PIZZA

STATE of the INDUSTRY

The BOTTOM LINE

Better-for-you options

Alternative crusts abound

Gluten-free still vital

Optional indulgence

Consumers search for better-for-you and gluten-free pizza options, as well as cauliflower crusts.

Neal Lorenzi, Contributing Writer

Pizza is essential to a high percentage of Americans, a fact reflected in the over $6 billion annual sales for this market segment in frozen retail pizzas alone. While diversification of crusts and ingredients is attracting health-conscious consumers, there is still demand for high quality, Italian-style premium frozen pizza.

Anne-Marie Roerink, president, 210 Analytics LLC, San Antonio, TX, sees the following key trends in the frozen pizza market:

Consumers are demanding “real” attributes–often specific to cheese, as in “real cheese.”

Pizza brands are innovating with alternative crusts substrates, like cauliflower

Rapid delivery options by grocery stores around the country are fueling opportunities for frozen pizza, a game-changer from a consumption-occasion perspective

Brands are addressing demand for organic, gluten-free, and “no artificial ingredients,” as well as innovation surrounding vegetarian and vegan

Growing demand for small, multi-pack pizza offerings

MARKET DATA

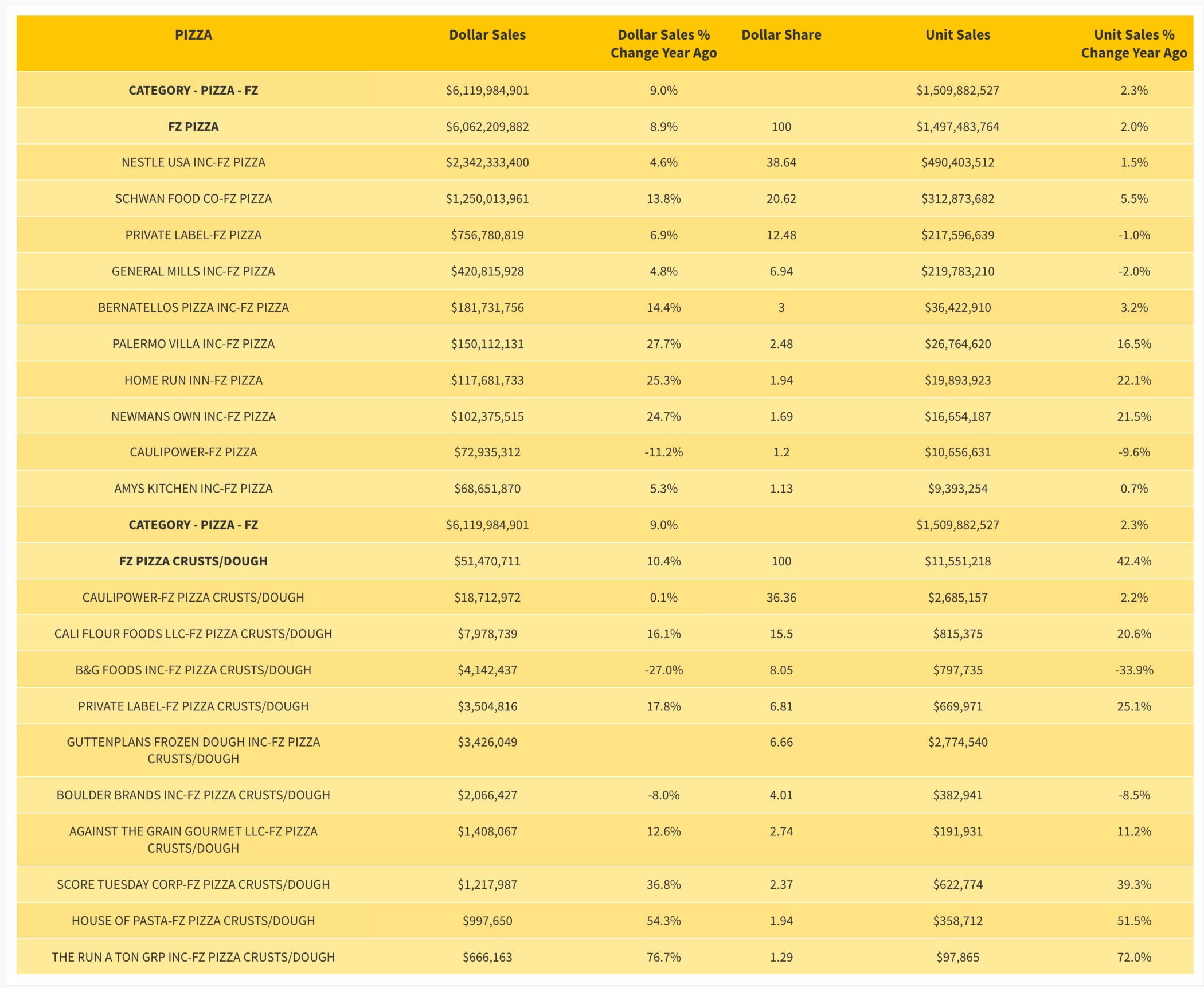

For the 52 weeks ending April 18, 2021, per IRI, Chicago, the frozen pizza category was up 9.0 percent to $6.1 billion. Frozen pizzas account for the majority of the category, up 8.9 percent to $6.0 billion. The category’s frozen pizza crusts and dough segment also grew, up 10.4 percent to $51.5 million.

Many top frozen pizza brands saw growth over the past year:

Nestlé brand DiGiorno, the segment leader, grew 4.7 percent to $1.2 billion

Schwan’s Co. brand Red Baron grew 19.1 percent to $938.7 million

General Mills brand Totino’s grew 4.8 percent to $420.8 million

Nestlé brand Jack’s grew 2.2 percent to $316.1 million

Nestlé brand California Pizza Kitchen grew 10.1 percent to $224.2 million

Schwan’s Co. brand Freschetta grew 9.4 percent to $213.4 million

Newman’s Own grew 24.7 percent to $102.4 million

Bernatello’s brand Brew Pub Lotzza Motzza grew 15.6 percent to $102.0 million

Home Run Inn grew 23.9 percent to $99.1 million

Nestlé brand Stouffer’s grew 22.4 percent to $86.3 million

Courtesy of Kaak Group

Frozen pizza crusts and dough is now dominated by gluten-free, vegetable-based crusts. Segment leader Caulipower—the 2021 SF&WB “Bakery of the Year”—remained flat for the year, with 0.1 percent growth to $18.7 million. Sales for Cali’flour Foods, made with cauliflower and mozzarella cheese, increased 16.1 percent to $8.0 million.

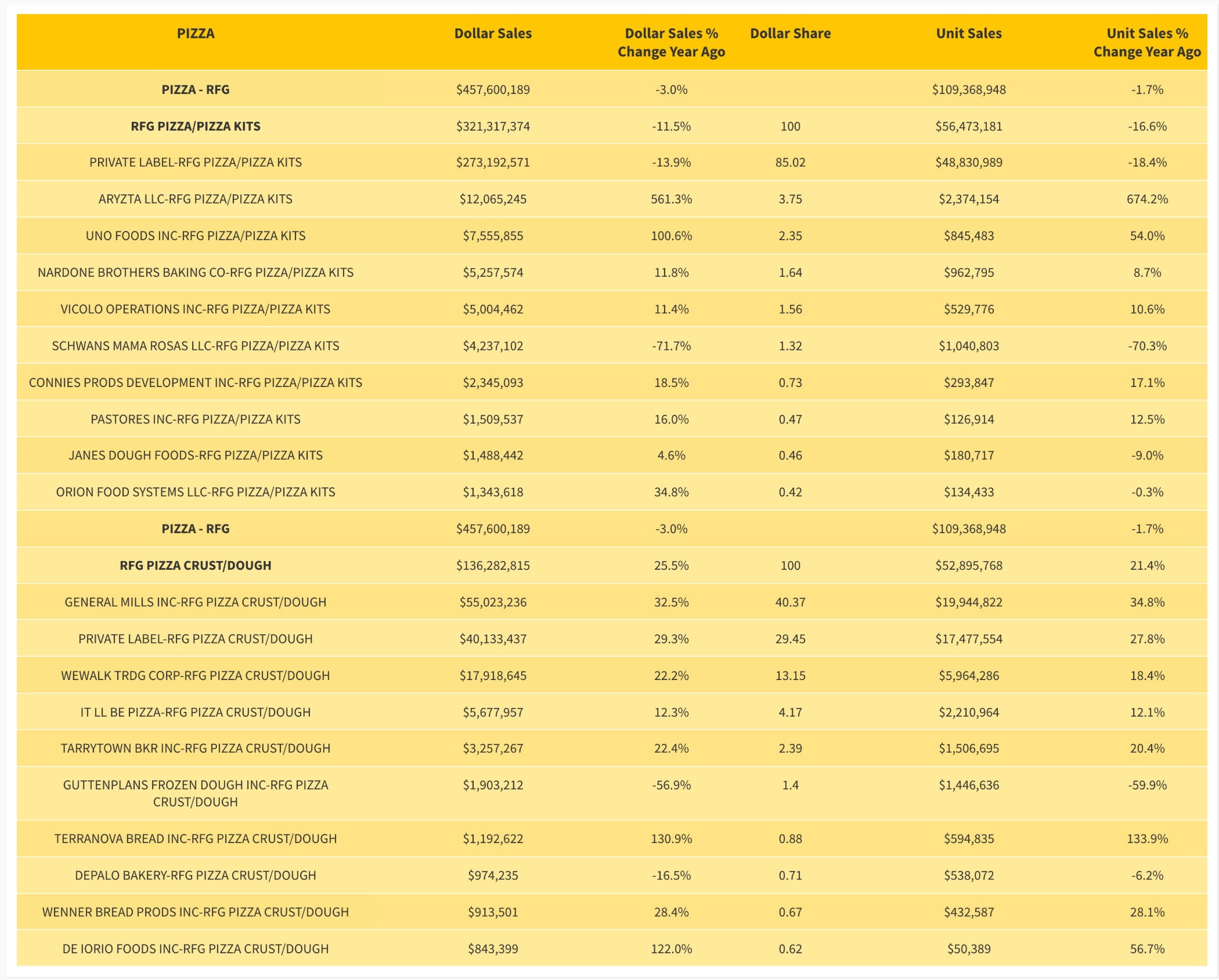

Refrigerated take-and-bake pizza lost ground over the past year, down 11.5 percent to $321.3 million. This was largely due to a slip from segment leader private label, which owns 85 percent market share but fell 13.9 percent to $273.2 million. But big sales increases were registered by Aryzta, up 561.3 percent to $12.1 million, and Uno Foods, up 100.6 percent to $7.6 million.

Looking back

Demand for pizza production equipment has skyrocketed over the past year because more people staying at home, according to Jerry Barnes, vice president, Babbco Tunnel Ovens, Raynham, MA, who is impressed by the increased variety, particularly craft/artisan and gluten-free products. “Having tried the cauliflower and sweet potato crust varieties, I can attest to how far these items have come in delivering taste and mouth-feel. Stone and brick hearth-produced crusts have grown in popularity, as consumers are willing to pay more for that restaurant taste.”

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

Major sales markets in North America and Western Europe in 2020 showed growing demand for high quality, Italian-style premium frozen pizza, according to Johan Laros, sales manager, North America, Kaak Group BV, The Netherlands. The year also saw an increase in artisanal pizza types with thick crust, high baking temperature and short baking times. “Another trend is the increased hydration level of pizza dough. Increased hydration can have a clear impact on the equipment configuration as well as the input on ingredient levels.”

Nestlé, Solon, OH, has continued its commitment to variety, according to Adam Graves, president, pizza and snacking. “With multiple pizza brands—DiGiorno, Jack’s, Tombstone, Outsiders, and California Pizza Kitchen—we believe it’s critical to offer consumers many choices. We recently launched a gluten-free option with DiGiorno, but we’ll continue to look across our portfolio for ways to give consumers more ways to enjoy frozen pizza.”

Courtesy of Nestlé USA

Plant-forward options are on the rise, according to Matthew Schueller, director of marketing insights and analytics, Ardent Mills, Denver. Another trend is gluten-free. “Technomic’s Pizza Report found that 23 percent of consumers are interested in gluten-free pizza options and another 27 percent are interested in low-carb pizza options. What’s more, 28 percent of consumers say they would eat pizza more often if healthier options were available.”

According to Nielsen, for the 52 weeks ending Dec. 19, 2020, frozen pizza with cauliflower crust grew 36 percent in dollars spent and 34 percent in units sold, and frozen pizza with gluten-free crust grew 30 percent in dollars spent and 30 percent in units sold, Schueller adds. “In addition, premade crusts grew 43 percent in dollars spent and 34 percent in units sold. Within that market, gluten-free grew 15 percent in dollars spent and whole grain/multigrain grew 16 percent.”

Courtesy of Ardent Mills

As consumers stayed home during the pandemic, they showed interest in indulgent and high-quality pizza innovation that doesn’t require a lot of effort or expense, says Mike Breitenbach, senior director category management, Schwan’s Co. “Some of our recent launches are designed to give consumers an easy way to get a delicious meal regardless of time of day. Items such as Red Baron Pizza Melts, which offer the great taste of pizza sandwiched between two slices of crispy toast and are microwavable, come in handy for lunch. Also, our Red Baron Stuffed Crust Pizza offers a convenient family dinner.”

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

Going full throttle with the “real ingredient” trend, Palermo Villa Inc., Milwaukee, introduced a Palermo’s Rising Crust line. “The cheese pizza has a half-pound of real mozzarella, parmesan, Romano & Asiago with our signature red sauce. The pepperoni pizza is overloaded with pepperoni and our 4-Meat has real bacon pieces, which you typically do not find in rising crust pizza,” says Nick Fallucca, chief product and innovation officer. The company also introduced two gluten-free crust flavors, cheese and roasted vegetable, within its Palermo’s Primo Thin line.

In addition, Palermo Villa now offers beer-infused crusts, called Screamin’ Sicilian ’Za Brewski, which hit the market in 2020 through a partnership with Leinenkugel Brewing Co. Six flavors are available: Philly Cheese Steak, Pepperoni, Six Cheese, Hot Italian Sausage & Pepperoni, Italian Inspired Special, and BBQ Meatball.

Courtesy of Palermo Villa

Looking forward

Plant-forward pizzas, alternative crusts, perceived healthy options, especially with a focus on immunity, and convenience without compromise are trends that are here to stay, says Schueller. “Also, pizza kits will continue to gain traction. In fact, 40 percent of pizza eaters say they’d like to buy pizza kits at retail locations, according to Technomic.” Pizza crusts offer manufacturers the opportunity to offer flavor innovation and perceived healthy benefits, he adds. “With these trends leading the charge in pizza sales, pizza manufacturers should explore the various options out there for making crust.”

Schueller says that new flour choices, as well as heirloom and ancient grains, open up a new world for pizza dough innovation because they bring interesting tastes and textures to crusts and can help meet the growing demand for healthy pizza ingredients such as vegan and whole grain. “Another avenue to explore is crust add-ins such as quinoa, spelt, and chickpea flour. They can help bring more nutrition, texture, and new flavors to pizza recipes,” he notes.

Laros of Kaak Group BV sees consumer demand for premium-style pizza continuing, as well as pizza featuring more craftsmanship and regional ingredients. “Due to changing nutritional profiles, consumer demand for new variants such as vegetarian, lactose-free, gluten-free and crusts made of plant-based ingredients will increase.” As a result of consumer preferences shifting towards premium-quality pizza with an artisanal look, Laros expects producers to apply longer dough fermentation times to pizza crusts for added flavor and taste.

Breitenbach of Schwan’s Consumer Brands sees a continuing surge in protein and plant-based innovation, given consumers’ desire to reduce carb intake. This may result in innovation using alternative food ingredients, or simple renovation of existing items or packaging callouts. “However, it is imperative that these new product attributes do not sacrifice taste. For example, as consumers strive to make small, manageable changes to their healthy lifestyles, our Freschetta Gluten Free pizza provides that perfect stepping stone to achieve their goals without sacrificing the great pizza taste they love.”