BARS

STATE of the INDUSTRY

The BOTTOM LINE

Bars sales dipped in 2020

Continued demand for convenience

Searching for healthier bars

Raising the bar

Consumers search for healthier snack bars, but not at expense of taste.

Kimberly J. Decker, Contributing Writer

After a year that strained the limits of everything—including the descriptive power of adjectives like “unprecedented,” “challenging” and “disruptive”—something resembling “normal” (another term laid low by 2020’s events) seems finally to be stumbling back to life.

And as it does, it’s no stretch to conclude that when workaday routines resume, so, too, will consumers’ search for convenient on-the-go snacks—including bars, in all their diversity.

That resumption couldn’t come at a better time for the category, either, as bars suffered the pandemic’s predations just as mightily, as did many other categories.

Courtesy of Almond Board of California

But bars aren’t down for the count, insists Charice D.E. Grace, manager, trade marketing and stewardship, Almond Board of California, Modesto, CA. “Despite changes to consumers’ lifestyles and eating behaviors over the past year,” she declares, “the bar category continues to be a competitive market with an integral place in day-to-day consumption.”

Market data

Even so, bars took a hit in 2020.

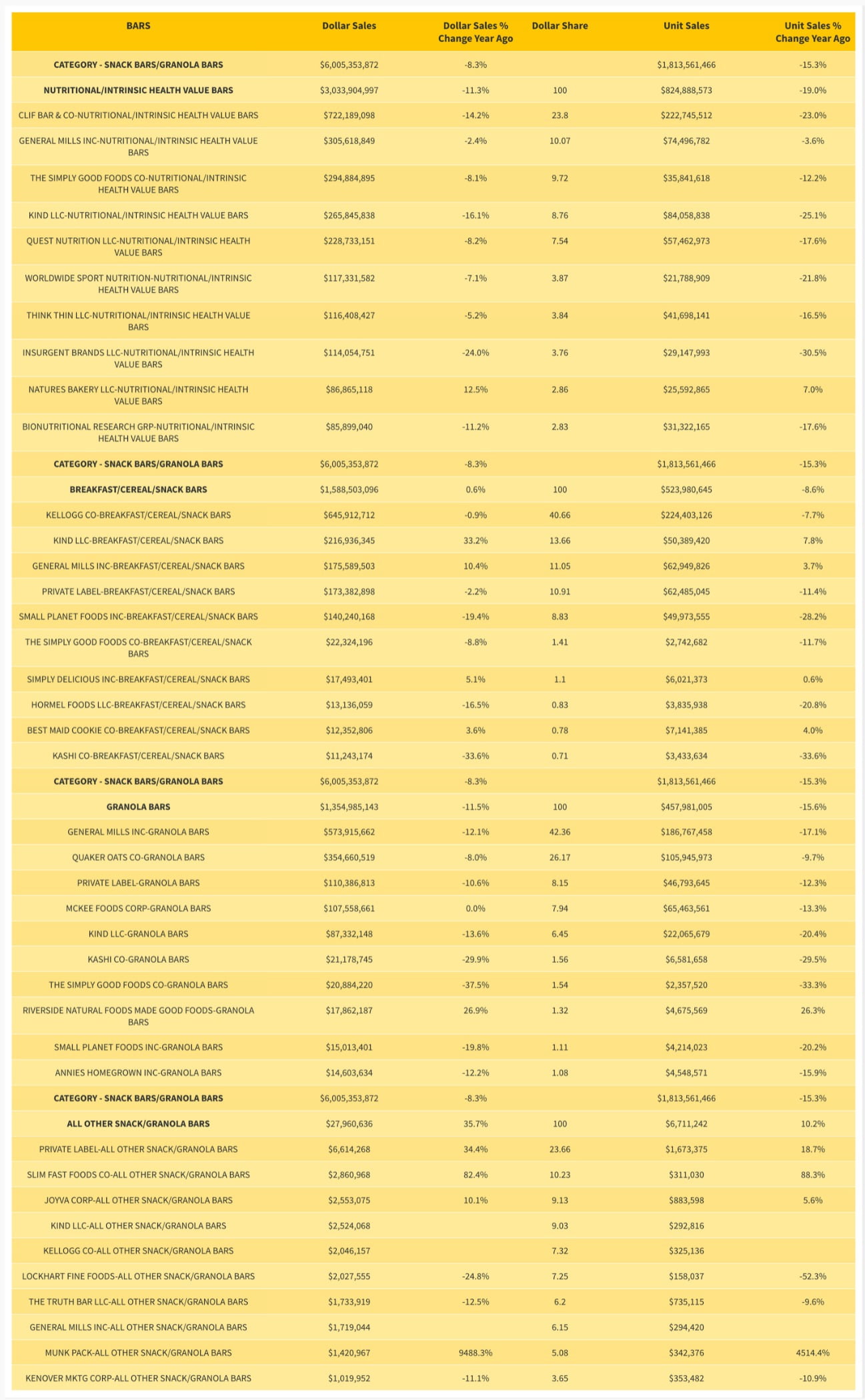

According to IRI, Chicago, dollar sales for the snack and granola bars category overall fell 8.3 percent for the 52 weeks ending April 18, 2021, registering sales of $6.0 billion.

Courtesy of Nature's Bakery

Such declines were the theme across most of the category’s sub-segments, including in nutritional and intrinsic health value bars, where sales dropped 11.3 percent to $3.0 billion. Only one of the top 10 manufacturers in the segment—Nature’s Bakery, which launched its organic Baked-Ins line in 2021—posted sales gains, taking in $86.9 million, up a respectable 12.5 percent from the year before. Other bright spots in the segment include a 5.4 percent gain for Quest Nutrition to $110.0 million, and a 7.3 percent gain for the CLIF Kid Z Bar brand to $95.0 million. Perfect Bar also saw a gain, up 17.7 percent to $58.8 million.

Breakfast and cereal bars saw slightly stronger sales, up 0.6 percent to $1.6 billion, with the two notable winners among the segment’s top manufacturers: Kind grew 33.2 percent to $216.9 million, and General Mills grew its breakfast and cereal bars by 10.4 percent to $175.6 million. Of particular note is the Kind Minis brand, which grew 86.9 percent to $60.2 million.

The granola bars segment saw sales fall 11.5 percent to $1.4 billion overall. The only top manufacturer on the plus side was Riverside Natural Foods, which saw its better-for-you MadeGood brand bank sales of $17.9 million, up 26.9 percent over the previous year.

Courtesy of General Mills

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending April 18, 2021.

HOVER OVER CHART TO SCROLL DOWN

One particularly bright light in the category shone from the “all other” bars segment, where a mixed bag of innovative products—many addressing lifestyle diets and special nutritional needs—recorded sales of $28.0 million, up 35.7 percent on the year.

Looking back

So given the above data, what happened to bars in 2020?

The subject will occupy category-watchers for years, but what matters to manufacturers right now, says Grace, is that “demand for snacking and convenience”—bars’ key calling cards—“continued even when stay-at-home orders had fewer consumers living on the go.”

In fact, the International Food Information Council reported that 36 percent of Americans claimed to be snacking more during the pandemic—and by self-soothing via snacks, they may have helped keep bars afloat.

But succor wasn’t all consumers sought from bars in 2020. “Even prior to the pandemic, we started seeing increased interest in nutritional bars with specialized functional benefits,” observes Bart Child, chief commercial officer, Nellson, Anaheim, CA. But once COVID-19 descended and consumers adopted proactive eating, he notes this trend accelerated.

Over time, that proactive eating started taking on the trappings of what Kyle Krause, product manager, functional fiber and carbohydrates, North America, Beneo, Parsippany, NJ, calls “healthy indulgence.” In other words, “Consumers want to be purposeful in their choices,” he explains. “Yes, taste and texture hold the most importance, but not at the expense of health.”

This compelled bar designers to target formulations toward high-profile health claims. Grace notes that Innova Market Insights’ 2019 Global New Product Introductions Report ranked the top-five health claims across bar introductions as high/source of protein (50 percent), gluten free (40 percent), high/source of fiber (33 percent), vegan (21 percent), and no additives/preservatives (20 percent)—all “attributes that continued to hold importance in 2020,” she says.

Courtesy of MadeGood

They’re also all attributes that almonds help bars achieve. Again citing Innova research, Grace says that health claims in general appear more frequently on introductions with almonds than on food introductions overall.

Beyond matters of health, Child notes the rising demand for private-label bars over the past year. One theory behind the surge holds that when national brands disappeared thanks to panic buying, private-label manufacturers found themselves with an opportunity to compete. As Child says, “Brands looking to get to market quickly sometimes opt for private label as a solution.”

But while the standard private label model dictates that brands merely emulate successful high-growth products, “As a custom co-manufacturer,” Child continues, “we partner with private-label brands that want to differentiate themselves on the shelf.”

Looking forward

As for whether or not that differentiation will sustain private label’s momentum into 2021, check this report a year from now.

In the meantime, rest assured that better-for-you, among other drivers, will keep shaping bar formulation as 2021 barrels past its midpoint.

“Once consumers re-acclimate to life post-pandemic,” Grace suspects, “they may look to bars to meet fresh priorities after a year of assessing nutrition and wellness goals.” And with plant-based, clean-label, lower-carb and higher-protein still high on those priority lists, Grace offers defatted almond flour as an ingredient that delivers not just all points, but binding action in bar bases and finished products with a “lighter, chewer texture.”

The ingredient—also known as almond protein powder—is simply almond flour with a percentage of the oil pressed out. Its slightly nutty flavor vastly improves upon the profiles of other plant proteins, Grace notes, and while it’s a great add to sports-nutrition and performance bars, she sees no reason why breakfast, dessert or snack bars can’t get in on the almond-protein action, too.

Courtesy of CORE Foods

Also in the plant-protein pantheon, Beneo’s Remypro rice protein helps formulators “pack more protein into bars,” Krause says. Applications work shows that it blends easily into a bar’s matrix when mixed with other dry ingredients, and that in the form of rice-protein crisps it adds appealing texture. Krause also calls attention to its “unique amino-acid profile” and mild flavor, “which makes it a good all-around choice for protein delivery in bars.”

Along with plant-based eating, lifestyle diets will keep gaining traction with wellness-minded bar buyers post-pandemic. And Grace notes that she sees almonds “excelling” in bars that meet low-carb, Paleo, and keto requirements. “With more than 14 different ingredient forms,” she adds, “almonds can achieve a range of textures from crispy to creamy and accommodate any flavor. Whole and chopped almonds and almond meal add crunch and desirable textures to bars, and almond butter makes a fantastic binder, drizzle or layer.”

Child predicts that “Positioning will be key when developing bars to meet emerging trends,” and a positioning that he sees evolving in the bar space and beyond is energy.

“Consumers want to be purposeful in their choices. Yes, taste and texture hold the most importance, but not at the expense of health”

— Kyle Krause, product manager, functional fiber and carbohydrates, North America, Beneo