The BOTTOM LINE

Better-for-you but indulgent treats

Searching for new, interesting flavors

High in-store bakery sales

Pandemic-inspired indulgence

Consumers still prize sweet goods as a form of comfort food during the pandemic.

Kimberly J. Decker, Contributing Writer

Conventional wisdom holds that COVID-19 had consumers searching for one thing above all others in 2020—and we’re not talking toilet paper.

sweet goods

STATE of the INDUSTRY

But will consumers keep craving feel-good sweet goods once we exit the COVID era? Given the innovations that brands and manufacturers have waiting in the wings, the quest for comfort may continue through 2021 and beyond.

Market data

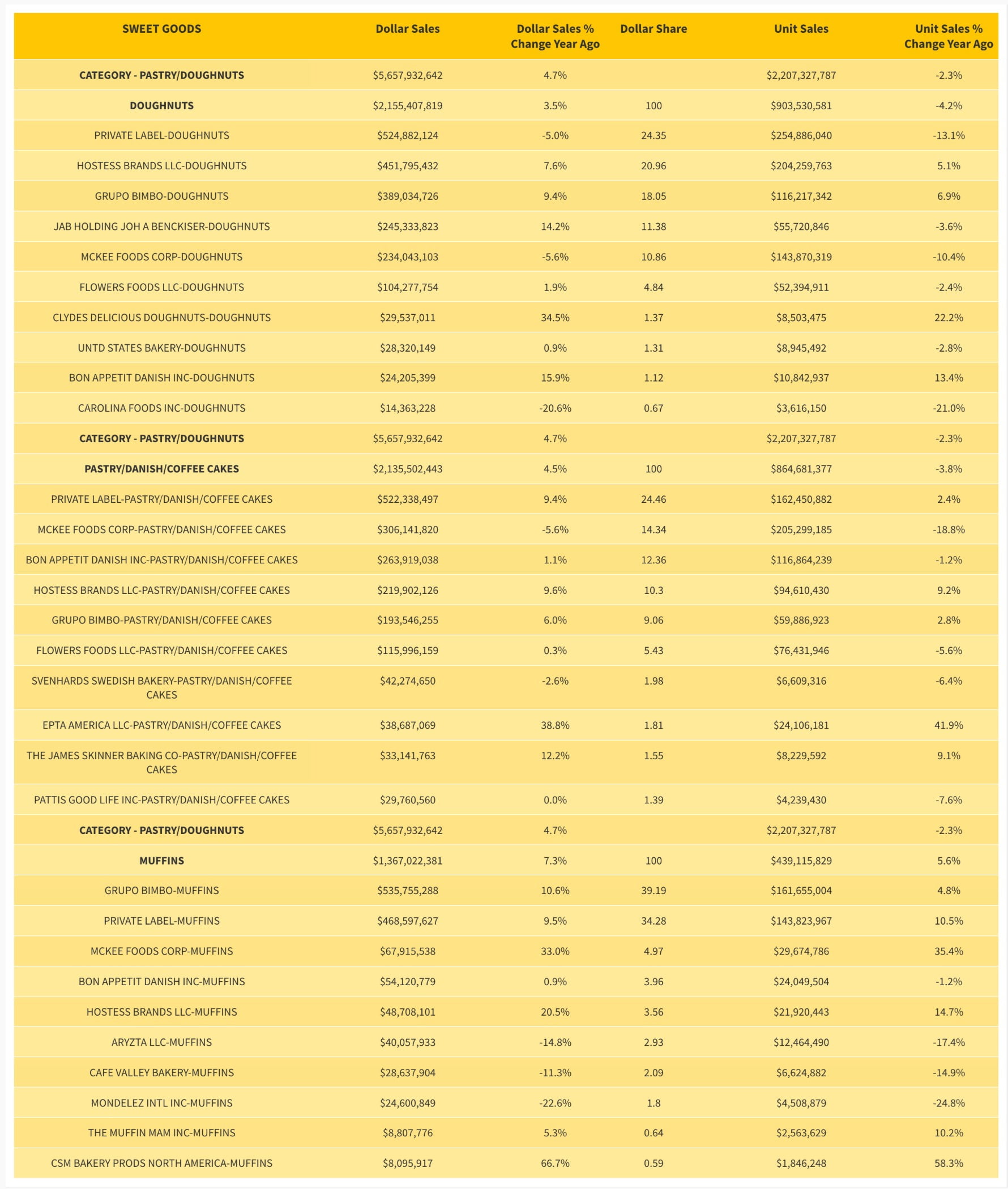

The 2020 scoop on pastries, doughnuts, and muffins merely amplifies the good-news story that’s characterized the category for some time. According to data from IRI, Chicago, the whole sector banked sales of $5.7 billion for the 52 weeks ending April 18, 2021, representing growth of 4.7 percent. Following 2019’s 3.3 percent growth and sales of $5.3 billion, that signals a category going from strength to strength.

Consider doughnuts, sales of which were up 3.5 percent on the year to $2.2 billion. The three leading manufacturers retained their top spots from the year before, with private label down 5.0 percent to sales of $524.9 million, Hostess Brands up 7.6 percent to $451.8 million and Grupo Bimbo up 9.4 percent to $389.0 million. But new to fourth place was JAB Holding, maker of Krispy Kreme, whose 14.2-percent growth and $245.3 million in receipts helped it nab the yellow ribbon from last year’s fourth finisher, McKee Foods.

Pastries, Danishes, and coffee cakes also exited 2020 in a comfortable position, with 4.5-percent growth bringing the subcategory’s value to $2.1 billion. Once again, private label brands took the (coffee) cake, banking sales of $522.3 million and growth of 9.4 percent—quite a turn from 2019’s 0.3-percent decline. Hanging onto their respective second and third spots for another year were McKee Foods, with $306.1 million in sales despite a 5.6 percent contraction, and Bon Appetit Danish Inc., with $263.9 million in the till and modest growth of 1.1 percent.

And let no one accuse muffins of being out of fashion, for the subcategory enjoyed another robust year, growing 7.3 percent to reach a value of $1.4 billion. As was the case last year, Grupo Bimbo bested private-label manufacturers to take both the top spot and $535.8 million in sales, riding impressive growth of 10.6 percent. But private brands were no slouches; growth of 9.5 percent filled their muffin cups with $468.6 million for the year. Rounding out the top three was McKee Foods, last year’s fourth-place finisher. While its sales of $67.9 million trailed the top-two companies’, its 33.0-percent growth proved impossible to ignore.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

Courtesy of Dawn Foods

Looking back

Those are extraordinary numbers following a year that decimated other sectors of the food industry. But the sweet goods space didn’t escape the pandemic’s stamp entirely; it just didn’t suffer much from it.

For example, the major stamp that Hartmut Siegel, managing director, Schubert North America, Charlotte, NC, noticed involved COVID’s changes to manufacturing. To wit, he says, “Because of the pandemic, retail business in general picked up, which put pressure on factories to manufacture single-serve packs instead of foodservice units.”

In addition, “The complexity of bakery products increased,” says Siegel. He tallied more multilayer items, as well as a wider range of SKUs, novel multi-flavor packs, more filled products and more options with decoration and icing.

Speaking of which, Siegel saw brands shift delicate finishing operations to the manufacturing site, rather than leaving them to a “second handling” at an in-store bakery or even their own facility. Why? The pandemic reinforced the importance of automation. Flexible robotic equipment lets companies “pivot with changing market demands to stay competitive,” he argues, adding that automation also empowers better quality control, efficient materials use and “hygienic production”—no small matters during a global contagion.

David Skinner, marketing manager, James Skinner Baking Co., Omaha, NE, saw the pandemic play out in consumers’ changing shopping patterns. “In the months following March 2020,” he recalls, “we saw center-store bakery really outpace in-store bakery thanks to shelf life and consumer uncertainty.” Once anxiety over out-of-stocks eased in the following months, “We then saw a shift—and increase—back to in-store bakery.”

Those in-store bakery categories that “skyrocketed” during COVID-19’s early months have since settled back to pre-pandemic sales, Skinner concedes, but as the market data show, the gradual growth that sweet goods enjoyed has plateaued at “high levels,” Skinner maintains. “We’re even seeing slight increases month after month.”

Looking forward

“The in-store bakery has always had an indulgent aura,” Skinner continues. And yet, he says, “I believe that in-store bakery is on the cusp of a kind of department renaissance.”

How so? “In-store bakery is almost the final frontier for healthier grocery options,” he wagers. “But with a 69 percent increase in products developed for cleaner labels and a 46 percent increase in ‘free-from’ products, we’re finally beginning to understand the health-centric in-store-bakery consumer.”

Anne Marie Halfmann, senior manager, channel marketing, Dawn Foods, Jackson, MI, agrees. “We continue to see strong demand for our better-for-you portfolio,” with cleaner-label, gluten-free and vegan items all priorities. “So we continue to innovate in this space and are working on some exciting products to bring new capabilities to our baking partners.”

Doing so pays dividends across the board. As Halfmann says, “Dedicating a portion of your bakery case to better-for-you options can make shoppers feel good about their sweet-good choices and include those with allergens and sensitivities.”

Sweet goods’ better-for-you motif doesn’t just manifest in ingredient statements, either; product flavor profiles help convey it, too.

Solveig Tofte, founder and head baker, Sun Street Breads, Minneapolis, points out that “during the pandemic, people were preparing a lot of comfort foods at home—typically rich, dairy-filled, and with a starchy component.” As they emerge from lockdown and visit her bakery, “They see something fruity and are happy to try something different.”

Indeed, says Andy Enfield, vice president, Enfield Farms, Lynden, WA, “The biggest trends we see for sweet goods are the desire for fewer ingredients, natural colors and real fruit. Consumers—and, in response, manufacturers—care about what’s in their sweet goods, and we’re seeing more interest in our raspberries because they naturally add flavor and color while meeting that real-fruit requirement.”

Kathy Casey, owner, Kathy Casey Food Studios, Liquid Kitchen, Seattle, agrees that “berry tends always to be a top winner in this category.” But layering flavors “is a cool option, too,” she adds, “as in lemon filling or curd on the bottom with berries on top.”

In fact, layered, blended and downright mixed-up flavors are making their mark in the sweet goods space. Notes Skinner, “Consumers are looking for flavor profiles that’re both traditional and innovative. The best way to approach this is to blend the two: design a product that’s semi-traditional and approachable, but that offers just enough innovation to seem unique. The innovative aspect excites the senses while the tradition makes it approachable.”