The BOTTOM LINE

- Consumers are still seeking out BFY brands, products

- Producers are experimenting with different flavor profiles

- Even with tighter budgets, taste will remain king

Beyond butter

The popcorn industry aims to please consumers’ palates with new and interesting creations.

Liz Parker Kuhn, Senior Editor

Popcorn, the ubiquitous movie snack, is definitely not going anywhere. However, producers have found that they will need to innovate—whether that be in portion sizes, flavors, or packaging—in order to keep customers returning for more.

POPCORN

STATE of the INDUSTRY

SPONSORED BY

Market data

The salty snacks category as a whole didn’t change much over the past year, bringing in $41.9 billion (0.3% less than the previous year) according to Circana (Chicago) data from the past 52 weeks, ending on April 20, 2025. The popcorn/popcorn oil category took in $1.1 billion of that total pie, with a small 5.2% loss in sales.

In the microwave popcorn subcategory ($985 million, a loss of 6.2%), Conagra Brands, known for its Orville Redenbacher brand, led the pack, with $555.1 million in sales and a small 0.5% uptick. Private label followed ($174.7 million, a 15.8% loss), with Our Home, parent company of Pop Secret, accruing $151.2 million, with a drop of 15.9% in sales.

The kernel popcorn subcategory ($152.7 million, a 0.5% increase in sales) again saw Conagra Brands in the lead, with $72.3 million and a 1.6% increase, followed by private label ($29.6 million, a 2.4% uptick), and American Pop Corn Co., with $24.5 million and a loss of 5.2% in sales.

HOVER OVER CHART TO SCROLL DOWN

Source: Circana OmniMarket™ Total Store View | Geography : Total US - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers) | Time : Latest 52 Weeks Ending 04-20-25

Looking back

“While health and wellness continue to shape many food decisions, we're seeing a strong cultural pull toward nostalgia and permissible indulgence. Consumers are gravitating toward snacks that feel emotionally familiar, whether it's a throwback flavor, a retro-inspired format, or simply a product that taps into childhood memories,” shares Megan Osowski, VP of marketing, Our Home. “At the same time, they’re looking for treats that feel satisfying but still aligned with their lifestyle: think portion-controlled formats, simple ingredients, or better-for-you takes on classic favorites. This intersection of comfort and consciousness is driving innovation and growth across the snack aisle, and popcorn is uniquely positioned to deliver on both fronts.”

Our Home’s Pop Secret brand recently released a ready-to-eat popcorn line, launching at Sam’s Club in June with Movie Theater Butter, followed by a national rollout in Kroger in August with both Movie Theater Butter and Double Cheddar.

Courtesy of Our Home

“Pop Secret has always been about bold flavor and buttery nostalgia, and now we’re bringing that experience to snack aisles in a new way. It’s a natural next step in our commitment to meeting people’s snacking needs with convenience, creativity, and quality,” Osowski finishes.

Adam Ingberman, director of marketing, Prospector Popcorn, says that the company saw strong year-over-year growth when it looked at sales in 2024 compared to the prior year.

“Sales climbed across all our key channels, including B2B marketplaces; gifting, in addition to customers looking for thoughtful, story-rich products, definitely made a big impact,” he states. “Our customizable gift options, which lets customers pick their own flavors and packaging options, kept people engaged all year. That, combined with our mission-driven products, gave us great support among buyers this year.”

He notes that on both B2B and D2C sides, he saw growing enthusiasm for supporting social enterprises and purpose-led brands. “Prospector Popcorn was grateful to be a natural part of this trend, as more people gravitate toward companies with a compelling story like ours.”

Challenges for the company included shipping during the warmer months, which needed extra care, since the brand uses real chocolate and offers heat-sensitive gourmet ingredients.

“We focused on creative packaging and smart delivery options to protect product quality and keep things cost-friendly,” Ingberman notes. “In 2024, we rolled out a new line of personalized and configurable gourmet popcorn gifts. These let customers design one-of-a-kind gifts with different sizes, themes, and flavors, making it easy to tailor something just right for any taste or occasion, and the response has been fantastic. For us, it taps into the broader trend of purposeful gifting, and we’re grateful people continue to choose Prospector Popcorn for those gift-giving moments.”

Roman Harlovic, senior brand manager, SkinnyPop, a Hershey brand, says brand sales have been strong, increasing 5.4% in the first quarter of 2025: “The launch of a new visual identity, paired with debuting the ‘Popular for a Reason’ campaign featuring Jennifer Aniston during a culturally relevant moment, the Oscars, helped to fuel the brand’s growth.”

SkinnyPop recently introduced new everyday flavors like Avocado Lime and an LTO, Harry Potter Butterbeer Flavored Kettle Popcorn, which cater to consumers seeking unique and gourmet snacking options.

“These flavors have not only helped to grow SkinnyPop, but they have also attracted more consumers to the ready-to-eat popcorn category,” Harlovic notes.

Johanna Ascencio, brand director, Conagra Brands, says its two microwave popcorn brands, Orville Redenbacher’s and ACT II, are outperforming the category.

“Orville and ACT II, the top two sellers in microwave popcorn, account for 56% of microwave popcorn category sales with a combined $552 million annually,” Ascencio shares. “While sales across the category have been flat over the past four years, our two brands have shown growth, led by ACT II, which has seen 6% dollar sales growth over that same four-year period.”

Courtesy of Conagra Brands

Ascencio adds that with microwave popcorn flavors, consumers want a range of options when it comes to butter.

“Later this summer we’ll introduce new Orville Redenbacher’s Homestyle Butter, a microwave popcorn with a touch of butter and salt that offers homestyle appeal. This new flavor will be available in six-count and 12-count bags,” she states. “ACT II is introducing Simply Salted later this summer. This popcorn is perfect for consumers seeking a lighter flavor; it’s the first lightly salted offering in the value price point microwave popcorn category.”

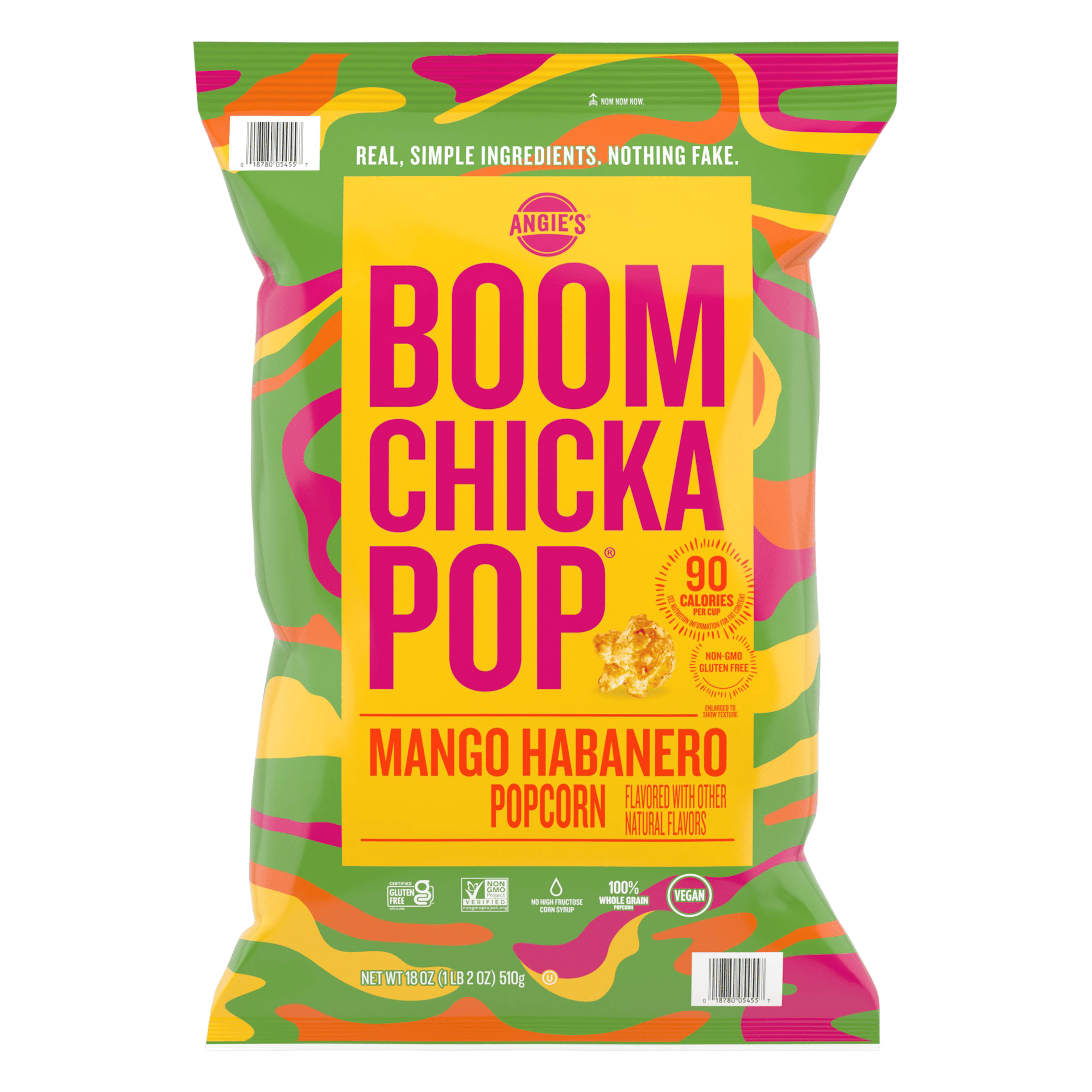

Angie’s Boomchickapop, another Conagra brand, has two new flavors coming to market this year: Mango Habanero and Cinnamon Churro.

“As the sweet heat trend in snacking continues to rise, Angie’s new Mango Habanero brings an exciting fusion of hot and sweet seasonings, layered atop Angie’s Sweet & Salty Kettle base,” Ascencio says. “For a sweet cinnamon taste with a hint of tempting fried dough flavor, Cinnamon Churro is sure to be a crowd pleaser.”

Mike Hagan, CEO, Snax-Sational Brands, says that the RTE popcorn category competes with other snacking sectors that drive purchasing behavior and fulfills needs such as BFY, indulgent cravings, and daily fill-in quick hunger fixes.

Courtesy of Prospector Popcorn

“From a health and wellness perspective, seedless oils in a snacking product’s DNA, such as coconut and avocado, is getting a lot of focus and attention, and among certain changes spoken about is most likely the easiest obstacle to overcome and position products in a healthier way,” he notes. “More recently, protein, due to GLP-1 households, and fiber have become a bigger piece of the conversation, but there is a debate on how much protein is a meaningful amount on a snacking item. We still see savory occupying the biggest segment of the RTE popcorn category with flavor versions of cheese, such as cheddar or jalapeno, or authentic ethnic flavors doing well. That being said, crossover savory and sweet such as our PBJ Pop is hitting the spot with consumers.”

In December 2024, Snax-Sational Brands introduced Jif & Smuckers “PBJ Grape & Strawberry” drizzled popcorn, he shares. “It was the first licensing partnership that Smuckers had done. We looked at the data and research and found that 50% of the U.S. consumer base consumes a PB&J sandwich weekly. The research also showed us that some retailers are more ‘strawberry-centric’ than ‘grape-centric.’ We also partnered with Be Happy Snacks, taking over sales, distribution, and manufacturing of their popcorn. Owned and created by the D'Amelio family, the ‘first family of TikTok,’ we enhanced their formulations, and have some exciting flavors that resonate with a younger demographic.”

Looking forward

Hagan says he believes the RTE popcorn category will have to continue to innovate to be able to compete with the innovation that is taking place within other salty snacks categories, such as pretzels, pork rinds, plantain chips, and puffs.

“Consumers love popcorn, and it will always be a sizable category. I think BFY will continue to occupy consumers' need for functional, deliverable ingredients for their snacking needs. However, consumers will continue to satiate their desires with semi-indulgent snacks as well. Freeze-dried candies on textured products is making a lot of noise, and we need to capitalize on it,” he suggests.

He says in the popcorn category, he continues to see cost challenges on seedless oils as demand goes up. “At some point, those increased costs will have to be contemplated. The question will be, will the consumer be willing to pay more for a healthier product? Portion control and/or smaller pack sizes could be a reasonable response.”

Courtesy of Hershey

Harlovic notes that ready-to-eat (RTE) popcorn is still on the rise. “RTE popcorn is catching up—volume growth, eatings growth, and household penetration gains have all exceeded salty snacks’ segment averages over the past five years, which shows that popcorn is climbing in relevance for consumers. Continued demand for healthier snacks is expected to draw more consumers to popcorn, as it is the most permissible segment within salty snacks.”

Ascencio says with Conagra Brands’ new introductions across microwave and RTE categories, the company is excited to see how these flavors perform: “Popcorn brings people together; within microwave popcorn, it’s the top motivating factor for popping up a bag. Whether a consumer is trying something new or enjoying one of our classic flavors, we love being a part of their together-time moments or solitary snacking.”

Osowski adds snacking continues to be a constant in consumers’ daily routines, and popcorn is well-positioned to meet that demand: “As shoppers look for small moments of comfort and enjoyment, products that lean into nostalgia, whether through flavor, format, or branding, are resonating in a big way.”

Value has become a key driver in snack purchasing decisions, and that’s not slowing down, Osowski notes: “With value playing an increasingly important role in purchase decisions, snacks that deliver on both emotional appeal and affordability are set to stand out in the year ahead. Consumers are looking for products that feel worth it—snacks that deliver on both quality and price. But even with tighter budgets, taste is still king. People want snacks that are craveable, comforting, and full of flavor. We’re also seeing continued interest in nostalgic flavors and formats, with brands reintroducing classics or putting a modern spin on familiar favorites. The sweet spot lies in delivering great taste at a great value, especially in a category like popcorn that’s rooted in everyday snacking moments.”

“Popcorn brings people together; within microwave popcorn, it’s the top motivating factor for popping up a bag.”

— Johanna Ascencio, brand director, Conagra Brands

“Consumers are seeking authenticity and transparency from brands more than ever.”

— Ayeshah Abuelhiga, founder, Mason Dixie Foods