BUNS & ROLLS

STATE of the INDUSTRY

The BOTTOM LINE

Staying at home leads to higher-quality breads

Brioche and vegan options

Searching for clean-label ingredients

Fresh SelectionS

Buns and rolls see a focus on higher-quality products that prevailed during pandemic.

Ed Finkel, Contributing Writer

The buns and rolls category grew steadily during the past year, as the COVID-19 pandemic led to prosperity for many types of products sold at grocery. Consumers have been trading up to restaurant-quality buns and rolls, since they haven’t been able to get out to actual restaurants as much, which has helped upscale products like brioche buns and rolls. And demand for those premium products might not necessarily wane along with the pandemic.

Market data

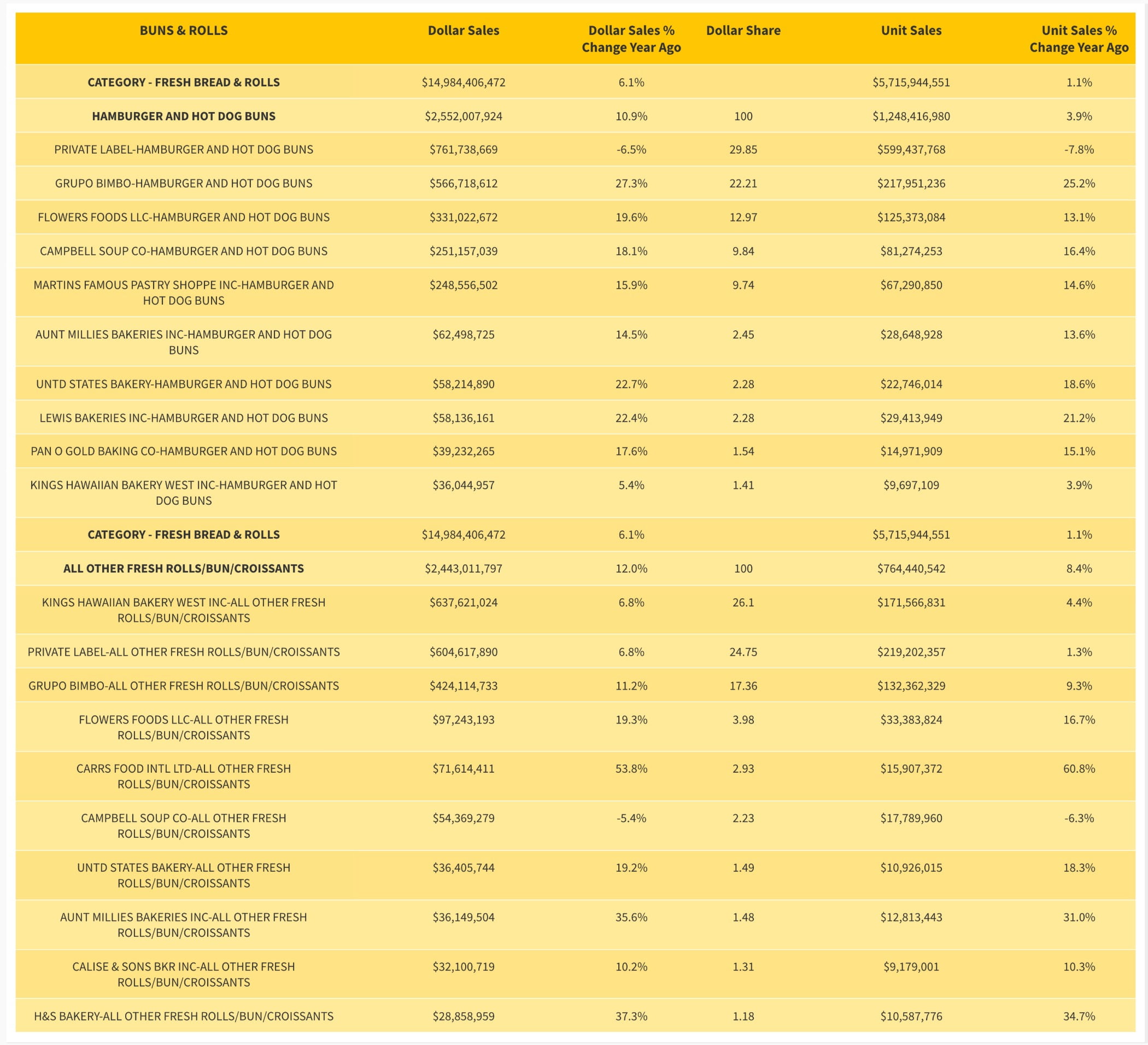

The overall fresh bread and rolls category saw 6.1 percent growth to $15.0 billion in sales for the 52 weeks ending April 18, 2021, per IRI, Chicago. The hamburger and hot dog buns segment rose 10.9 percent to $2.6 billion, while the “all other” fresh rolls, buns, and croissants segment jumped 12.0 percent to $2.4 billion, IRI data found.

While private label leads the hamburger and hot dog buns segment, those sales dropped by 6.5 percent to $761.7 million in sales. Meanwhile, all branded business in the segment grew. Brands were led by Grupo Bimbo, with $566.7 million in sales, up 27.3 percent; Flowers Foods LLC, $331.0 million, up 19.6 percent; Campbell Soup Co., $251.2 million, up 18.1 percent; and Martins Famous Pastry Shoppe Inc., $248.6 million, up 15.9 percent.

Every slot in the top 10 for the “all other” segment saw growth, led by King’s Hawaiian with $637.6 million in sales, up 6.8 percent. Private label in the aggregate notched $604.6 million in sales, also up 6.8 percent. Grupo Bimbo had $424.1 million in sales, up 11.2 percent. Fastest-growing companies included Carr’s Food International (better known as St Pierre Groupe these days), up 53.8 percent to $71.6 million; H&S Bakery, up 37.3 percent to $28.9 million; and Aunt Millie’s, up 35.6 percent to $36.1 million.

Looking back

St Pierre Groupe, Manchester, England, has grown about 80 percent in sales during the past year thanks to its brioche burger buns and hot dog rolls, and the company now comprises about one-third of the brioche subcategory, which has grown from $108 million in sales in $305 million “in a relatively short time,” says Paul Baker, co-founder.

“Brioche is one of those products that’s more than a fad or a fashion—it’s becoming a fundamental,” Baker asserts. “The attractiveness of brioche burger buns and hot dog rolls is really quite simple: It’s not an intimidating product to try. Because so many people are at home, we’re all sitting on our porches, and you want that restaurant meal experience, which we haven’t been able to have. People are trading up. The switch from normal burger buns to brioche sounds simple, but the eating experience is quite different.

Courtesy of St Pierre Groupe

With more meal occasions at home, sales of hot dog buns in particular were “quite stratospheric,” especially at the beginning of the pandemic, Baker says. “If the whole family is locked up at home, and you need to make lunch for five or six people, it needs to be quick, versatile and tasty. We’ve seen a huge uplift on lunchtime, and breakfast. People are looking for quality, they’re looking for new flavors, they’re spending more than pre-pandemic, and they’re not compromising.” St Pierre recently added a sesame seed brioche burger bun to its lineup.

Brioche buns cam come into play throughout the day, Baker says. “We’re seeing more growth than the average bakery business because of all those points,” he says. “It’s not one thing, it’s multiple things—flavor, quality, texture. We score highly on all of those with the brioche. The versatility is huge.”

The uptick in consumer interest in plant-based proteins has led to opportunities for bakeries to develop vegan buns and rolls to cradle vegan burgers and hot dogs, Suarez-Bitar says. “Plant-based breads serve as perfect carriers for better-for-you options—such as a plant-based burger on a vegan brioche bun,” he says. “The challenge with traditional brioche is that it typically calls for butter and eggs, which simply would not work in a vegan burger.”

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

Courtesy of Bellarise

Products like the Bellarise Brioche Base and Bellarise Brioche Improver can be used to make both conventional and plant-based versions of brioche, Suarez-Bitar says. They “work exceptionally well in vegan recipes,” he says. “They also help make brioche more accessible to U.S consumers who are allergic to dairy and eggs.”

Hawaiian-style rolls are another popular option, although many center-aisle brands are not clean-label options, Suarez-Bitar notes. Bellarise offers a proprietary enzyme technology in its clean-label Bellarise Hawaiian Roll Improver. “This simplifies commercial and industrial bakeries’ process since fewer ingredients used in production reduces the number of variables affecting the quality of the final product,” he says.

Bellarise also offers both Organic Gluten Replacer and a conventional Gluten Replacer that helps commercial and industrial bakeries replace up to 30 percent of vital wheat gluten, Suarez-Bitar says. “Vital wheat gluten price fluctuations complicate planning for bakeries of all sizes,” he says. “We designed Bellarise gluten replacers to remove that variable from bakeries’ procurement and formulation processes.”

In the equipment space, Sasa DeMarle, Cranbury, NJ, has seen trends toward faster automation of production lines, particularly for soft breads like buns, says Geoffrey Conforti, global head of the bakery business unit. “The market is certainly demanding, and we have the ability to provide, ‘even more and even faster’ productions with a better quality, a longer shelf life, and ‘green’ ingredients,” he says.

For this reason, industrial producers have needed to adapt to meet higher standards in terms of tray materials and coatings, Conforti says. “We’ve worked to develop coatings with longer durability and higher resistance for more aggressive environments,” he says. Bakers appreciate the company’s MECA baking trays, Peelboard ABS proofing trays, and stainless-steel baking trays, as well as the INF6001 silicone coating, he adds.

Looking forward

Sasa DeMarle is now developing a new coating “that goes beyond the perimeter of known silicones and fluoropolymer coatings,” Conforti says. “This coating will have the ability to be more resistant to repeated abrasions and will allow higher anti-adherence, which is a very important combination of specs in the world of coatings. We are also developing new trays in order to meet some market expectations—for example, a stone oven effect.”

More broadly speaking, Sasa DeMarle expects a continued emphasis in the buns and rolls category on higher quality products with a focus on healthy, organic, and “clean” ingredients, Conforti says. He also sees “a focus on even higher-quality gluten-free products, and overall more artisan products rather than mass-produced, low-quality” SKUs.

Suarez-Bitar believes that the demand for buns and rolls will increase in the coming months. “With the summer grilling season approaching and pandemic restrictions gradually changing, now is a good time for bakeries to consider new product launches, including plant-based, clean label, and organic buns and rolls that address current consumer needs and preferences,” he says.

“We think this is going to be one of the biggest grilling seasons we’ve seen, with Father’s Day, Independence Day, and the completion of the vaccine rollout.”

— Paul Baker, co-founder, St Pierre Groupe