State of the Industry

CANDY

2024

Cover video courtesy of mikdam via CreatasVideo+ / GettyImages Plus

The BOTTOM LINE

- Consumers are searching for unique flavors and products

- More than 98% of consumers purchased confectionery items last year

- Nostalgic candy, appealing to both kids and adults, is making a comeback

A little treat

The desire for distinctive offerings

is driving consumer choices

in confectionery.

Liz Parker, Senior Editor

In 2023, the confectionery industry appealed to consumers by experimenting with new flavors, colors, and ingredients—and consumers responded.

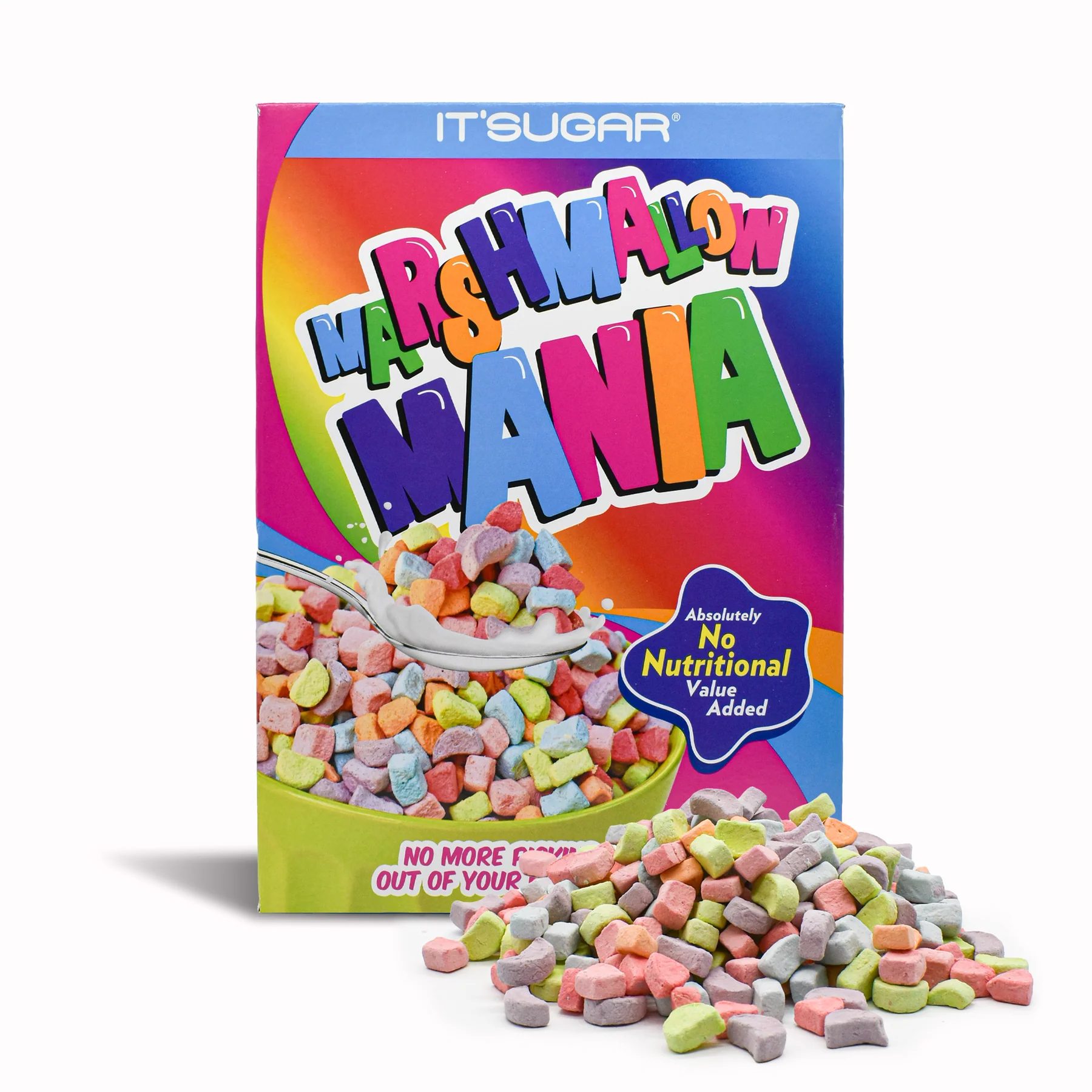

“The past year in the candy industry has been dynamic and full of innovation. We've seen a surge in the popularity of unique and novel candy products, such as freeze-dried candies, peelable gummies, and edible crystal gems,” says Jarett Levan, CEO, IT’SUGAR, and president and CEO, BBX Capital (parent company of IT’SUGAR).

“The demand for these viral products has been tremendous, driving growth and excitement across the industry,” he adds. “In 2023, the candy industry saw a strong emphasis on experiential products. Consumers are increasingly looking for candies that offer a unique sensory experience, whether it's the intense sourness of certain candies, the popping sensation of others, or the crunchy texture of freeze-dried treats. Another common thread has been the rise of adventurous flavors, such as pickle-flavored and spicy chamoy candies, which have captured the market's attention.”

Courtesy of IT'SUGAR

Image courtesy of Nata Vkusidey via iStock / GettyImages Plus

Lisa Burkart, category director, ECRM, says with candy sales continuing to rise, it's safe to say the industry is thriving.

“For ECRM, candy continues to be one of our best categories in food and beverage. We have been hosting sessions for 30+ years so we have built a foundation that continues to help buyers and sellers efficiently do business. Our candy sessions are where buyers go to see the latest and greatest trends and innovation; we love being part of it,” she shares. “I love watching the new trends and that's one of the great things about our sessions, we get to see a preview of what's to come at the next holiday. Freeze-dried candy is really having a moment [and] better-for-you continues to be a common theme with the addition of cleaner ingredients and less dyes. We're also seeing a lot of nostalgic candy making a comeback or being reinvented, which appeals to kids and adults, too.”

Carly Schildhaus, director of public affairs and communications, National Confectioners Association, confirms that the state of the confectionery industry is strong.

“Sales reached an all-time high of $48 billion in 2023 and are projected to top $61 billion by 2028. More than 98% of consumers purchased chocolate, candy, gum, and mints last year, demonstrating once again the unique role these treats play in enhancing everyday moments and special occasions. That's especially true around Valentine’s Day, Easter, Halloween, and the winter holidays—these seasonal celebrations account for 64% of total chocolate and candy sales,” she comments.

Industry challenges

“One challenge the industry has faced is proposals of food additive bans across the country—though more states are walking away from these bans than are adopting them,” Schildhaus notes. “Following California’s adoption of a food additive ban in the fall of 2023, several states considered copycat proposals. Similar bills have been rejected in the following states because the proposals lack scientific basis: New York, Illinois, Indiana, Maryland, Missouri, Rhode Island, South Dakota, Washington, and West Virginia. Kentucky legislators passed a resolution acknowledging that food safety decisions should be based in fact and driven by those with regulatory expertise.”

“At the federal level, this year's farm bill process showed positive momentum behind common sense, bipartisan updates to the U.S. sugar program. As we head into the election, voters have said the cost of food is a top concern and they believe that the sugar reform proposal will bring down those prices. While confectionery companies continue to work in collaboration with their retail partners to manage down costs and keep chocolate and candy accessible to consumers, Congress must seize on this opportunity to strengthen America's food economy by passing the Farm, Food, and National Security Act of 2024,” Schildhaus adds.

Courtesy of IT'SUGAR

Burkart says although the situation has improved, suppliers are still faced with supply chain issues, motivating them to make adjustments that require more lead time than she’s seen before.

“This is causing some retailers to shift up their timeline to account for any delays which can be tough for suppliers. Cost continues to be one of the biggest challenges; we all feel it at our weekly grocery trips or when eating out. Suppliers are faced with the struggle to produce top quality products while still keeping costs at a spot the consumers are going to purchase—it's a tough balancing act,” she notes. “However, [producers] rise to the occasion. We continue to see unique flavor combinations and companies partnering up for limited-time offerings, which really generates buzz around the products. Suppliers are continuing to capitalize on new licenses for popular TV shows and upcoming movies, which are always popular, like Bluey and Trolls.”

“In regards to higher costs, we are still seeing consumers stay in and do more family activities at home. Suppliers are making candy products that have an activity involved, whether it be a flavor guessing game or a toy or craft that comes with the candy. These are things that parents look for, to not only pick up a treat for their kids but get an activity too—a win-win,” Burkart finishes.

Levan says one of IT’SUGAR’s biggest challenges has been managing inventory to keep up with the high demand for viral products. “Ensuring a steady supply chain and maintaining adequate stock levels, both in physical stores and online, has required meticulous planning and tracking. Additionally, the industry faced challenges related to rising costs of raw materials and logistics, which necessitated innovative solutions to maintain profitability,” he notes. “Maintaining consumer interest in an increasingly competitive market has been a pressing issue. The industry had to continually innovate and introduce new products to capture and retain customer attention. Supply chain disruptions also presented significant challenges, requiring companies to adapt quickly to an ever-changing market.”

“Freeze-dried candy is really having a moment [and] better-for-you continues to be a common theme with the addition of cleaner ingredients and less dyes.”

— Lisa Burkart, category director, ECRM

“In 2023, we observed a growing consumer preference for customizable and DIY candy experiences. This trend prompted us to explore new product formats, such as mystery boxes and DIY candy kits, to meet the evolving demands of our customers. Plus, we are constantly adapting new strategies to ensure we continue providing quality products at affordable prices for our consumers,” Levan notes. “At IT'SUGAR, we have closely monitored sales trends and industry shifts to stay ahead of upcoming trends. By leveraging data analytics and maintaining a strong pulse on consumer preferences, we have been able to adapt quickly and efficiently.”

“IT'SUGAR's success in launching and promoting unique products is a testament to our innovative approach. We have also capitalized on the popularity of adventurous flavors. These innovations have not only kept us relevant, but also allowed us to thrive in a competitive market,” he concludes.

Shifting landscape

“The coming year presents both challenges and opportunities for candy professionals,” suggests Levan. “Managing supply chain complexities and rising costs will remain significant hurdles. However, opportunities lie in embracing innovation and catering to evolving consumer preferences. Companies that can offer unique, memorable experiences and stay ahead of trends will be well-positioned for success.”

Burkart says the industry will see ongoing challenges, but as candy sales continue to rise, the category will see a lot more innovation as compared to last year.

“I think retailers are going to be more open to new ideas and products, and ways to attract consumers to their locations. For ECRM, we're all about giving our clients the best experience from the moment they register to their follow up. We're excited to be back in person, which allows for more networking opportunities and relationship building. We make decisions with our clients’ best interest in mind and want them to be successful, I think that is great advice for anyone to follow!” she exclaims.

Schildhaus says that the future of the confectionery industry is promising. “From advocating alongside our members for forward-thinking policy, to building on the success of the Sweets & Snacks Expo in Indianapolis—attended by a record-breaking 1,000 exhibitors and 16,000 people from more than 80 countries—NCA is not slowing down. Enhancing special moments and occasions was a key trend emerging from the Expo this year; in keeping with that theme, NCA is excited to continue championing all the ways chocolate and candy make life sweeter.” SF&WB