The BOTTOM LINE

- Frozen snacks and apps have fared better than other freezer-case offerings

- Better-for-you items in the subcategory may have an edge over conventional

- Global flavor profiles and bold tastes likely will continue to appeal to consumers

Keeping it cool

Frozen snacks and apps saw mixed results but producers are feeling rosy about the road ahead.

Jenni Spinner, Chief editor

Sales of frozen appetizers and snacks have been somewhat cool, coincidentally. Still, companies offering the heat-and-eat items—despite the challenges of the past year, many of which aren’t going away anytime in the foreseeable future—are warming up to the possibility of future growth.

FROZEN SNACKS & APPETIZERS

STATE of the INDUSTRY

SPONSORED BY

Market data

Interestingly, the frozen snacks and appetizers category finished at the exact dollar sales figure as it did last year--$4.4 billion—according to the numbers from Circana (Chicago) for the 52-week period ending May 18, 2025. The top-ranked producers in the category had mixed results; private-label products saw one of the dollar-sale gains, with the $665.3 million PL items took in constituting a 4.5% increase. The biggest share of sales went to General Mills’ brands—the $802.3 million sold represented a loss of 3.1%.

Here are the notable gains among the ranked players:

- Ajinomoto Foods: $466.1 million, up 6.2%

- SFC Global Supply Chain: $432.5 million, up 1.7%

- Rich Products: $301.3 million, a 4.9% increase

Then, two more companies in the red:

- Kraft Heinz: $490.8 million, a 15.7% decrease

- Ruiz Food Products: $220.3 million, down 1.5

HOVER OVER CHART TO SCROLL DOWN

Source: Circana OmniMarket™ Total Store View | Geography : Total US - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers) | Time : Latest 52 Weeks Ending 05-18-25

Fewer consumers were interested in bringing home products from the breaded vegetables subcategory; overall, the $45.5 million raked in by the top-ranked companies constituted a decline in dollar sales of 5.7%. Conagra topped the list but also posted a loss of 15.8%, bringing the company’s take down to $18.3 million. Pictsweet took in $12.2 million (2.3% less than last year), and private-label products in the subcategory raked in $9 million, about $7.1% more than the previous year.

Looking back

“Snacking is becoming the main event, especially among Gen Z, who are replacing full meals with nutrient-dense snacks,” remarks Jenna Behrer, chief growth officer for the BFY-focused Dr. Praeger’s. “At the same time, busy parents are looking for easy wins—snacks that are convenient, nutritious, and something their kids will actually eat. The common denominator across age groups? Taste and health have to go hand-in-hand.”

On top of that, says Judy Zhu (CEO of Synear Foods USA), the food field overall has been impacted by a number of factors.

“We’ve seen the snack category undergo meaningful shifts over the last year, shaped by evolving consumer needs and external pressures. Inflation and supply chain instability continued to challenge the industry, particularly around ingredient sourcing and transportation costs,” she notes. “Despite this, the category showed resilience. Consumers leaned heavily into comfort, convenience, and authenticity, especially within global flavor profiles and better-for-you options. Brands that delivered on quality, cultural relevance, and accessibility stood out.”

While frozen apps and other nibbles in the chilly section of the store tend to be outpaced by snack categories in the ambient parts of the store, the category offers a number of benefits that appeal to consumers.

“Frozen has become an exciting space where taste, nutrition, and convenience are all in demand—and that’s where Dr. Praeger’s is well positioned,” says Behrer. “We've been in frozen snacking for nearly two decades with our Littles line, offering fun, veggie-packed options that families trust.”

Zhu concurs, saying the snacks and apps located in retail freezer cases have outpaced the meals, veggies, and other products around them.

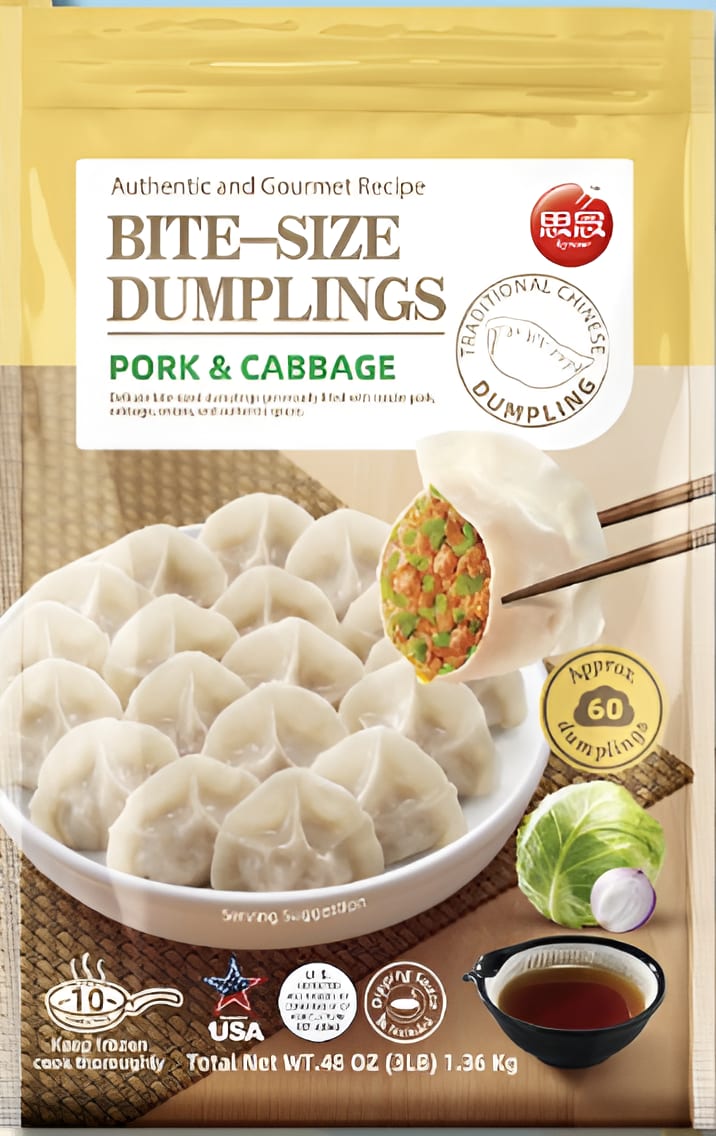

Courtesy of Dr. Praeger's

“Frozen snacks and appetizers have remained a bright spot within the larger frozen food category. At Synear, we saw growing interest in Asian-inspired offerings, with dumplings and bao leading the charge. Consumers are increasingly seeking products that feel indulgent but are easy to prepare—whether for quick family meals or entertaining,” she notes.

Not that the frozen subcategory of the snack world was without obstacles. According to Zhu, Major challenges this year included:

- Cold chain disruptions and rising transportation costs

- Increased competition for shelf space as retailers tightened assortments and competitors offering similar products

- Global tariff changes continue to disrupt international sourcing possibilities

Courtesy of Dr. Praeger's

“Yet, we saw strong performance where flavor, texture, and authenticity came through,” Zhu shares. “Customers are more discerning, looking beyond generic options and seeking out brands with heritage and culinary integrity, while continuing to be very price-sensitive.”

Dr. Praeger’s had a number of launches in recent months, including Pizza Stars, celestial-shaped nibbles that offer a twist on typical pizza snacks by combining cauliflower, mozzarella, whole grains, and an overall clean label. The brand also unleased Taco Stars, Ranch Crunchy Veggie Fries, and Broccoli Cheddar Cheesy Bites.

“Each of these launches is rooted in what families are looking for—convenient, craveable, better-for-you snacks made with real, veggie-forward ingredients that everyone can enjoy,” notes Behrer.

Looking forward

When looking to the future of frozen snacks and appetizers, Behrer advises, market watchers should anticipate a number of current and emerging trends to impact the category.

“We expect to see more demand for clean ingredients, high-protein options, snacks that double as meals, and bold flavor profiles that appeal across age groups,” she says.

And while the subcategory has been challenging in recent years, Zhu and other leaders in the field believe things are looking bright.

“Looking to the next 12 months, we are optimistic about the frozen snacks/appetizers category. We believe there is ample runway for growth, especially for brands that can offer premium quality at accessible prices,” she states. “Synear will continue to invest in innovation that bridges traditional Chinese flavors with modern American consumption habits.

Courtesy of Synear

“Snacks and appetizers have remained a bright spot within the larger frozen food category.”

— Judy Zhu, CEO, Synear Foods USA