Slicing, cutting, and portioning

Tech & Techniques

The BOTTOM LINE

- Ease of sanitation appeals to producers

- Equipment that offers long useful life has an advantage

- Flexibility helps producers do more with less

Clean cut

Producers want slicing, cutting, and portioning equipment that offers ease of cleaning, automated features, and endurance.

Ed Finkel, Contributing Writer

Cleanability, automation, longevity of equipment and the ability to fit into tighter footprints are among the features and benefits most top of mind for snack food and wholesale bakery companies seeking new or improved slicing, cutting and portioning equipment.

Wants and needs

Customers of Urschel Laboratories Inc. want ease of sanitation, automation, and the ability to make unusual snack shapes.

“Ease of sanitation is one of the main things,” states Alan Major, chief sales officer with Urschel. “Gone are the days when you could expect the end user to do complicated things to clean the machine and maintain the equipment.”

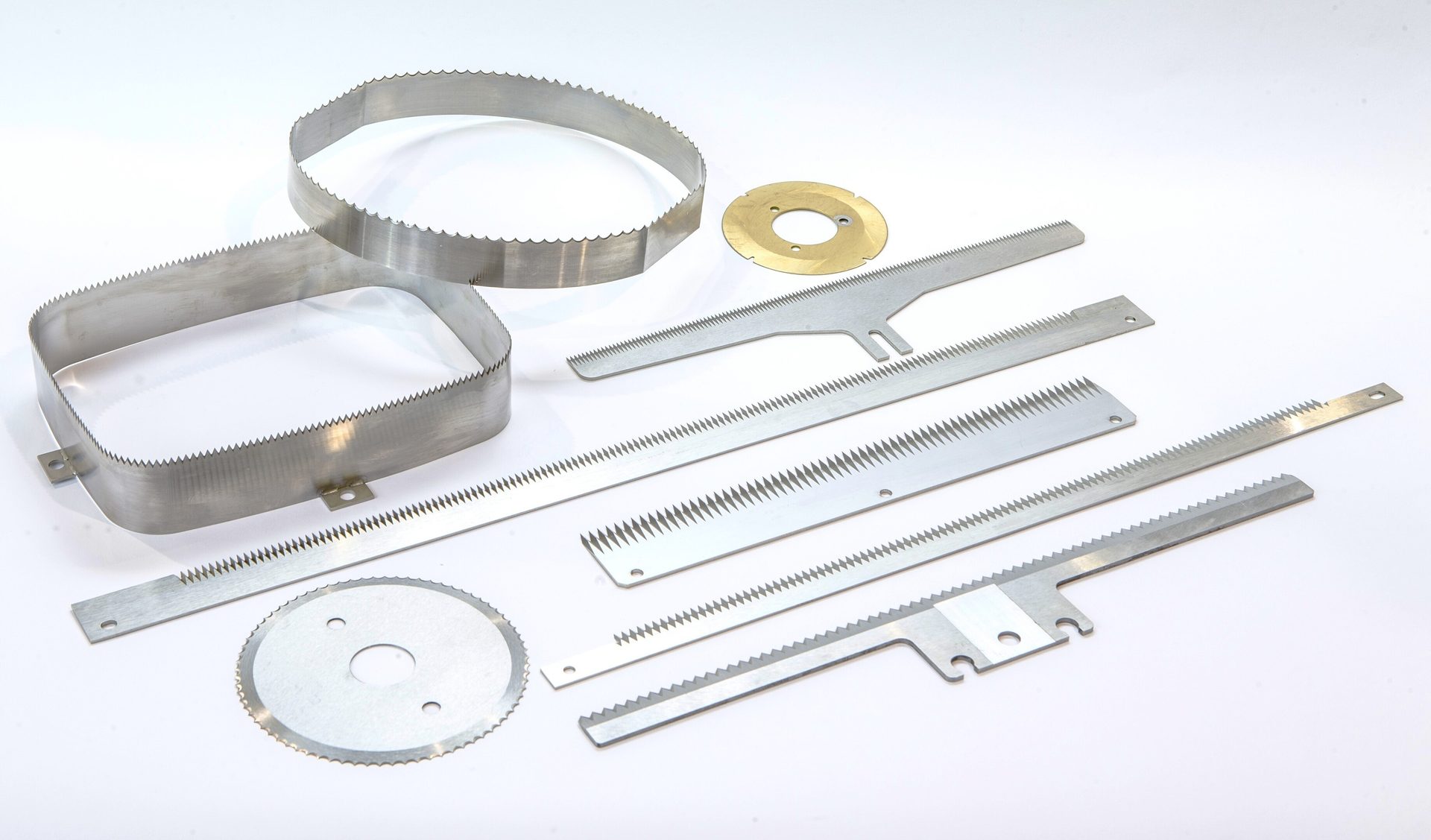

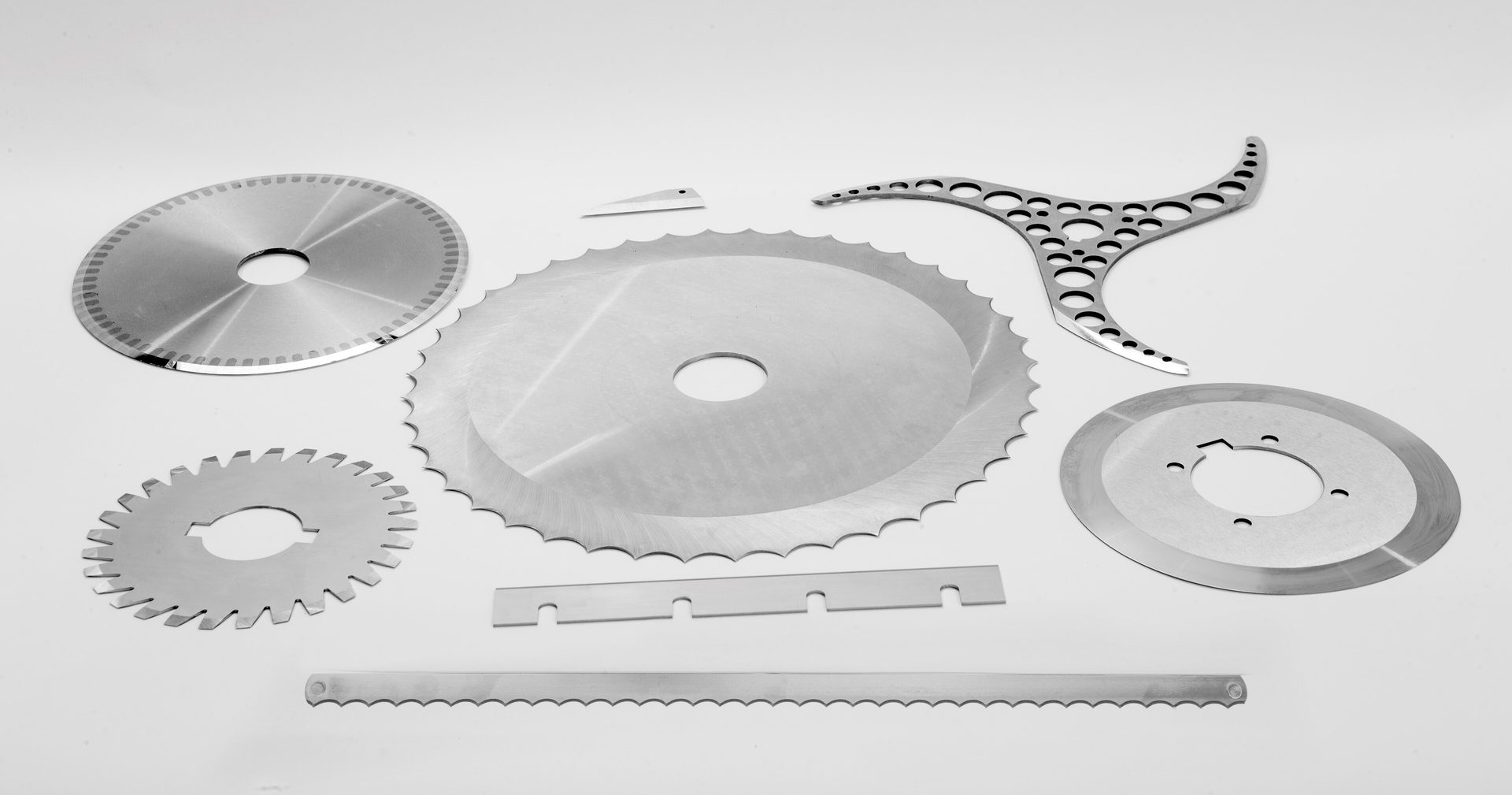

Courtesy of Edge Technologies

Courtesy of Delkor Systems

Delkor Systems plans to introduce a new generation of Combo-line Bread Case Packers designed as an all-in-one solution for single-use shippers and reusable trays in 2025. “Producers can switch between corrugated (one way) shippers and bread tray formats in the same machine,” says Dale Andersen, president and CEO. “Retailers are moving away from direct store distribution (DSD) trays and into corrugated cases due to the challenges and costs involved.”

Delkor Systems recently introduced Smart-Lock, which streamlines packaging size adjustments using a linear bearing slide, LED-based feedback and an automatic locking system. It reportedly eliminates the need for rotary counters, allowing precise, manual adjustments with minimal effort. “It is three times faster, more accurate and designed to virtually eliminate operator errors,” Andersen notes.

“Customers want conveyor belts that can be cleaned more easily.”

— Rudy Sanchez, food handling product manager, Key Technology

That’s in part because it’s challenging to find new employees, says Scott Klockow, director of applications and product development at Urschel: “With the newer designs, we keep in mind that we want to make it as user-friendly and as simple to change over and maintain as possible,” he says.

Major says Urschel has received multiple requests for the ability to make new shapes in the past several months. “Companies want to differentiate their product from their competitors, offering something new—a different-shaped potato chip, for example,” he notes. “That comes at a price. There has to be some volume of sales to make the economics work.”

Edge Industrial Technologies—the parent company of TGW, Pearl, and Leverwood—most often hears requests from snack and bakery customers about longevity, sustainability, and automation, according to Eric Pfeiffer, global vice president of marketing.

“They want blades that will last longer. We can help with coatings, with different alloys of steel,” he claims.

In terms of sustainability, Edge offers recycling programs through which customers can return used blades. “When the blade is worn out, return it to us, and you don’t have to worry about disposal,” Pfeiffer adds. “Steel is highly recyclable. The more we can pull it into one location and send to the steel mill to turn it into new steel, the better it is for everybody.”

Increased throughout through automation is another customer focus, Pfeiffer adds. “On the processing side, those processes have been fairly automated for a number of years,” he notes. “On the packaging side is where we’re seeing the biggest push for automation.”

Danny Friend, lifecycle leader at The Grote Co., says his customers seem most concerned about automation, tighter tolerances and footprints, and the ability to produce multiple SKUs at once to better meet consumer interest in healthier snacks.

“One of the biggest things we’re seeing is more and more automation to reduce manual interactions, like robotic auto-loading, or pneumatic or vibratory solutions,” he says. “Allow us to move things quicker with less people. They have resource constraints. A lot of them are looking for tighter tolerances on products to reduce giveaway. They want waste assessments for continuous improvement. And with wider product lines, they want to get more throughput in the same space. That means tighter footprints.”

Customers of FoodTools are most focused on sanitary design and automation, according to Sergio Caballero, sales manager.

“Automation is a conversation that never goes away: ‘How can we eliminate people? How can we be faster and more productive?’” he says. “Also, should the line go down, what’s the troubleshooting [protocol]? How can we help? A lot of that is remote log-in these days, making sure we can go through their firewalls and get to their machine. It’s for reassurance on their end, knowing that they’re getting the right piece of equipment and we will be able to stand by it at any time of the day.”

Courtesy of The Grote Co.

Caballero hasn’t seen many changes in terms of the types of SKUs snack and bakery companies want to produce. “Sweet goods are sweet goods. Bread is bread. Energy bars are energy bars,” he notes. “90% of products are all stuff that’s been around for a long time. Portion size is the biggest [change] for us, asking, ‘Can I get another row of brownies smaller than it used to be?’”

Egan Food Technologies representatives most often hear requests from snack and bakery companies about ease of sanitation and cleaning, and the availability of parts, says Mike Sherd, managing partner.

“If you lead with that, they’re happy,” Sherd advises. “Every machine, we improve something on it. It’s rare to set up the exact same machine twice. We have custom equipment. We react to the feedback. They want to take the belts out and clean them easily, and access everything easily.”

Customers often ask Egan if they stock the parts that might be needed down the line, Sherd adds. “Especially after COVID, they’ve honed in on parts that are available,” he says. “Price is one thing, but man, if you can’t find parts, and you can’t cross them over, it’s such a nightmare in these high-production environments.”

Questions to Ask

When shopping for new or improved slicing, cutting, and portioning machines, customers should ask their potential manufacturers how many similar machines they already have in the field, says Major of Urschel.

“What is the cost of ownership? Will I be able to get aftermarket parts easily? What’s the reliability of the equipment? And, how can I see a machine?” he says. “Customers purchasing our machines, it’s in their best interests to see one, first-hand, operate and run a product that would be something similar to what’s running in production in their plants.”

Pfeiffer of Edge Industrial says snack and bakery customers should be asking manufacturers about improvements in throughput: how they can get more product through the same number of machines with less human intervention.

“With all the talk about tariffs and trying to reshore manufacturing, the biggest challenge we see with all the plants we deal with, all the industries we deal with, is they continue to struggle to get people in the door and hold onto them,” he observes. “Americans these days are really not interested in manufacturing jobs.”

Life expectancy should be top of mind for slicing, cutting, and portioning equipment customers, Friend states.

“The Grote Co. is servicing equipment that’s 25 to 30 years old. We’re able to do updates,” he says. “That ties to cost of ownership: Will the purchase of this equipment last you 25 or 30 years, or is it a 10-year piece of equipment?” The other question he suggests is how simple the equipment will be to use. “What is the skill level of the operators required to run the equipment?”

Caballero of FoodTools suggests that slicing, cutting, and portioning customers ask where equipment is made and how service is going to be handled.

“We won a couple projects against competitors because we’re U.S.-based, the customer’s U.S.-based, and they were having problems getting service and parts when it was [a supplier in] Europe, or Asia, or different parts of the world,” he reports. “That conversation is obviously a little bit at the forefront nowadays with the current administration bringing everything back to the U.S. But we also sell internationally, and they want to know about service and longevity. People don’t want to be down.”

Courtesy of FoodTools

“Manufacturers are always looking at new products, formats, and SKUs, and inspection equipment needs to be flexible enough to support that.”

— Richard Reardon, general manager, Antares Vision Group