delivers a dessert experience with 1g of sugar and 3g net carbs,” she shares.

Zink added that as consumers continue to seek out delicious flavors of bars that aren’t full of sugar, Atkins recently launched its Strawberry Shortcake Meal Bars and Endulge Chocolate Chip Cheesecake Dessert Bars.

“The Strawberry Shortcake Meal Bar is a crispy and creamy bar with an indulgent fruit flavor that delivers 15g of protein and 3g net carbs. For an indulgent treat, the Atkins Endulge Chocolate Chip Cheesecake Dessert Bar combines a rich and creamy burst of flavor with a subtle, delicious crispiness with 2g net carbs. And Atkins has a lot of amazing new products in development, so stay tuned,” Zink finishes.

Glienke says that Munk Pack added two new flavors to its Keto Granola Bar line in April 2022: Dark Chocolate Cocoa and Peanut Butter Cocoa Chip.

“The perfect snack for the growing consumer base looking for guilt-free indulgence, these bars are contain just 1 gram of sugar, 2 grams of net carbs, and 4-5 grams of protein. They’re also plant-based, grain-free, and contain no added sugar or sugar alcohols,” he notes.

Glienke adds that innovation is core to the Munk Pack brand, so the brand is constantly strategizing on what it can do next to surprise and delight its consumers.

“We have a few exciting projects in the pipeline that are inspired by other high performing categories and formats, while still allowing us to build upon our growing success in the bar space,” he says. SF&WB