Cookies are versatile enough to function well as “on-the-go” snacks. However, in the midst of a pandemic, they’re still solid enough to be enjoyed as an “at-home snack,” too. Although tried-and-true flavors like chocolate chip will always reign king, consumers are also searching for better-for-you, gluten-free, and grain-free options.

Cookie essentials

In the middle of a pandemic, cookies continue to fly off grocery store shelves.

Liz Parker, Managing Editor

Cookies

market trends

The BOTTOM LINE

- Consumers seek familiar flavors

- Increase in baking during the pandemic

- Also an increase in keto and other trends

Market data

According to data from IRI, Chicago, for the 52 weeks ending on November 29, 2020, the cookies category was up 6.5 percent from the previous year, with $9.6 billion in sales.

Mondelēz International, owner of the leading OREO brand, saw $3.9 billion in sales, an uptick of 11.1 percent, per IRI, with boosts across several brands. The regular OREO line brought in $916.2 million for the year, an increase of 17.1 percent. OREO Double Stuf grew 21.5 percent to $391.3 million. The company’s Nabisco Chips Ahoy line grew 16.0 percent to $747.3 million, Nilla grew 14.9 percent to $184.6 million, and Nutter Butter grew a strong 23.3 percent to $169.0 million.

McKee Foods Corp. brought in $656.0 million, with a 4.4 percent increase in sales. Its Little Debbie cookies grew 4.3 percent to $312.2 million, while its Little Debbie Nutty Bars grew 4.0 percent to $210.9 million.

Pepperidge Farm brought in $522.5 million, with a nice increase of 15.7 percent in sales. Its Milano brand was up 16.2 percent to $201.1 million.

Tate’s Bake Shop is a brand to watch, with growth of 21.7 percent to total sales of $115.1 million.

Equipment strategies

Competition keeps producers focused on strategic ways to streamline production.

Sam Pallottini, director of cookie, cracker, and pet food sales, Reading Bakery Systems, Robesonia, PA, says that cookie production over the years has been driven by batch mixing. “As throughput increases and demand to lower costs continues, continuous mixing for this market continues to expand by enabling customers to streamline cookie production and automate lines. Continuous mixing provides a continuous stream of dough to the forming equipment. It is recipe-driven and fully automated. This process reduces the size and cost of the feed systems as well as reduces energy usage by a third versus a batch system.”

The PLC system and the dedicated stream of ingredients reduces the number of employees running the line by up to three people, Pallottini notes. “The biggest benefit of continuous mixing for cookies is providing the same dough to the dough-forming equipment. It allows you to dial-in the formulation that is best suited for your machine. In batch systems, the dough is usually too wet at the beginning, perfect in the middle, and dry at the ending, forcing the operator to adjust their machine and their bake profile in order to produce the same product from start to end. Inclusions are added at the end of the continuous mixing, which also makes it easier and more efficient to distribute the inclusions through the dough, making a more-consistent product.”

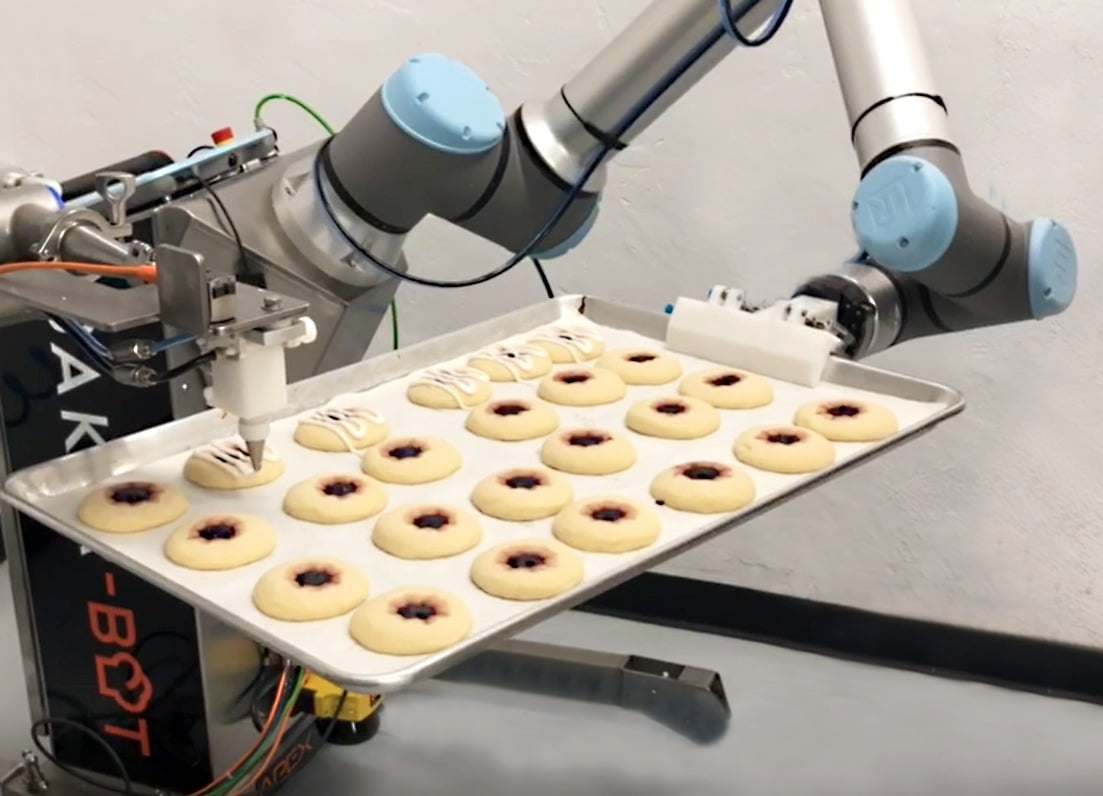

Martin Riis, director of sales and marketing, Apex Motion Control, Surrey, British Columbia, says decorating and pan/tray handling are a few great examples of potential points of automation with cookies. “These labor-intensive tasks should always be considered when designing an automation plan for cookie production—even more so now with extreme labor shortages.”

Riis says that the Tray Feeder and Baker Bot can help create a semi-autonomous cookie production system. “The Tray Feeder can automatically load sheet pans onto a conveyor with or without parchment paper prior to cookie dough extrusion. Then, at the conveyor outfeed, the Baker-Bot Cobot can depan and rack the trays from the conveyor, either pre- or post-bake.”

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending November 29, 2020.

Courtesy of Apex Motion Control

Automating decorating tasks helps streamline production—including controlling ingredients costs and maintaining product consistency, Riis comments. “Depending on your production requirements, Apex Motion Control has two options that help specifically in the area of automating your decorating process. The Deco-Bot is perfect for large, high-level production automation, and the Baker-Bot Cobot can handle all the requirements needed for small to mid-level production requirements. Both of these options can automatically decorate, drizzle, draw, and write onto your cookies.”

Two developments from Baker Perkins, Grand Rapids, MI, contribute to streamlined cookie production and quality, says Keith Graham, business development manager. “A new dough-feeding technique improves plant efficiency and product consistency. Technology ensuring equipment is Industry 4.0/Industrial Internet of Things ready is now fitted as standard to all new Baker Perkins machinery,” he says.

Weight variation and product inconsistency caused by batch-feeding forming machines is a long-standing problem, and although this can be reduced with an automated dough feeding system, moisture evaporation on the feed conveyors can also cause problems, Graham notes.

“This process has been improved by a new automated Baker Perkins system ensuring dough reaches the forming machine in optimum condition. A portioning device in the bulk hopper creates individual logs or slabs of dough instead of a continuous stream. This reduces the amount of dough on the conveyor and hence the amount of time it spends travelling between the bulk and machine hoppers. The conveyor travels rapidly and the system is controlled to ensure the feed of dough matches the machine output,” adds Graham. It also standardizes product weight and quality.

Courtesy of Baker Perkins

Top trends

While overall new cookie product launches were down year-over-year, unit sales from many of the leading cookie brands were up, no doubt benefiting from consumers’ pandemic-fueled home-snacking binge, says Allison Leibovich, senior technical service specialist, bakery, Cargill, Minneapolis. “Nostalgia was on full display, as unit sales for vanilla wafers, sugar cookies and snickerdoodle cookies all posted double-digit sales increases.”

With the onset of COVID-19, many consumers have sought whatever can bring comfort or incite a sense of joy or relief, says Margalit Gould, brand manager, Simple Mills, Chicago. “Within packaged foods, the cookie category has been well-positioned to capitalize on this trend.” She particularly emphasizes the importance of brands and formats that signal comfort or nostalgia, noting recent strong performances of classic sandwich cookies, as well as those with craft-baked or homemade positioning, including in natural-leaning brands.

“That being said, given the continued uncertainty in this climate and its prolonging tenure, consumers are becoming increasingly health-conscious—choosing more better-for-you brands across categories, including cookies, for themselves and their families, with particular consideration for brands that can deliver on both taste and purposeful ingredients,” says Gould.

“No one could have anticipated the challenges of 2020, but the initial response to the stress of these unprecedented times was classic, literally and figuratively,” says Julia Decruz, R&D director and innovation team member, PROVA, Inc., Danvers, MA. The response? Seek comfort in familiar baked favorites. “Cookies are comforting and strike a strong positive emotional memory chord.”

Earlier this year, PROVA noticed an increase in requests for its vanilla extracts and flavors, as well as its natural vanillin replacer, Natural Provanil US7, a cost-effective, clean-label alternative to vanillin, notes Decruz. The vanilla oleoresin that coats the natural vanillin, she says, offers heat stability while still delivering the sweet vanilla top-note characteristic of vanillin. Other top flavor requests included salted caramel and allergen-free nut flavors, including maple-nut and hazelnut praline, as well as alcohol-inspired flavors that blend with other classic flavors, evoking a warming effect, she says.

Premiumization and indulgence are two big trends in the cookie space, as brands add decadent inclusions and highlight premium ingredients like dark chocolate with high cacao content, says Leibovich. “Creamier and more-abundant fillings, tantalizing frostings, and rich flavor cues like ‘triple chocolate’ are all part of today’s cookie landscape.”

Chocolate chip cookies remain the standard-bearer for the category, Leibovich notes. “However, even these time-tested classics can go upscale, with artisan-cut chunks of indulgent, high-cacao chocolate,” she recommends.

Courtesy of Cargill

“Chocolate will forever remain a top ingredient used in cookies,” says Gretchen Hadden, marketing manager, Cargill Cocoa & Chocolate. “However, slight nuances can provide consumers with permission to treat themselves, such as using high-cacao chocolate chips—which have a health halo and are inherently lower in sugar than a milk chocolate chip.” Chocolate solutions that can help manufacturers bridge the gap between taste and label appeal include non-GMO options and those with no artificial flavors or colors.

“Beyond the label, the consumer quest for a packaged cookie that rivals ‘home-baked’ continues,” says Hadden. “Whether that’s doubling down on inclusions for extra indulgence or using irregular-shaped chocolate chunks for that ‘perfectly imperfect’ look, there are a variety of choices that can help cookie manufacturers inch closer to the at-home cookie jar.”

Matthew Schueller, director, marketing insights and analytics, Ardent Mills, Denver, has seen increased market interest for organic flour. “With this trend, however, we’re also starting to see consumers seek out modern twists on the familiar married with ingredients that provide health and planetary benefits. Plant-based, cleaner label, reduced sugar, and functionality are key cookie trends.” That opens opportunities for ancient grains and pulse flours, such as quinoa and chickpea.

Courtesy of Ardent Mills

“The use of plant-based ingredients in the cookie category—and many other categories—is growing,” says Ricardo Rodriguez, marketing manager, confectionary and bakery, Ingredion Incorporated, Westchester, IL. “This past August, Ingredion completed a proprietary study with free-from consumers. In the cookie category, 83 percent of consumers showed interest in a plant-based cookie.”

With plant-based snacking continuing to grow, replacing eggs in a cookie is an important first step in developing a vegan cookie, notes Brook Carson, VP research and development, Manildra Group USA, Leawood, KS. Manildra offers a clean-label wheat protein isolate as an option for egg replacement in cookies. “It provides the needed binding, structure, and resilience needed in a cookie, without the finish product becoming too firm.”

Carson suggests resistant wheat starch as a fiber source for bakery. “In a cookie, it can be used to replace a portion of the flour with only a slight adjustment in absorption. The fiber provides an absorption more similar to wheat flour as compared to other fiber types. It contributes a white color, clean flavor, and smooth texture.”

Courtesy of Ingredion

Protein continues to be a nutrient of interest, Carson says. “A high-protein cookie is a great way to add protein throughout the day. Manildra’s range of wheat protein means that you can dial in on the optimum texture in your cookie.”

There’s room for “permissible” treats, Leibovich says. “For these consumers, creating smaller portions—think minis, thins, and bites—can help rationalize the splurge or mitigate the guilt. In that same spirit, we’re seeing a rise in free-from claims encompassing no additives and preservatives, GMO-free, gluten-free, and more. There’s even a place for cookies with healthy inclusions, be that in the form of added protein (preferably from plants), added fiber, or a similar nutritional hook.” She notes Cargill has created indulgent cookie prototypes using pea and soy proteins that appeal to consumers interested in more nutrient-dense snacks.

Rodriguez says the cookie category will continue to see innovation in gluten-free. Ingredion recently completed a proprietary gluten-free study to estimate how many consumers in the U.S. purchase gluten-free cookies, and the number was a whopping 46 million.

“Consumers are paying close attention to the ingredients on product labels, and that extends to the fats and oils space,” says Jamie Mavec, marketing manager, Cargill. “In our most recent FATitudes survey, conducted in May 2020, we found 53 percent of American consumers closely monitoring the type and amount of fat and oil in their packaged food.”

Mavec notes “clean label” has always been a moving target, without clear definition. “Early on, clean label focused on simplicity, with an eye toward recognizable ingredients and short, easy-to-understand ingredient lists. Today, however, the clean label trend has morphed to encompass much more, reflecting a shift by some consumers toward a lifestyle that supports healthier eating for both people and the planet.”

Sweet considerations

Changes to the Nutrition Facts panel, coupled with growing interest in keto-friendly and low-carb diets, may spark opportunities for reduced-sugar formulations, so long as they still deliver the indulgent experience consumers expect, Leibovich says.

Options include stevia sweeteners, erythritol, chicory root fiber, and more. Leibovich notes the potential for modest sugar reductions of 15–20 percent without impacting taste, texture, or appearance.

Courtesy of Mavericks Snacks

Sugar reduction factors into designing snacks for children. Christian Quie, president, general manager, Mavericks Snacks, Santa Monica, CA, says, based on consumer research and captured insights, the top three benefits parents seek in kids’ snacks include low/reduced/no sugar, protein, and whole grains. “We created our cookies by championing the use of chicory root fiber, which helps deliver on sweetness without the negative effects of sugar.”

Mavericks pairs this better-for-you sweetening strategy with indulgent flavor profiles. “Our No. 1 performing SKU right now is our ‘Birthday Cake’ cookie,” Quie notes. Mavericks Cookiez have 40 percent less sugar than the leading kids’ cookie.

Recently voted SFWB’s “Best Healthy School Snack of 2020,” Mavericks Snacks launched its better-for-you cookies and crackers in April 2020 in Whole Foods stores nationwide, as well as on Amazon. “In October, we joined Target’s incredible roster of featured brands within 600+ of their stores, bringing Mavericks to life via single pouches in the Café,” says Quie.

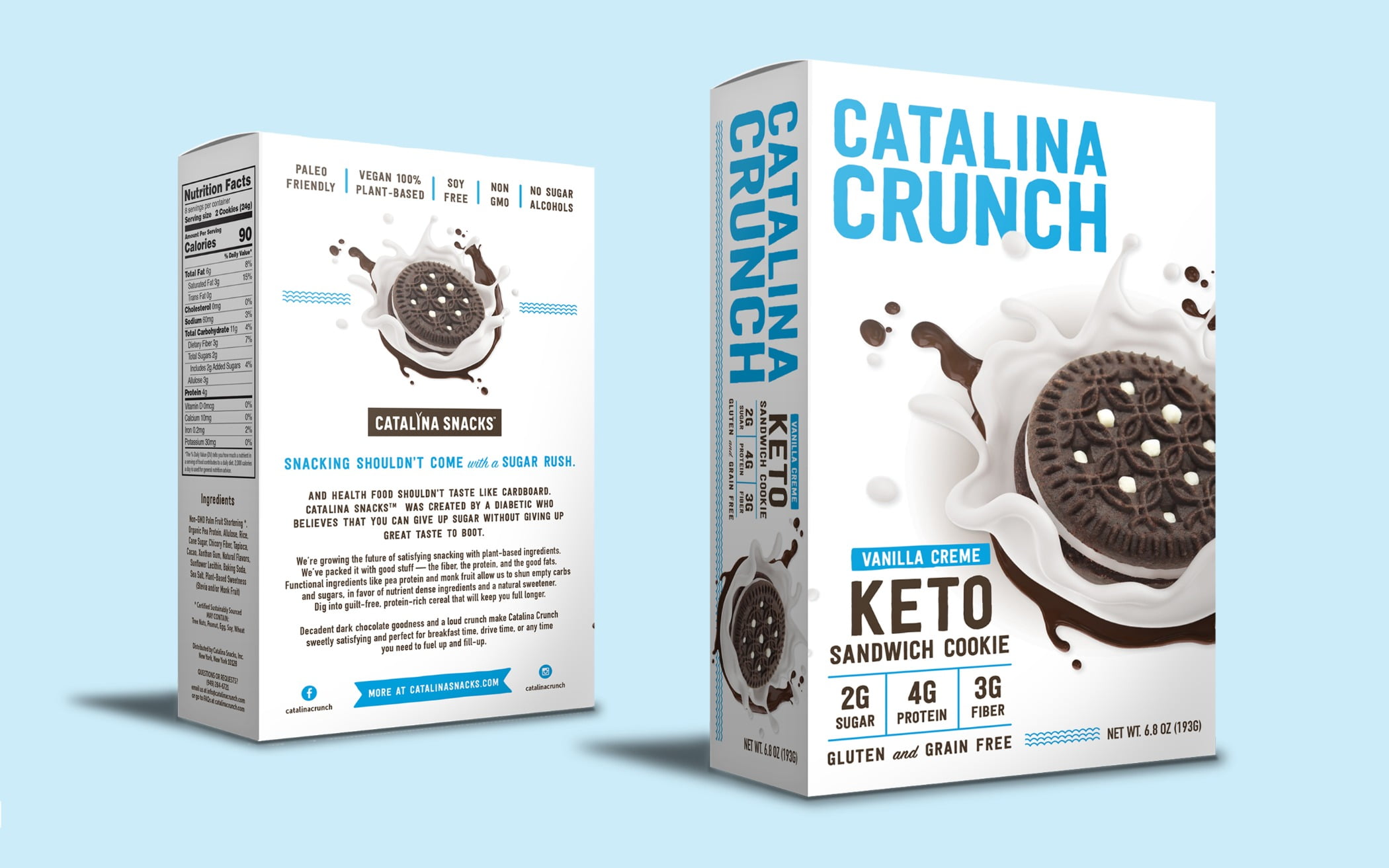

Joel Warady, president, Catalina Snacks Inc., New York City, says he’s seeing more consumers choose products that serve a dual purpose: They want them to taste great, but also offer some functionality. “In the past, the functionality was focused on protein and, in some cases, gluten-free. Now, consumers are becoming more sophisticated, and they are looking to incorporate cookies into different eating occasions, not just as a dessert.”

In spring 2020, Catalina Snacks launched its Catalina Crunch Keto Sandwich Cookies, with new flavors coming in 2021, says Warady. “We saw an opportunity to offer a healthier choice on the staple chocolate and vanilla sandwich cookie of everyone’s childhood by introducing a version that has plant-based protein, is low in sugar and carbs, and still provides that sweet indulgent taste.” The cookies are gluten-free, grain-free, keto, Paleo-friendly, and vegan.

“As we look at 2021, we believe that functional cookies will command even greater shelf-space as the consumer demand grows,” says Warady. “The keto-friendly cookie demand has exploded in the past year or so, and we expect it to continue growing.”

Rodriguez says some consumers are looking for less sugar in their desserts. “Since 2009, Ingredion has conducted proprietary research into what consumers seek on product labels, and the latest round of research indicates that consumers want to see less sugar.”

This is leading some cookie manufacturers to opt for alternatives like allulose, a rare sugar that is about 70 percent as sweet as sucrose, with a similar taste profile and comparable functional bulking and browning. “In a recent Ingredion proprietary study on the awareness and acceptance of allulose, consumers had the highest acceptance of allulose both pre-definition and post definition (of allulose) in the cookie category, out of all the categories studied,” says Rodriguez.

“With keto, the focus is on fewer net carbs and low carbs,” continues Rodriguez. “Typically, fiber and sugar alcohols are used to lower carbohydrates, and now allulose, as well. An appealing attribute of allulose is that it is not absorbed and does not impact blood glucose, similar to fibers and sugar alcohols, so in theory it can help to lower overall net carbs in cookies to make them keto-friendly.”

Courtesy of Catalina Snacks Inc.

2021 category outlook

“Cookies are being challenged by other products as consumers continue to have many different choices,” says Pallottini. “Cookie companies are looking to diversify their products to attract customers.” He points to continued interest in health-based cookies, and even caffeinated cookies for the growing “energy snack” market.

The segment showing the most potential for growth are frosted cookies, predicts Pallottini. “Frosted cookies are formed, baked, cooled, and then frosted. In order to be frosted, the cookies are cooled and then positioned so the frosting can be applied correctly.”

Courtesy of Reading Bakery Systems