The BOTTOM LINE

- Bakery snacks category sales are mostly up

- Consumers are snacking more throughout their day

- Millennials search for nostalgic snacks

Snacking on-the-go

Consumers look for healthy and portable bakery snacks, but occasionally want to indulge, too.

Liz Parker, Managing Editor

The bakery snacks category overall experienced an increase in sales in 2021, the possible reason for that being that consumers are now returning to the office and want on-the-go snacks to keep them company at their desks. In addition, bakery snacks have become an “all-day” snack—good for breakfast, lunch, dinner, or for a “traditional” snack time.

bakery snacks

STATE of the INDUSTRY

SPONSORED BY

Market data

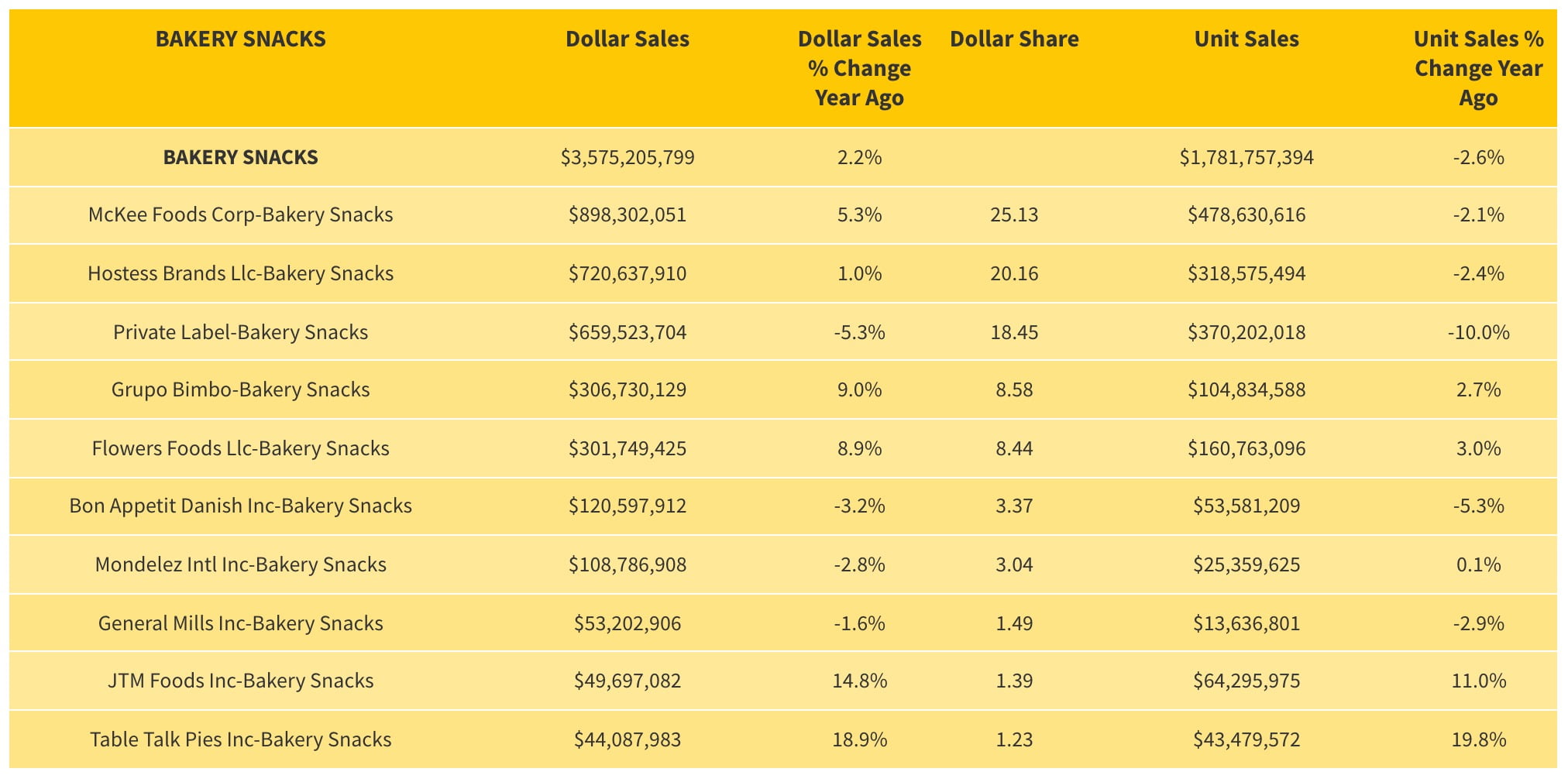

According to IRI (Chicago) data from the past 52 weeks, which ended on March 30, 2022, the “perimeter muffins” category was up 20%, with total sales of $1.026 billion.

The leader in the category was private label, bringing in $778 million and a rise of 25.5% in sales. The Muffin Mam Inc. followed, with $10 million in sales and a 17% increase. Also to note is Bill Knapps Inc, with $1.7 million in sales, but a 1477.3% increase from 2021.

In the “center store muffins” category, the category brought in $1 billion in sales and experienced a 19.2% increase. Of those, mini muffins brought in $757 million, with a 21.7% increase. Grupo Bimbo experienced $578 million in sales, with a 15% increase, and McKee Foods Corp. brought in $103 million in sales, with a 58.7 percent increase.

HOVER OVER CHART TO SCROLL DOWN

Source: IRI Market Advantage, Integrated Fresh, Total U.S. - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers), 52 Weeks Ending 03-20-22

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

In the “center store snack cakes” category, which brought in $1.899 billion in sales and experienced a 10.3% uptick, the “center store bar/finger snack cakes” category brought in $1.165 billion, with a 12.6% increase. McKee Foods Corp. led the category, with $393M in sales, and a 0.8% increase, and Hostess Brands followed, with $299 million and a 7.6% increase. The Hershey Co. is also one to note, with $23 million in sales but a 367.6% increase.

The “center store snack cupcakes” category brought in $458 million, with a 9.7% increase, and Hostess Brands LLC led the way, with $270 million in sales and a 10.3% increase. Flowers Foods LLC brought in $96 million in the category, with a 9.6% increase, and Taste of Nature Inc. brought in $353,800 but experienced 1052.7% in growth.

The “center store roll snack cakes” category brought in $177.6 million in sales, with a slight decline of 2.5%, and McKee Foods Corp. led the way, with $158 million in sales and a slight loss of 1.4%.

The perimeter cakes category, which includes perimeter snack cupcakes and cupcakes, brought in $5 billion in sales, with a 16.8% increase. Perimeter snack cupcakes brought in $425 million, and experienced 24.8% in growth, with private label leading the way ($294 million in sales, and a 23.7% increase). Perimeter cupcakes brought in $395 million, with a 42.7% increase; private label again led the pack, with $389 million in sales and a 42.7% increase.

In the “center store pies” category, which overall brought in $398 million and had a 2.1% increase in sales, the “center store individual/snack pies” category brought in $386 million of that, with a 0.8% increase, and private label brought in $97.6 million, with a 2.6% increase. The “perimeter pies” category brought in $1.121 billion in sales, with a 5.8% increase, and the “perimeter individual/snack pies” category brought in $82 million of that, but experienced a 3.7% dip in sales.

The “center store croissants” category brought in $210 million in sales, with a 23.8% increase, and the “center store filled croissants” category brought in $101 million of that, with a 37.7% increase. Bon Appetit Danish Inc. brought in $46.8 million in sales, with a 19.7% increase, and the Starbucks Coffee Co. brought in $6.4 million, but with a 122.7% increase.

“As consumers age, they become more concerned about their health but at the same time, they don’t want to give up their favorite sweet treats.”

— Tina Lambert, vice president of innovation and growth, Hostess Brands

Lastly, the “perimeter croissants” category brought in $529 million in sales, with a 22.1% increase from last year, and the “perimeter filled croissants” category brought in $50.9 million of that, with a 31.2% increase. Private label brought in $34.1 million, with a 36.1% increase, and worth noting is Bakerly LLC, which brought in $452,200 in sales but experienced an 84.8% increase.

Looking back

“Americans are increasingly snacking their way through the day instead of eating three traditional meals,” says Tina Lambert, vice president of innovation and growth, Hostess Brands, Lenexa, KS.

“Through consumer research, we’ve identified 18 different consumer snacking occasions where consumers are enjoying snacks that include bakery snacks. At Hostess Brands, we have snacks for every occasion, with some of the top occasions being a sweet start to the morning, in the lunchbox, as an afternoon reward, immediate consumption (on the go), and afternoon snacks for sharing,” she says.

Other trends that Lambert sees are renewed family focus, the “era of trusted brands,” and “aging without compromise.”

“Research shows that millennial parents are prioritizing family and spending more time with their kids than recent past generations. They also are seeking out little ways to bring moments of joy into their children’s lives. In challenging economic times, those small joys, such as a sweet snack, become an even bigger focus. In fact, according to Ipsos, 63% of consumers consider sweet snacks to be a small affordable indulgence,” she says.

Research shows that during times of uncertainty and stress, consumers turn to brands they know and trust, she adds.

“In fact, according to the 2021 Edelman Trust Barometer Special Report, 88% of consumers say trust today is critical for deciding which brands to buy or use, and 68% say it is more important for them to trust the brands they buy or use than in the past. We’re seeing this trend influence what consumers are buying as they seek out snacks they trust to meet their needs for something fast, easy, and delicious,” Lambert notes.

“As an established brand with 92% awareness among U.S. consumers, the Hostess brand benefits from this trend. Our research shows that consumers trust the Hostess brand to provide them with high-quality snacks,” she says.

Another trend that Lambert is tracking is what Hostess calls “aging without compromise.”

Courtesy of Hostess Brands

“As consumers age, they become more concerned about their health but at the same time, they don’t want to give up their favorite sweet treats. That mindset leads them to look for better-for-you snack options with simple and straightforward ingredients that help them balance their wellness goals and their desire to continue to enjoy a sweet indulgence,” she says.

Christine Prociv, senior vice president, marketing, innovation, and R&D, Aspire Bakeries, Los Angeles, says that consumers have been prioritizing convenience and comfort when it comes to sweet treats, especially as they’re returning to the office.

“One of the trends we’re seeing is a return to breakfast. As consumers go back to the office, even for a few days per week, they’re looking for grab-and-go, wholesome morning options that taste great. Convenience and freshness are not always easy to find together in one item, and our Otis Spunkmeyer individually wrapped (IW) muffins fill that need beautifully.”

Another trend in 2021 included keto snacks. In September 2021, ThinSlim Foods released a low-carb and keto-friendly line of bakery snacks, including Cloud Cakes, muffins, and Pumpkin Spice Squares. The 40-calorie muffins contain “hints of cinnamon, nutmeg, and pumpkin,” and the Pumpkin Spice Cloud Cakes are a refresh of its existing Cloud Cakes recipe.

In November 2021, Veggies Made Great launched keto-friendly muffins, with flavors including Mochaccino Chip, Chocolate Raspberry, and Cinnamon Roll. The muffins were touted as being lower in sugar and carbs and higher in protein than the brand’s other muffins.

For those wishing to indulge, in March 2022 Bimbo Bakeries USA released its Little Bites S’mores Muffins, in portioned pouches for on-the-go snacking. The muffins, made with real ingredients including graham flour and milk chocolate, also contain no high-fructose corn syrup.

Looking forward

Partnerships with movies and/or celebrities will continue in 2022. For example, in March 2022, Flowers Foods collaborated with the new Sonic the Hedgehog 2 movie to release Tastykake Mini Donuts, Mini Muffins, and Pecan Swirls, all with special Sonic the Hedgehog 2 packaging. In July 2021, Kellogg released Pop-Tarts Bites with The Addams Family 2-inspired packaging.

Kellogg also appealed to its millennial consumers when it re-released its Frosted Grape Pop-Tarts in April 2022. The Pop-Tarts, which include grape jelly-flavored filling, white icing, and a purple crunch, originally came out in the Y2K era.

Courtesy of Aspire Bakeries

"At Pop-Tarts, we know what our fans want. Frosted Grape has been among the top flavors fans have been asking us to bring back," says Heidi Ray, senior director of marketing, portable wholesome snacks. "So, we could not be more stoked to finally bring back this Pop-Tarts G.O.A.T.—Grape-ist Of All Time."

Lambert says that Hostess Brands is introducing new snacks to appeal to millennial parents and their families. One such product includes Hostess Baby Bundts.

“Hostess Baby Bundts are individually wrapped mini bundt cakes that come in three flavors: Lemon Drizzle, Cinnamon Swirl, and Strawberry Cheesecake. The light, fluffy, and moist cakes have just the right amount of sweetness with a drizzle of icing,” she adds.

The company is also introducing on-the-go snacks for consumers who frequent convenience stores, including Hostess Muff’n Stix, portable muffin snacks available in Blueberry and Chocolate Chip flavors.

“[In addition], this fall, we are introducing our biggest innovation of the year: Hostess Bouncers, which are poppable, bite-sized versions of popular Hostess snacks and are a perfect lunchbox snack. They come in three varieties, including Cinnamon Donettes, Glazed Chocolate Ding Dongs, and Glazed Twinkies, and will begin to roll out at retail in late September,” Lambert finishes. SF&WB