Pastries

market trends

The BOTTOM LINE

- COVID-19 changes traditional “meal times”

- Online pastry shopping grows

- Clean-labeling still important

Still hitting the sweet spot

COVID-19 catalyzes multiple variables impacting bakery businesses.

Kimberly J. Decker, Contributing Writer

It’s a safe bet that nobody in the sweet-goods or pastry sectors—nobody anywhere, for that matter—expected still to be contending with COVID-19 a full year and a half after lockdowns threw the baking industry, and life as we know it, into upheaval.

But here we are, approaching the end of 2021 with a scary new Delta variant on the rise and the pandemic’s costs continuing to mount.

The good news, though, is that those costs aren’t all sunk, and that the more we wrap our heads around this “new normal,” the better we understand the opportunities that its disruption hides.

After all, says Paul Baker, founder of St Pierre Groupe, Manchester, England, and international director for the St Pierre brand, “How people eat, when they eat, and the sense of occasion around each meal changed during COVID. It altered our circumstances.”

And as far as he’s concerned that’s a gift. “The growth potential for brands is huge,” Baker insists. “And for sweet baked goods in particular, it’s phenomenal.”

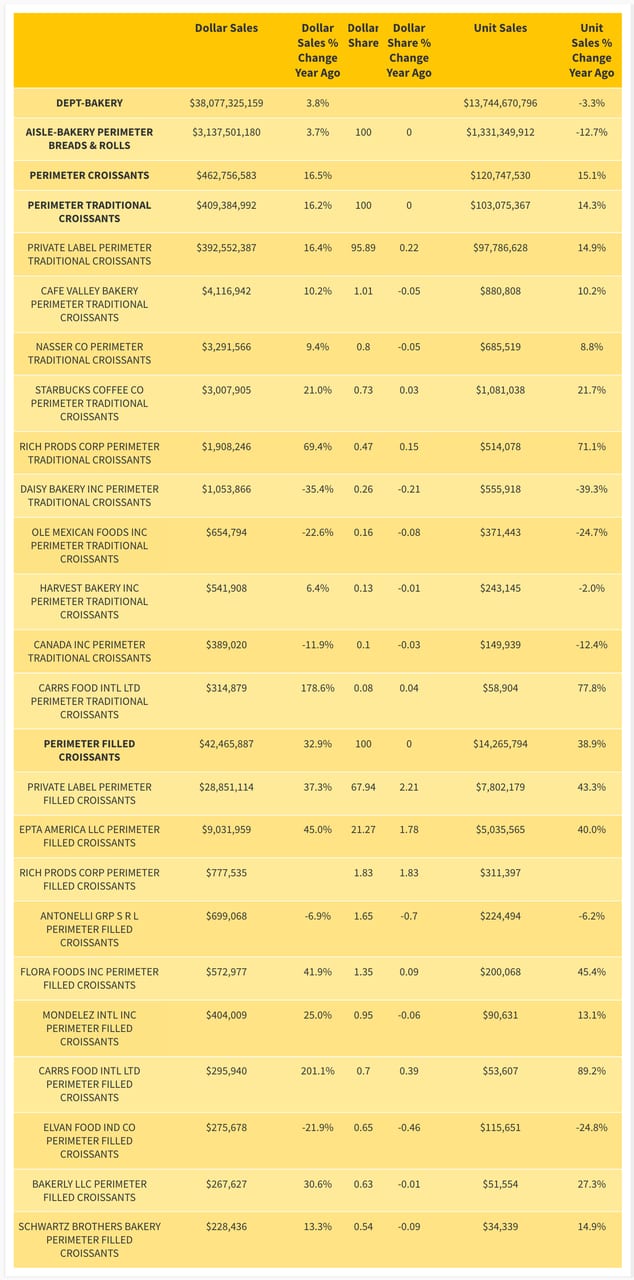

Crunching numbers

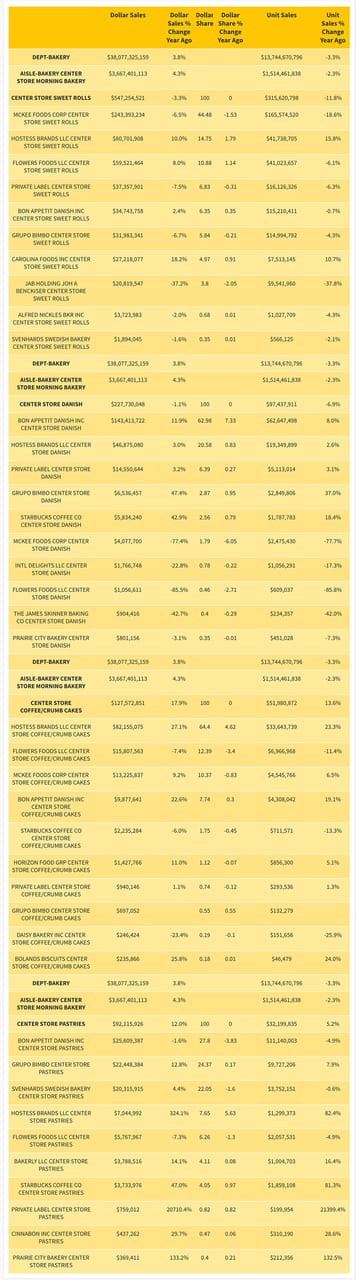

That promise of growth may paint a rosy picture for sweet goods and pastries going forward, but data from the preceding year calls to mind more of a crazy quilt—for whether toting up sales in the center store or perimeter, it’s hard to tease out a coherent narrative.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021

HOVER OVER CHART TO SCROLL DOWN

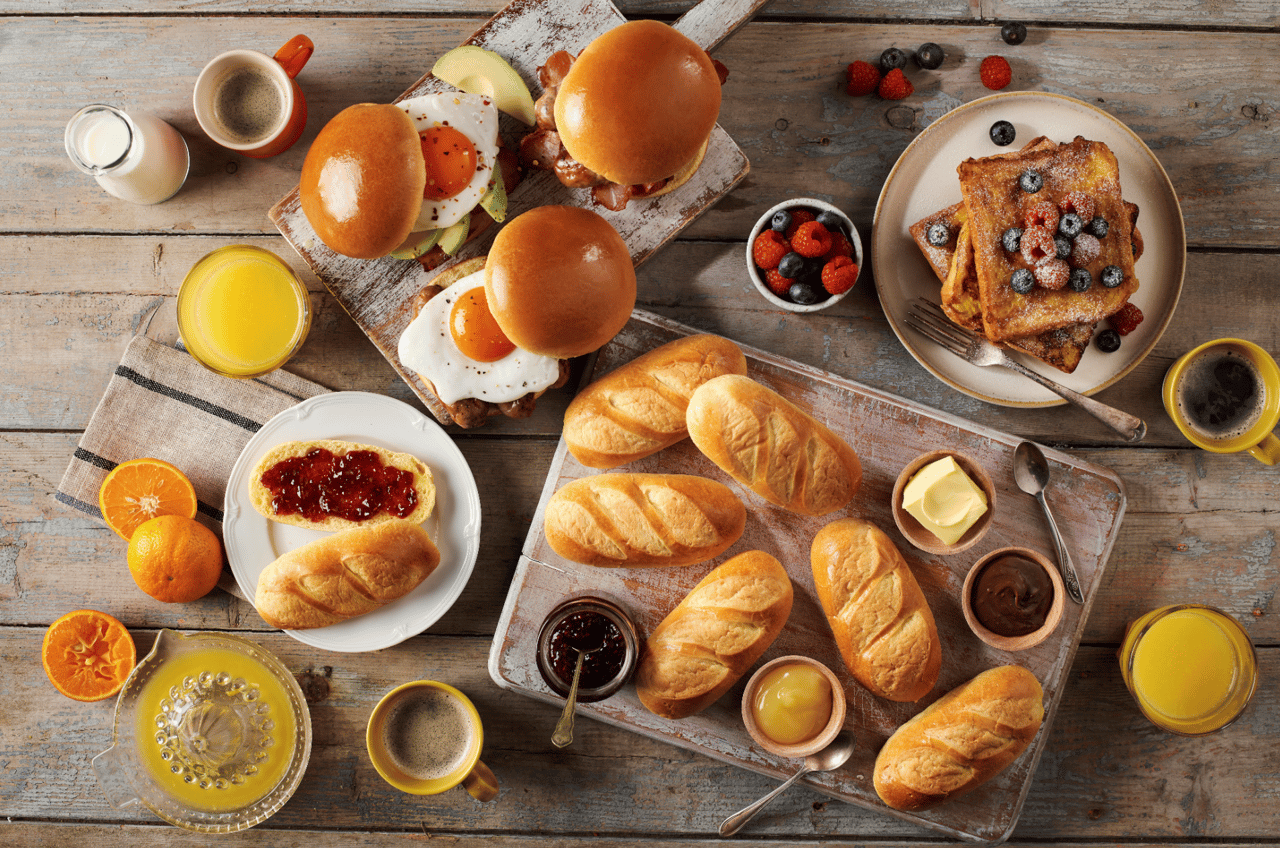

Courtesy of St Pierre Group

To wit, center-store dollar sales for the entire pastry, Danish, and coffee-cake category barely budged up 0.4 percent to $1.1 billion for the 52 weeks ending July 11, 2021, according to IRI, Chicago. Meanwhile, the category’s perimeter sales grew a more noticeable 8.4 percent to $1.5 billion.

More granularly, perimeter sweet roll sales grew 9.7 percent to $358.1 million, with private-label perimeter offerings leading the pack at $201.9 million on growth of 7.8 percent. Sales of $39.7 million earned Grupo Bimbo second place among perimeter sweet rolls, with growth of 28.4 percent appearing substantially more impressive. Also impressive was growth of 27.2 percent—translating to dollar sales of $8.4 million—for The J. Skinner Baking Co.’s in-store bakery sweet rolls.

Center-store sweet-roll action was less dynamic, with sales contracting 3.3 percent to $547.3 million. Here, McKee Foods held the lead with sales of $243.4 million—a 6.5 percent decline from the previous year. Hostess Brands’ center-store sweet rolls grew their take 10.0 percent to reach $80.7 million in sales. And as for private label and Grupo Bimbo, they ranked fourth and fifth place, respectively, in center-store sweet roll sales, with the former banking $37.4 million (a decline of 7.5 percent) and the latter $32.0 (declining 6.7 percent).

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021

HOVER OVER CHART TO SCROLL DOWN

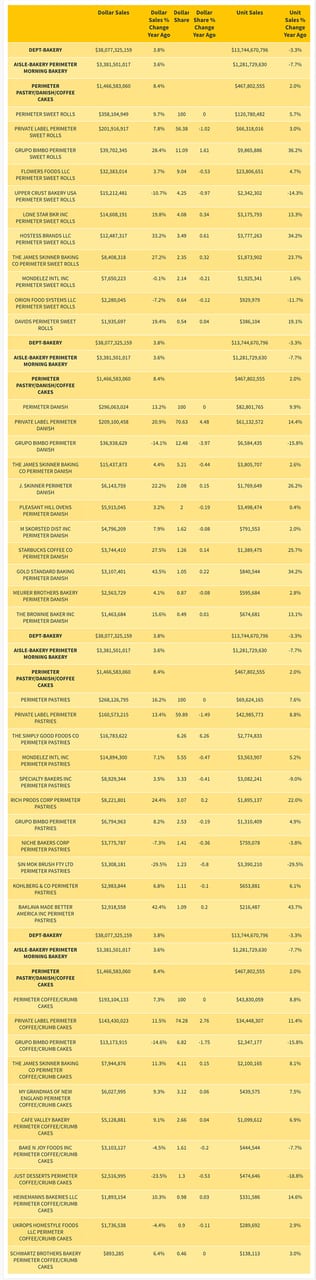

In the Danish space, perimeter sales rose 13.2 percent to $296.1 million, while center-store Danish offerings fared less favorably, declining 1.1 percent to $227.7 million. Private label ($209.1 million in sales and 20.9 percent growth), Grupo Bimbo ($36.9 million in sales, down 14.1 percent), and Starbucks Coffee Co. (sales of $3.7 million on 27.5 percent growth) took the top-three spots in the perimeter, while Hostess Brands ($46.9 million in sales, up 3.0 percent), private label ($14.6 million in sales, up 3.2 percent), and Grupo Bimbo (a mere $6.5 million in sales, but whopping growth of 47.4 percent) owned the Danish podium in the center aisles.

Worth noting is the contrasting perimeter and center-store performances of assorted and multi-pack pastry, Danish, and coffee cake formats. Legend has it that the larger pack sizes scored pandemic points with cooped-up families looking for bulk items to fill pantries fast. And indeed, the family-style formats thrived on stores’ outskirts, growing 22.1 percent on the perimeter to hit $1.1 million in sales. But the same formats took a 14.8 percent tumble in the store’s center, while still raking in $21.4 million.

And finally: croissants. The buttery baked goods have a stronger presence on store perimeters, where they brought in $462.8 million and grew 16.5 percent over the 52 weeks measured. But in stores, the category topped out at $181.1 million overall on 10.6 percent growth. In both grocery regions, though, private-label brands seized the top spots among traditional croissants, with sales of $101.1 million and 8.0 percent growth in the center store, and $392.6 million in sales—up 16.4 percent--on the perimeter.

From edge to center

Any way you crunch the numbers, a key theme to emerge from the pandemic involved consumers’ shifting “hows” and “wheres” of shopping for sweet goods and pastries.

Those shifts were inevitable given the shifts retailers themselves had to make in the name of public safety, notes John Pimpo, marketing director, Parker Products, Fort Worth, TX. “Many in-store bakeries had to close during the early part of the pandemic,” he recalls, “and in some stores, they didn’t even reopen once delivery and pickup began trending.”

David Skinner, marketing manager, J. Skinner Baking Co., Omaha, NE, recalls a similar scenario. “The effects on bakery evolved quickly as the initial panic mentality had consumers seeking shelf-stable items,” he says. The upshot: “We watched center-store reap the benefits—especially center-store bakery.”

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021

HOVER OVER CHART TO SCROLL DOWN

Courtesy of Parker Products

Interestingly, consumers discovered that center-store baked goods offered benefits beyond the pandemic, Baker contends. “It’s not a new idea,” he explains. “Extended-life products are very common in Europe, and as consumers looked to reduce their time in supermarkets amidst a global pandemic, they realized that products with an extended shelf life also carry environmental appeal because they lead to less food waste.”

A new bottom

On the supermarket’s perimeter, “We saw sales of bakery staples—breads, rolls, English muffins and tortillas—spike significantly,” Skinner continues. “But once the dust settled and consumers accepted the new normal, many perimeter staples fell back to their pre-pandemic sales.”

But sweet baked goods charted a different course. As Skinner recounts, “Something unique started happening with sweet baked goods in the perimeter.” To wit, “A big sales spike occurred,” he explains, “but instead of waning and eventually declining to pre-pandemic numbers, things jumped, creating a new bottom for the market. And from there, we’ve seen a slight upward trend in more unique breakfast-bakery sweet goods.”

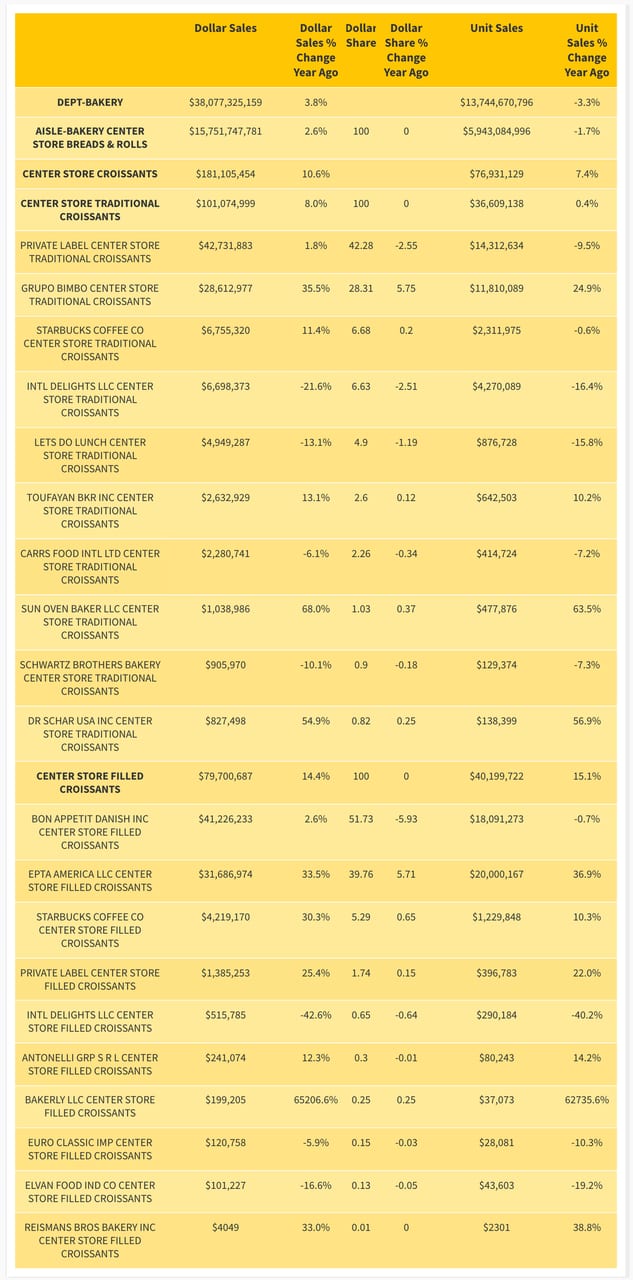

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending July 11, 2021

HOVER OVER CHART TO SCROLL DOWN

Skinner theorizes that this happened because the pandemic introduced new consumers to in-store bakeries’ sweet goods and pastries. And as it turned out, the items on offer proved impressive enough to keep those shoppers coming back.

Evolving pastry platforms

The pandemic also kept shoppers—or at least, the more digitally-inclined among them—coming back to their phones and laptops to order sweet pastries online. And retailers with an omnichannel presence were at the ready to serve them.

Case in point, Skinner says: “Retailers with sophisticated portals for digital shopping were able to leverage their investment in algorithms that display higher-profit-margin items—including sweet baked goods—into strong sales.”

Brands with established delivery partners also found themselves equipped to pivot.

Such was the case with Cinnabon, says Kristen Hartman, category president, specialty brands, Focus Brands, Atlanta. “As many consumers turned to at-home dining over the past year, we were able to expand our presence on third-party delivery platforms to let our fans order their favorite treats and enjoy them at home,” she says.

Cinnabon saw its domestic e-commerce business grow, too, thanks to a 2019 deal it inked with Harry & David making the retailer’s website the sole online outlet for purchasing Cinnabon gift boxes. As Hartman notes, “During the pandemic many consumers looked for ways to gift their loved ones—or themselves—something sweet.”

Disoriented dayparts

Many of those consumers likely found themselves—or their loved ones—digging into their gifts at random times throughout often-unstructured days. The reason: The pandemic threw daily routines, including meal times, out the window.

Courtesy of Cinnabon

“And with dayparts blurring and consumers snacking more at home throughout the day,” Pimpo adds, “the traditional morning meal suffered.” In fact, he’s seen data indicating that consumers enjoyed pastry products less as breakfast items than as desserts or snacks.

Yet Pimpo sees potential in this daypart disruption. “Is the opportunity for the sweet-pastry market in the morning or at dessert?” he asks. “And will consumers grab that extra Danish with their morning coffee, or will a unique baked good make it to the dessert plate?”

Either way, there’s room for growth—especially for sweet baked goods that can wear many hats and meet many needs. “Consumers are opting for products that offer multiple uses, or greater versatility in the purposes they serve,” Baker says. “Savvy brands and producers will highlight versatility in their offering to make the most of this opportunity.”

All in the family—or less is more?

As mentioned earlier, the pandemic also goosed demand for multi-serving family packs.

That was certainly the case with Cinnabon’s CinnaPacks, Hartman says. The boxes of six, nine, 12, and 15 rolls “have always been a significant part of our sales mix,” she notes. “But we saw it grow during the pandemic both in our bakeries and through third-party delivery and ecommerce, as consumers needed larger quantities to feed homebound families.”

That said, “We still saw guests ordering single servings of our baked goods and beverages,” she goes on. And the brand’s conspicuously petite MiniBons and BonBites—the former weighing in at slightly smaller than the original roll and the latter smaller still—are popular with consumers who lean toward a less-is-more mindset.

And those consumers are out there, Baker says. St Pierre’s mini croissants are “the biggest-selling product in our sweet-treats and pastry range,” he notes, and though the minis are sold in packs of 10, he says, “They still let shoppers enjoy smaller portions.”

Craving comfort

The fact that those croissants are doing such brisk business reflects another trend that Baker noticed during the pandemic: a return to familiar favorites.

“Nostalgic baked goods like croissants provide comfort during stressful times,” he points out, “and an increased yearning for nostalgia in food was notable throughout and after the pandemic.”

Pimpo agrees: “The pastry category thrives on comfort, and this is exactly what the world needs as we ease back into regular life.” No wonder flavors like chocolate, vanilla and caramel maintain their lead, he says, with similarly rich profiles like brown butter and salted caramel also gaining ground.

“Yet traditional comfort foods are making their way into pastry sections along with mashups and new creations, too,” Pimpo continues. “New iterations of s’mores, cannoli, churros, and the like are all in development as innovative options.”

“The pastry category thrives on comfort, and this is exactly what the world needs as we ease back into regular life.”

— John Pimpo, marketing director, Parker Products