TORTILLAS

STATE of the INDUSTRY

The BOTTOM LINE

Experimenting with bases

Healthy choices

Pandemic trends

Tortilla tales

Consumers experiment with better-for-you tortilla choices.

Liz Parker, Managing Editor

Tortillas, always one of the most versatile breads, had extra mileage to accomplish this past year: consumers wanted better-for-you options for their tacos, flautas, and fajitas. They also wanted these to be easily accessible at their local grocery stores so that they could cook at home during the pandemic.

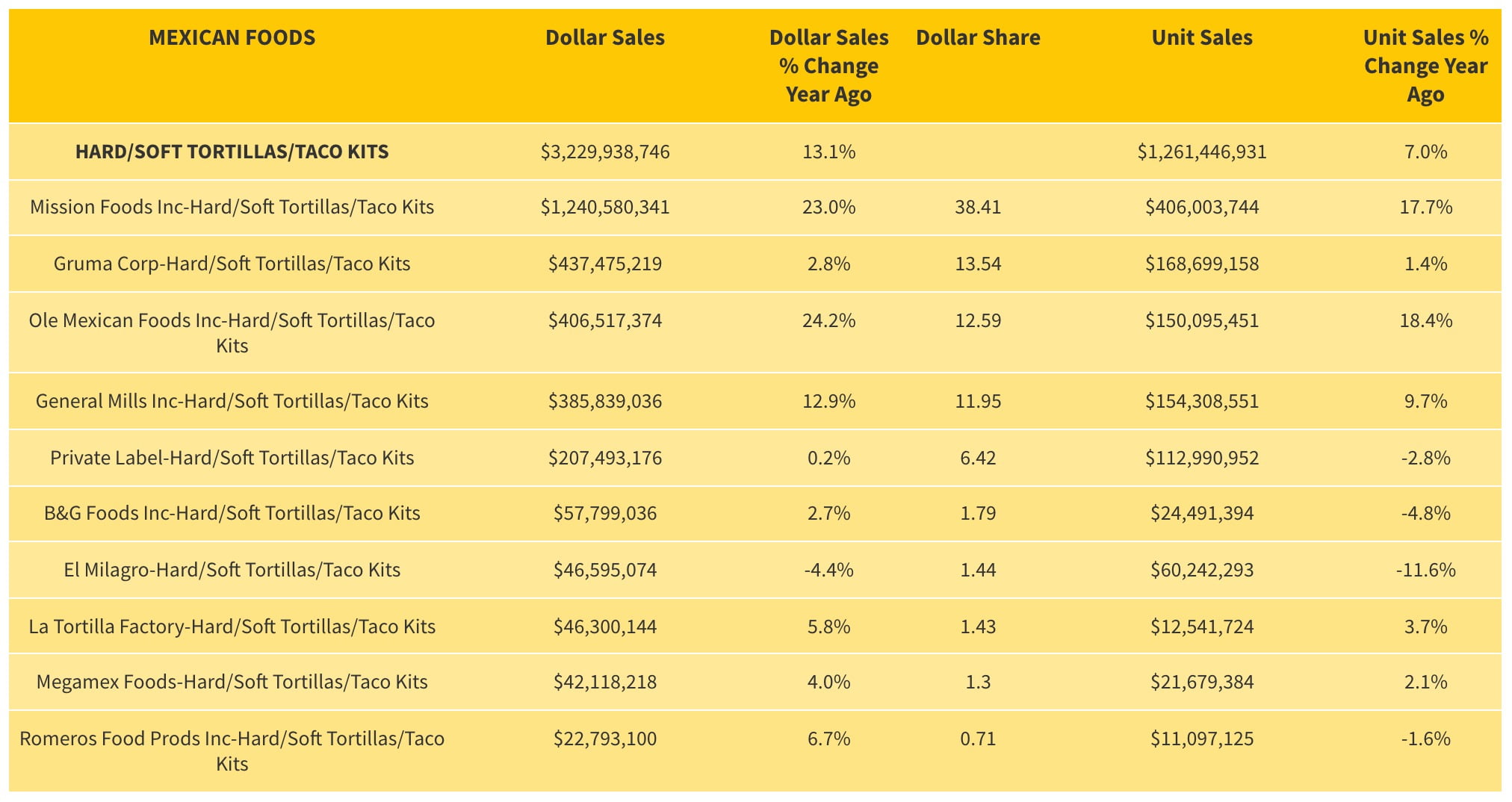

Market data

According to data from IRI, Chicago for the past 52 weeks ending April 18, 2021, the retail tortilla product segment grew 13.1 percent to $3.2 billion. Mission Foods Inc., the category leader, took in $1.2 billion in sales, an increase of 23.0 percent from last year, and Gruma Corp. took in $437.5 million, with a slight increase of 2.8 percent. The No. 3 company in the segment, Olé Mexican Foods Inc., took in $406.5 million in sales, with a sizable increase of 24.2 percent. Also of note, General Mills had a 12.9 percent increase in sales to $385.8 million.

Mission’s Super Soft tortillas brand had a particularly strong year, up 104.5 percent to $466.0 million. Better-for-you tortillas also resonated, with Mission’s Carb Balance tortillas growing 46.7 percent to $267.7 million.

In other better-for-you notes, Olé Mexican Foods saw continued growth for its Xtreme Wellness brand, up 33.3 percent to $90.1 million.

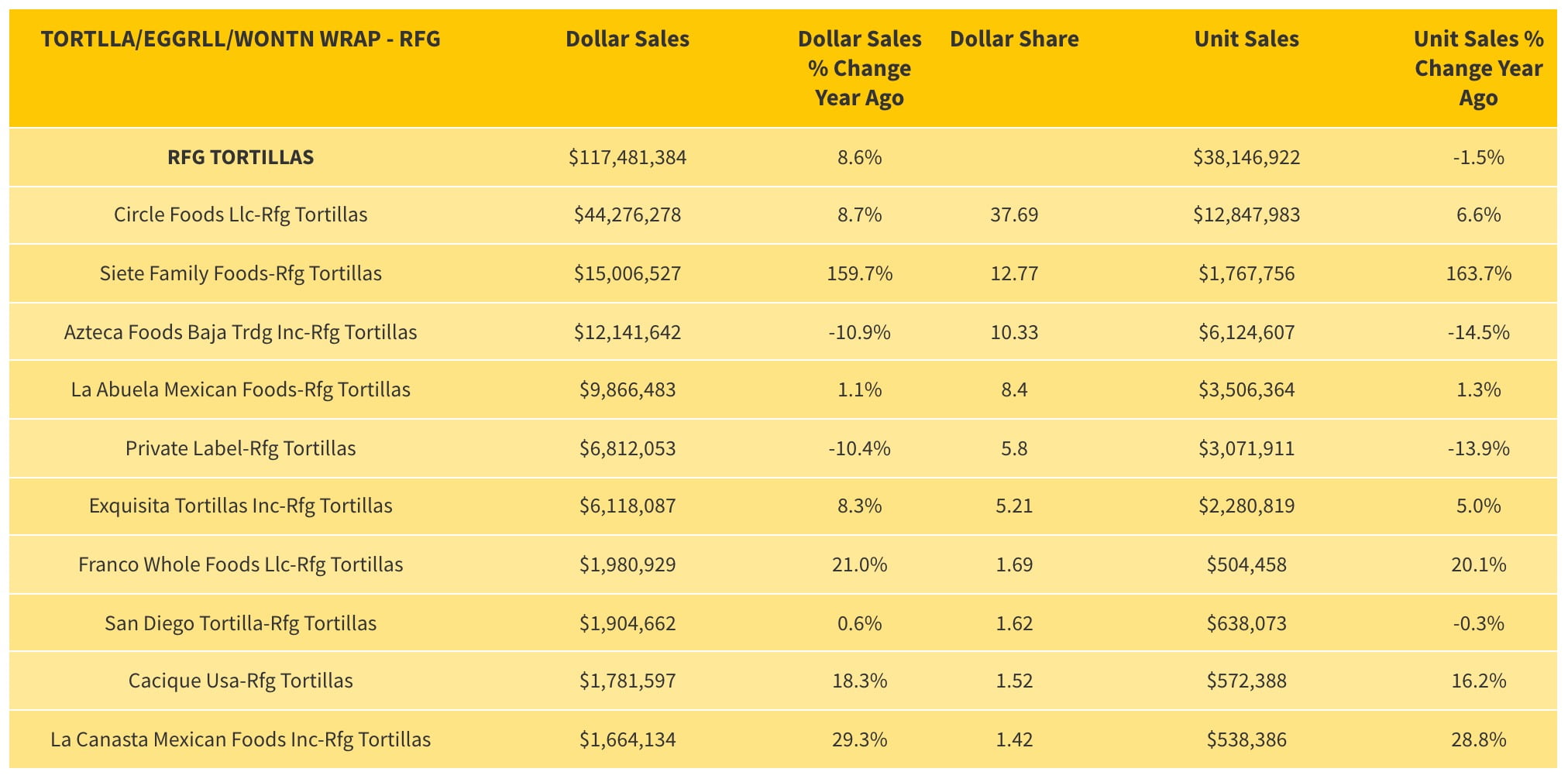

The refrigerated tortillas segment was up by 8.6 percent to $117.5 million in sales. Circle Foods LLC continues as the category leader, bringing in $44.3 million in sales, with an increase of 8.7 percent. Siete Family Foods experienced a notable increase of 159.7 percent in sales, bringing it to $15.0 million total.

Looking back

In 2020, tortillas often pivoted to using different bases versus just corn and flour.

In August 2020, La Tortilla Factory released cauliflower tortillas, made with cassava flour, as well as low-carb, high-fiber quinoa and flax tortillas. In addition, Tia Lupita released its first upcycled tortilla line, which is also grain-free, and includes nopales (cactus). The flour used, organic okara flour, is a grain-free flour with neutral taste and superfood benefits.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

Courtesy of Healthy Food Ingredients

“One of the areas we are seeing an increase in is the prevalence of lentil and pea-based snacks. These plant-based snack foods have taken off over the last year as consumers look for alternative protein sources and better-for-you options. These trends, while not new, have gained interest during the pandemic,” says Anita Srivastava, Ph.D., senior technical service manager, bakery, Kemin, Des Moines, IA.

“With shortages in meat at the beginning of the pandemic, many turned to alternative protein sources, which has helped to increase their popularity. The bigger driver is the focus on health and wellness amid the COVID-19 pandemic. Consumers are paying more attention to what foods they are eating and are seeking out some of these plant-based products as alternatives to traditional snack foods,” says Srivastava.

“When we look at bakery, and specifically tortillas, Kemin offers a robust line of products to help meet shelf-life and microbial stability goals. Our SHIELD line of food safety products helps with mold inhibition in corn or flour tortillas. Our line of tortilla softeners helps to extend the shelf life of tortillas and helps reduce the wastage due to textural spoilage,” Srivastava notes. “Our TillaSoft Relax helps manufactures reduce machine uplift of tortillas. Finally, Kemin offers innovative delivery options for manufacturers. Our Kemin Application Services and technical teams can work with manufacturers to provide dosing systems that deliver precise dosages, help minimize ingredient wastage and lessen the cross contamination of ingredients.”

Jennifer Tesch, chief marketing officer, Healthy Food Ingredients, Fargo, ND, says that trends in the tortilla category include continued growth and demand for clean, simple label, whole grain, gluten-free, plant-based proteins, non-GMO, and organic. “We have seen continued demand for amaranth, buckwheat, and quinoa, and a resurgence in interest in sorghum, flax, and millet specifically. In general, ancient grains play into a whole grain, gluten-free trend while encompassing a clean and simple label,” she explains.

“Non-GMO Project Verified and certified organic, our Suntava Purple Corn is a great fit for tortilla applications, providing a bold purple color to the finished product with added functional properties including antioxidants and anthocyanins, which speak to a better-for-you trend,” Tesch finishes.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN