The BOTTOM LINE

Better-for-you options available

Gluten-free and keto trends

COVID-19 trends

Delicious and nutritious

As consumers stay home more often, the focus is on better-for-you cookie flavors, albeit those evoking nostalgia.

Liz Parker, Managing Editor

During the COVID-19 pandemic, consumers have been staying home more often, and searching for familiar snacks. Cookies have helped fill that void, and top brands have taken note of what is trending.

cookies

STATE of the INDUSTRY

Market data

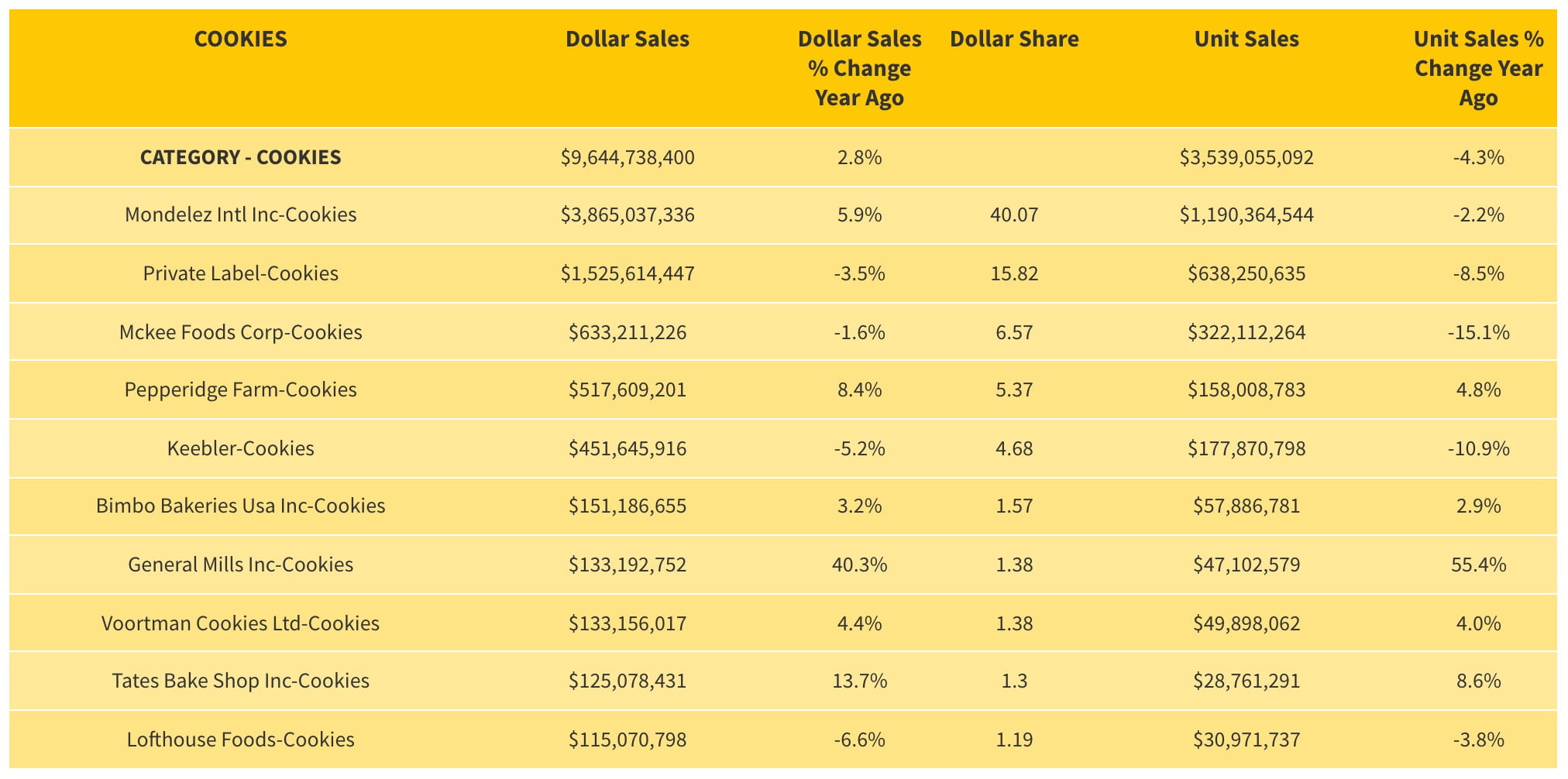

According to IRI, Chicago, data from the past 52 weeks ending April 18, 2021 show the cookie category up 2.8 percent, with total sales of $9.6 billion. Mondelez International leads the category by a significant margin, with $3.9 billion in sales, an increase of 5.9 percent. Private label cookies had a 3.7 percent decline, with $1.5 billion in sales. McKee Foods Corp. saw a 1.6 percent sales decline to $633.2 million, and Pepperidge Farm grew 8.4 percent to $517.6 million. Of particular note is the debut of the Pillsbury brand from General Mills in the cookie aisle. In March 2021, Pillsbury launched its new Soft Baked Cookies, which helped propel General Mills to a 40.3 percent increase to $133.2 million in sales.

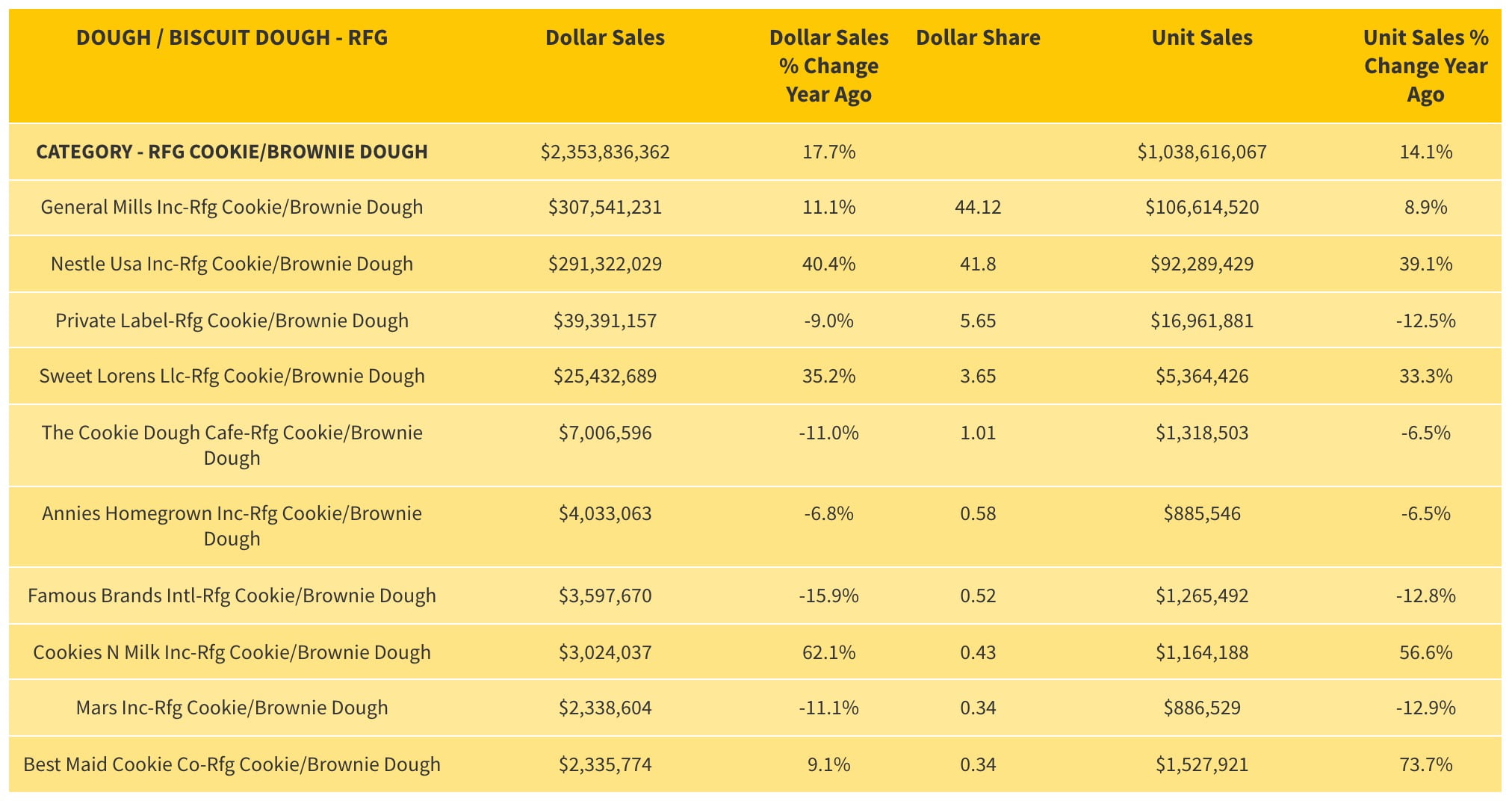

The refrigerated cookie/brownie dough segment grew 19.7 percent to $697.0 million. General Mills (backed by the Pillsbury brand) grew 11.1 percent, with $307.5 million in sales, and sales for Nestlé USA (Toll House) increased 40.4 percent to $291.3 million. Other standouts include Nestlé’s M&M Minis, which grew by 172.7 percent to $12.8 million in sales, and its Toll House Funfetti refrigerated cookies, a new brand that hit $3.7 million in sales for the period.

The frozen cookie dough segment saw strong growth for the sales period, up 86.4 percent to $38.2 million. Unilever subsidiary Ben & Jerry’s Homemade—a ready-to-eat frozen cookie dough product—leads the segment, up 115.1 percent to $27.8 million. All three top branded ready-to-bake frozen cookie products likewise saw growth.

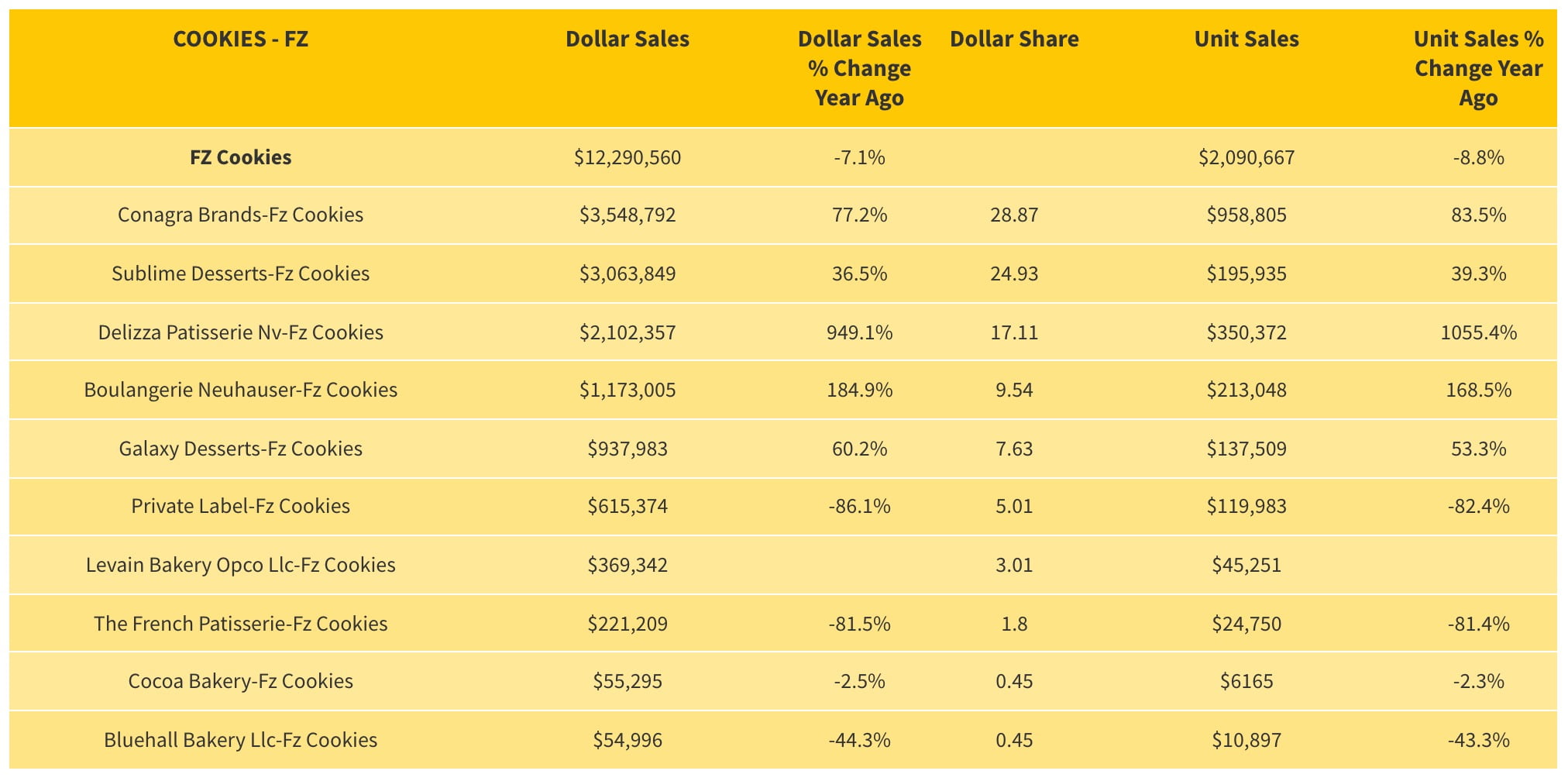

The frozen cookies category experienced a decline of 7.1 percent, with $12.3 million in sales. Nevertheless, all of the top companies working in the category saw strong growth. Conagra Brands led the way, with $3.5 million in sales and an increase of 77.2 percent. Sublime Desserts, entering its sophomore year, brought in $3.1 million in sales, with an increase of 36.5 percent, and Delizza Patisserie brought in $2.1 million in sales.

Courtesy of Campbell Snacks

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

“Over the past year, we know consumers snacked more frequently and when it came to choosing what to snack on, they turned to favorite brands for comfort and familiarity.”

— Danielle Brown, VP of marketing for cookies and crackers, Campbell Snacks

Looking back

“2020 saw a major shift in life as we know it—and it materially changed the way people eat,” says Danielle Brown, VP of marketing for cookies and crackers, Campbell Snacks, Norwalk, CT. “Over the past year, we know consumers snacked more frequently and when it came to choosing what to snack on, they turned to favorite brands for comfort and familiarity. We anticipate consumers continuing to seek out familiar brands that offer simple solutions for everyone at home to enjoy,” she notes. “Pepperidge Farm offers over 50 cookie varieties to satisfy these needs, from lightly sweet classics to deliciously decadent new favorites,” says Brown.

In January, Pepperidge Farm expanded its Thin & Crispy portfolio with the introduction of Pepperidge Farm Farmhouse Thin & Crispy Butter Pecan cookies, the brand’s first-ever nut-based cookie. “Inspired by homemade recipes and made with familiar ingredients, Pepperidge Farm Thin & Crispy cookies are deliciously buttery, rich, melt-in-your-mouth treats,” says Brown. She notes they’re made with real butter, crunchy pecans, real eggs, and vanilla extract.

Vegan and gluten-free cookies continued to be popular in 2020, with Yvonne’s Vegan Kitchen releasing a new lineup in December 2020. Keto was also very popular: HighKey released Chocolate Peanut Butter Mini Cookies and Lemon Almond Tea Cookies in October 2020, with only 3 grams net carbs per serving.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

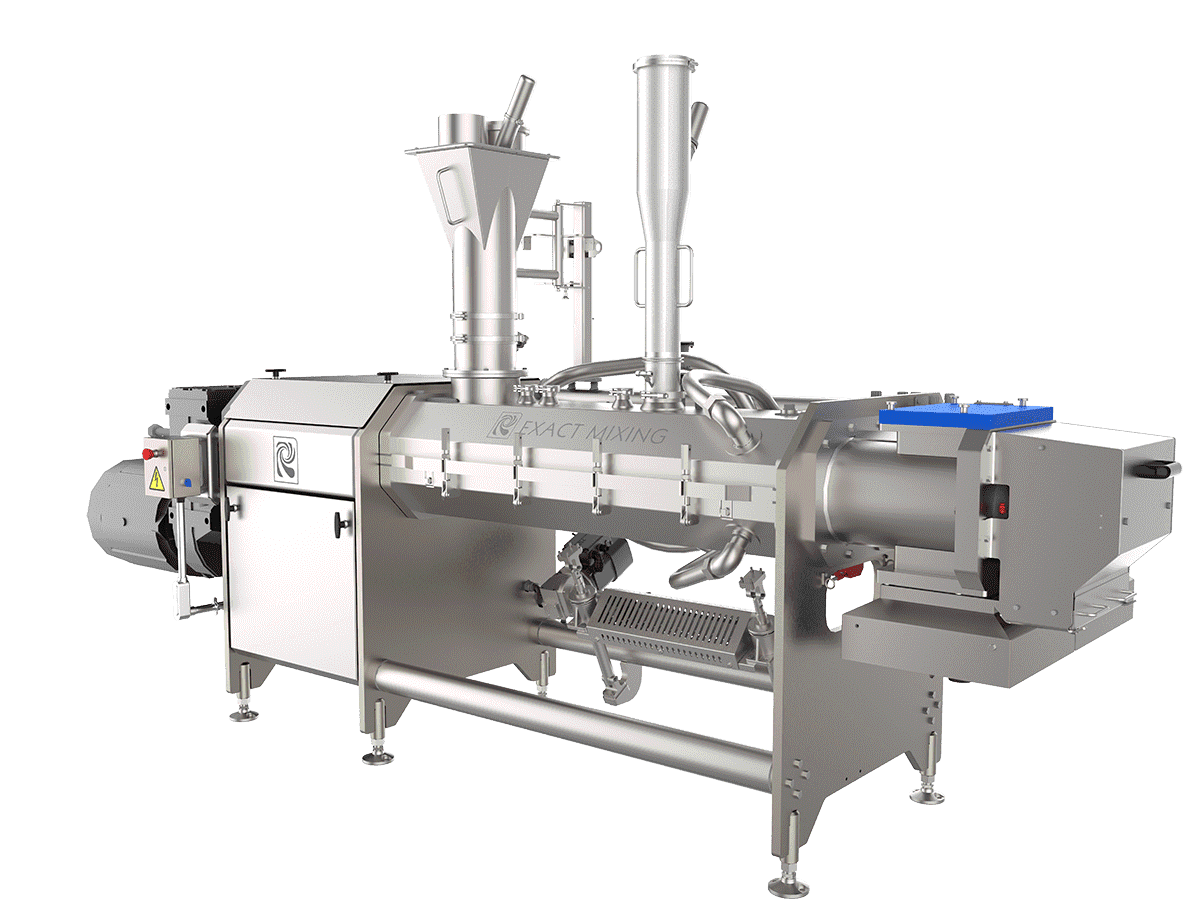

Courtesy of Reading Bakery Systems

“Big picture” issues like improved efficiency and sustainability are top concerns in this competitive market. On the equipment side, sustainability, ecofriendly, and net zero carbon are now discussions occurring in the cookie market, says Sam Pallottini, director, cookie, cracker, and pet food sales, Reading Bakery Systems (RBS), Robesonia, PA. “As the customer base changes, they are pushing the cookie industry to change with it.” He notes one of the easiest ways to make the largest gains in this segment can come through focusing on ovens—and particularly older ovens. “Direct gas-fired (DGF) ovens for baking cookies are a thing from the past,” he notes.

“Today, RBS offers one of the most-efficient ovens when you utilize our Emithermic zones using our Thermatec tiles combined with a hybrid arrangement (Emithermic/convection zones),” says Pallottini. “This arrangement will reduce your gas consumption for baking cookies by 50 percent and perhaps even more in some cases. The oven design is easier to maintain and operate, as you only focus on one burner per zone with individual blowers for top and bottom,” he explains.

The number of variables is reduced, making it easier for the operator to run their oven, Pallottini says. “The oven is designed to reduce wasted heat with properly designed airflow for even baking across the oven band. If you have an older outdated oven and you want to take steps to change your bakery to a net zero carbon facility, look at replacing those ovens.”

Courtesy of HighKey

Pallottini notes RBS also offers continuous mixing for the cookie market. Continuous mixing, a system offered by Exact Mixing, provides a steady stream of dough to the forming equipment, he says. “The stream is more consistent, thus making it easier to set up the forming equipment, such as wirecuts and rotary moulders, as well as the ovens,” he says. “It also requires 30 percent plus less energy to mix versus a batch mixer, because you are always seeing a constant load on the machine. Continuous mixing is not always the right application for cookies, but if you have an arrangement where you focus on a few types of cookies and want to produce lots of them, investigate the benefits of continuous mixing for your company,” he recommends.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART