Puffed and extruded snacks

CATEGORY FOCUS

The BOTTOM LINE

- Consumers want BFY alternatives to traditional snacks

- People want health and product transparency

- Smaller-serving portions and on-the-go bags are trending

Pleasantly puffed

From cheese puffs to lentil-based loops, consumers have wide choices in the puffed and extruded snack category.

Liz Parker Kuhn, Senior Editor

Although the puffed and extruded snacks category suffered a slight loss in sales last year, it’s not going anywhere anytime soon: Cheetos, BFY snacks, and other varieties are ubiquitous in American pantries. In addition, puffed and extruded snacks aren’t just for adult consumers: there’s a large baby and toddler market for them, too.

Market data

Per Chicago-based market research firm Circana’s data from the 52-week period ending February 23, 2025, the other salted snacks (no nuts) category experienced a slight decrease of 0.6%, with $8.7 billion in total sales.

HOVER OVER CHART TO SCROLL DOWN

Source: Circana OmniMarket™ Total Store View | Geography : Total US - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers) | Time : Latest 52 Weeks Ending 02-23-25

Frito-Lay and its brands dominated the top three spots, with generic “Frito-Lay” taking in $3.4 billion in sales but with a minor 3.1% decrease; Funyuns, also a Frito-Lay brand, with $717.2 million in sales and a 1.4% decrease; and SunChips, yet another Frito-Lay brand, with $652.7 million and a 1.8% decrease. There were some bright spots among all of the decreases, though, with Quest brand snacks’ sales increasing by 37.9% versus the same time period last year; and Quaker and Cheez-It brands experiencing growth, by 9.3% and 12.6%, respectively.

In the cheese snacks category, which brought in $4 billion (albeit with a 2.6% decrease), Cheetos came in first—in fact, making up most of the sales in this category, with $3.2 billion and also a 2.6% downtick—and Cheez-It brought in $127.5 million, unfortunately with a loss of 32.1% in sales. Coming in third was Utz, maker of cheese balls and other cheesy snacks, with $126.6 million in sales and a healthy uptick of 5.7%. Other brands to watch include Chesters, with an 813.4% growth in sales (not a typo!), and Like Air, with a 59.6% upturn. The Sabritas brand, although only bringing in $5.3 million, also expanded, by 76.2%.

Trends

“Consumers are seeking better-for-you alternatives to traditional puffed and extruded snacks,” says Nicole Stefanacci, brand manager, Popchips. “We also see consumers prefer short ingredient lists with recognizable, natural ingredients.”

Popchips Sweet Heat specifically meets the demand of the growing “swicy” (sweet and spicy) flavor trend, incorporating both sweet and spicy flavor profiles and giving consumers more for their tastebuds in every chip, she adds.

“With Popchips’ lineup of BBQ, Sea Salt, Sour Cream & Onion, Sea Salt & Vinegar, Nacho, and our newest Sweet Heat, we offer a variety of bold flavors for consumers to indulge in, all with 50% less fat compared to regular potato chips,” Stefanacci finishes.

Courtesy of Popchips

Courtesy of Low and Slow Snacks

Jared Drinkwater, CEO/co-founder/chipmaster, Low and Slow Snacks, says he is seeing a lot of latent love in the cheese puffs subcategory, especially around the brand’s smoked BBQ cheese puffs.

“It’s our No. 1 SKU in some markets by a 4:1 margin. We’re thinking the reason for such a strong market reception is twofold. First, puff bags are bigger than most other salty subcategories, providing a better value impression in a time where value is king,” he explains. “Second, the category hasn’t seen a ton of true innovation; there is a lot of room for us to innovate with our unique smoked platform in this category. In addition to savory flavors, we are also seeing some cool trends within the sweet, puffed category, like cinnamon sugar.”

Maiko Shimano, director of marketing at Calbee America, Inc., suggests consumers are becoming more intentional about their purchases, choosing snacks that deliver on nutrition, taste, and convenience.

“On social media, we’re seeing more conversations and content around health and wellness in general; among this health-conscious group, protein intake continues to be important, and our Harvest Snaps lineup meets this demand with 3-5 g of protein per serving from utilizing whole ingredients [as the first ingredient], such as green peas, red lentils, or navy beans,” she shares.

“Another trend we’re seeing is the use of ‘real ingredients’ on packaging. Brands like Harvest Snaps that truly utilize ingredients in an honest way (in our case, real veggies) are calling this out for clearer communication on pack. For snacking more mindfully while on the go, we also offer a Variety Snack Pack that includes three of our popular baked veggie snacks in single-serve bags. Consuming multiple, smaller meals throughout the day continues to be a trend, and our multipack offers a convenient way to enjoy a nutritious and satisfying snack anytime, anywhere,” Shimano adds.

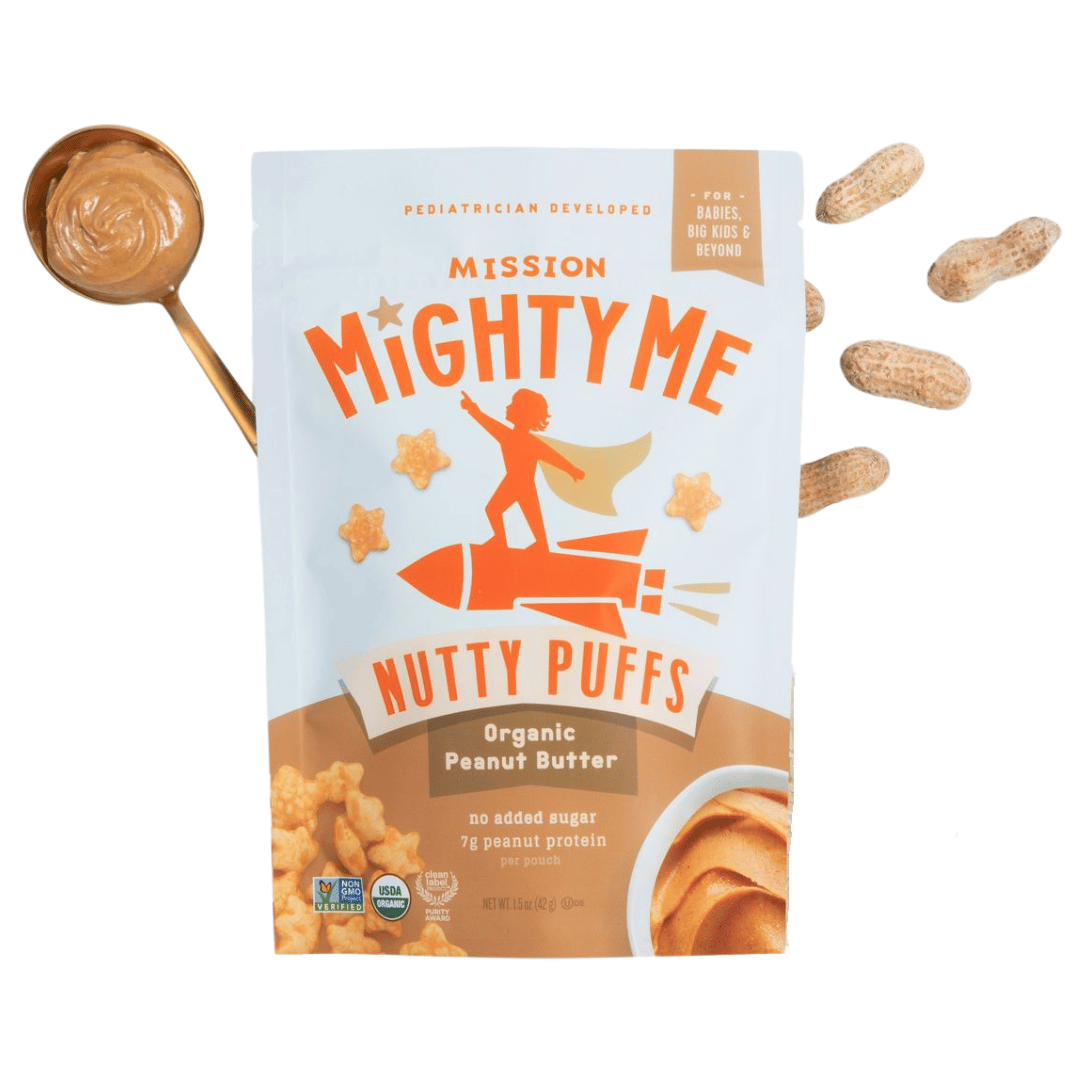

J.J. Jaxon, co-founder and co-CEO, Mission MightyMe, says he’s seen that parents—the brand’s main purchasing base—are deeply invested in their children's health, particularly in early nutrition and allergen exposure, and seek convenience, safety, and trust when selecting foods for their young children.

Courtesy of Calbee America, Inc.

“We can relate: MightyMe was born when my wife Catherine and I weren’t happy with the ingredients in the few nut butter puffs that existed. Our experience inspired us to develop science-backed snacks that also delivered on taste, quality, and nutrition. With puffs specifically, we think parents enjoy the versatility and multi-use appeal of the category—i.e. the flexibility of an on-the-go snack for a toddler, ability to crush into yogurt or mix with purees for a baby starting solids, etc.,” he comments.

Listening to consumers

Consumer preferences are at the forefront of every decision made at Calbee America, Shimano shares.

“Before launching products, we utilize multiple research methods, including quantitative consumer research to ask shoppers about their snacking habits, occasions, and brands they purchase, all to make sure we’re addressing their needs. We also attend numerous trade shows throughout the year to stay on top of new brands and upcoming trends, including flavors, ingredients, and packaging callouts,” she adds.

“We incorporate these findings into our internal workshops where we discuss brand strategies and our innovation pipeline. As a global company (No. 4 as a salty snack company, based on Euromonitor data), Calbee America also participates in workshops with the Calbee AU, UK, and Japan teams to exchange information about international insights and trends as well. In addition, our team is passionate about food and snacks! We’re always visiting local stores when we travel to find inspiration to take back to the team. We also remember that we’re consumers ourselves, and follow our intuition about what we feel will resonate with shoppers,” she notes.

Shimano continues to see an increase in innovation tied to international flavors, with snackers getting more adventurous and wanting to explore tastes from around the world.

“With a 75-year-snack heritage that originated in Japan, our team is in a unique position to bring products to market that align with this trend. Over the past year, Calbee America has found success introducing our legacy products to conventional U.S. retailers, including our iconic Shrimp Chips, wheat-puffed snacks made with sushi-grade, wild-caught shrimp and baked to a light and airy crunch,” she finishes.

Jaxon says MightyMe does not follow emerging tastes and trends—instead, it looks for gaps between what parents need for their kids and what is available.

Courtesy of Mission MightyMe

“We spend time monitoring what’s new on store shelves and through e-commerce, but we mostly listen to our customers and our team. We think we have the best customers in the whole world and they come to us all the time with ideas,” he shares. “Nobody is more innovative than a mom with a pain point that she wants solved! We love talking with customers about ideas. We’re also super lucky that many of our team members are working moms—most with infants or toddlers. They have ideas all the time and are a built-in focus group for us … and their little ones are the best taste-testers.”

New products

“[Popchips]’ next-gen approach to snack production aligns with the values of today’s conscious consumers, who prioritize health and product transparency in their better-for-you snacking decisions; so you can feel free to eat one, two, three handfuls, or even a whole bag,” suggests Stefanacci.

“Our newest Sweet Heat flavor features notes of tangy sweetness and a slow-building heat, carefully crafted to fill the demand for bold, complex flavors that appeal to adventurous eaters. In a market saturated with basic flavors, Popchips Sweet Heat taps into the growing trend of consumers seeking snacks that offer both indulgence and health-conscious benefits, combining the perfect balance of sweet and spicy in a way that stands out from typical savory snacks,” she finishes.

Adding to a rapidly growing culinary trend, Good Health (another brand in Our Home’s portfolio), is bringing to market a lineup of avocado oil Veggie Stix, Straws, and Chips this June.

“Avocado oil is the fastest-growing culinary oil, growing 47% YoY, highlighting its rising popularity for its health benefits and versatility making it a great alternative to seed oil. Good Health will be the only brand in the segment to offer veggie snacks made with avocado oil, leveraging this better-for-you trend,” shares Laura De La Torre Chevallier, brand manager, Good Health. “Good Health is elevating its veggie snack lineup by transitioning to avocado oil, bringing a better-for-you twist to its Veggie Stix, Veggie Straws, and Veggie Chips. With vibrant colors that appeal to kids and simple, natural ingredients, these snacks make better-for-you snacking easy and enjoyable for busy households.”

Drinkwater says given Low and Slow Snacks is a BBQ brand first, salty snack brand second, it is immersed in BBQ culture.

“If we wouldn’t be excited to throw it in our smoker, we won’t throw it in our bags. Having this strong center of gravity has unlocked tons of flavor ideas we’ve never seen explored in our category, but we think consumers will love. We spend way too much time eating BBQ, but we love it,” he enthuses. “Our newest flavor, Hickory Smoked Jalapeno Cheese Puffs, will be hitting shelves in Q2 2025 and we have three more puff flavors in development.”

Shimano notes that this year, Calbee is introducing new packaging for Shrimp Chips, with a design that’s more authentic to the original lineup sold in Japan.

“There are also exciting launches in the pipeline for Harvest Snaps, including a new Zesty Ranch flavor to replace Wasabi Ranch. Our research shows that Ranch is a growing flavor profile both in units and dollar sales in the BFY puffed snacks and straws segment,” Shimano says. “We’re also introducing an Original flavor to our Crunchy Loops lineup, which is a family-friendly addition that features an approachable flavor and is free of allergens. Stay tuned for more details.”

Jaxon says MightyMe recently transitioned its puff grain ingredient from organic rice to organic sorghum—a superfood grain with robust health benefits—across all four SKUs.

“Consumers are seeking better-for-you alternatives to traditional puffed and extruded snacks.”

— Nicole Stefanacci, brand manager, Popchips