The BOTTOM LINE

New and innovative flavors

Clean-label and healthy ingredients

Consumers look for “simple labels”

Pretzel paradise

Cleaner labels, healthier ingredients, greater variety of flavors on the menu for consumers.

Ed Finkel, Contributing Writer

The hard pretzel category grew steadily in the past year as consumers stuck at home continued to snack, although fortunes varied significantly from brand to brand. During the past year, consumer focus on cleaner labels and healthier ingredients has ramped up, while manufacturers have continued to experiment with a wider variety of flavors. Pretzel product and ingredient makers predict those trends will continue.

PRETZELS

STATE of the INDUSTRY

Market data

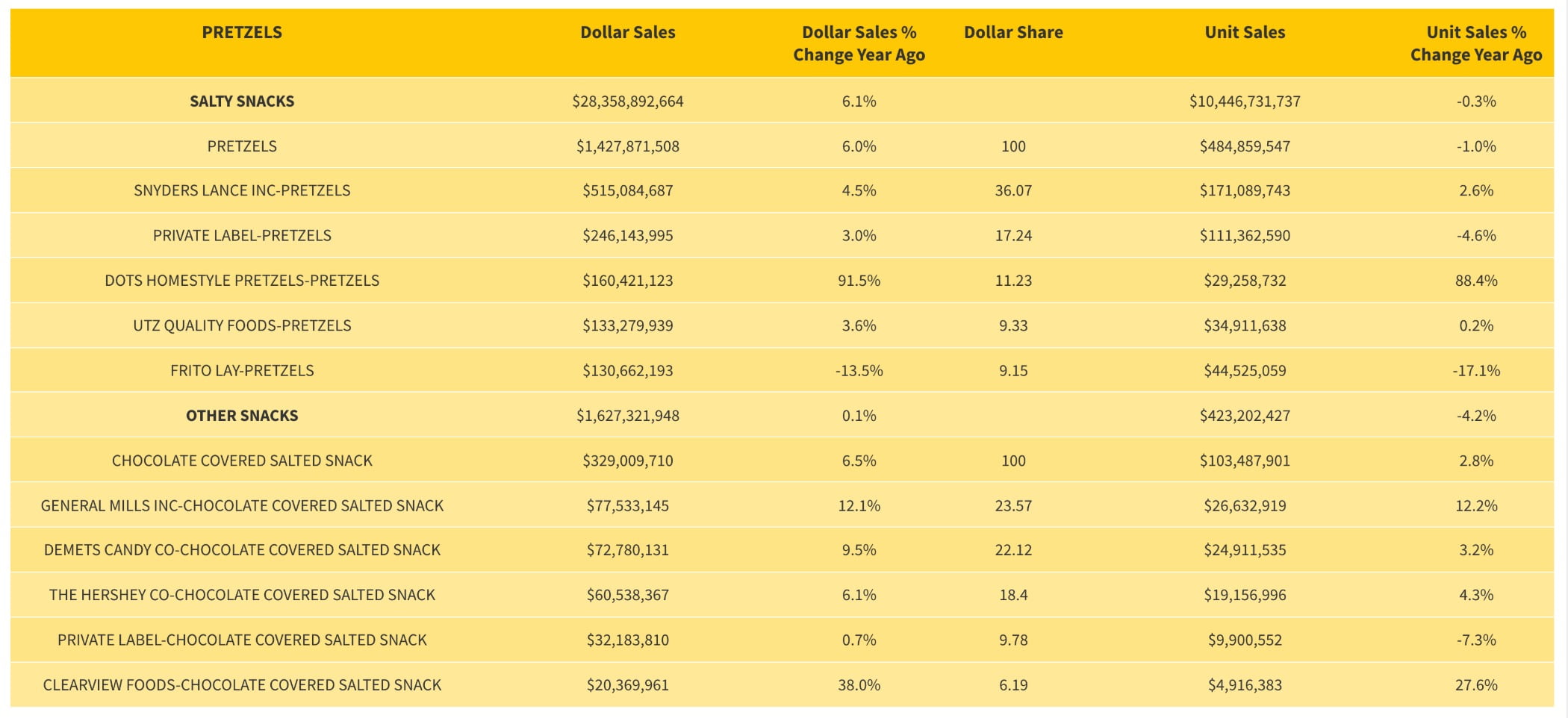

The overall pretzels category saw 6.0 percent growth to $1.4 billion in sales for the 52 weeks ending May 16, according to multi-outlet data from IRI. Snyder’s of Hanover was the top-selling brand at $489.4 million, up 5.6 percent. Private label brands combined for $246.1 million in sales, up 3.0 percent.

Dots Homestyle Pretzels, the next-highest-selling brand at $160.4 million, nearly doubled in sales from the previous year, up a whopping 91.5 percent. Other top-selling brands did not fare as well—ROLD GOLD saw $130.6 million in sales, but that was down 13.5 percent from a year earlier, while Combos enjoyed $111.4 million, down 9.7 percent.

The Chocolate Covered Salted Snack category, which includes pretzels among other munchables, grew 6.5 percent to $329.0 million in sales for the 52 weeks ending May 16, IRI found. General Mills Chex Mix Muddy Buddies led the category with $77.5 million in sales, up 12.1 percent, while Flipz took in $72.4 million, up 8.9 percent.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

HOVER OVER CHART TO SCROLL DOWN

Looking back

ADM, Chicago, has evidence that consumers are repeatedly reaching for snacks, says John Powers, marketing director, snacking and baked goods. He cites research from The Hartman Group published in October 2020 showing that 76 percent of consumers report weekly consumption of salty snacks and 70 percent say they’re having sweet snacks that often. About 20 percent say they changed how they snacked in the past year, and 35 percent said they snack more often, “citing reasons such as boredom, more time home and with kids, and to manage stress,” Powers says.

“Throughout the past year, people have relied on familiar flavors, brands, and snacks to provide comfort in a changing world,” he says. “For example, classic flavors provide a sense of consistency and an element of nostalgia. Shoppers often select salty and sweet combinations, such as chocolate-covered or drizzled pretzels, as well as caramel and sea salt, and caramel and dark chocolate coatings. Cheddar cheese, honey mustard, Buffalo sauce, and sriracha are popular savory flavors.”

In terms of shape and format, ADM has noticed growth in pretzel thins and pretzel pieces, “which are perceived as a permissible indulgence because the pieces are smaller than more traditional hard pretzel forms,” Powers says. “Portion control also plays a role in packaging. At the height of the pandemic, consumers shifted from individual size to family size bags. Now, there’s a pivot back to the snack pack as people return to their pre-pandemic routines and are looking for convenience and affordability.”

Consumer interest in better-for-you options for pretzels and other snacks has been growing, ADM’s own research has found. More than 70 percent of consumers rate protein from plant sources as healthy, for example, and “plant proteins can be baked right into hard pretzels, using soy, pea, beans and pulses, [or] wheat and peanut flours or powders,” Powers says.

In addition, 46 percent of consumers look for whole grains and 43 percent look for multigrain on snack and baked good ingredient labels, ADM found. “Ancient grains and seeds are a wholesome addition to pretzels and other snacks,” he says. “Product developers can improve the appeal of emerging ingredients like chia, hemp seeds, sorghum, quinoa, and millet by pairing them with more recognizable whole grains like wheat, rice, and oats.”

Courtesy of Unique Snacks

To create differentiation via product ingredients, ADM’s research has shown that 69 percent of consumers say simple, recognizable ingredients influence their purchasing decisions, and 66 percent say they are looking for simple labels, Powers says. “Additionally parents and caregivers tend to adhere to stricter health-oriented guidelines when choosing snacks for their children, focusing on low sugar as well as a range of free-from labels and clean label-centered cues,” he says. “Hard pretzel brands aiming for clean-label appeal should emphasize ingredient attributes like natural, free from artificial ingredients, and non-GMO.”

Unique Snacks, Reading, PA, spent the pandemic celebrating its 100th anniversary and undergoing a rebrand from Unique Pretzel Bakery, although the company has not produced anything aside from pretzels just yet, says Justin Spannuth, vice president and chief operating officer. The company changed its logo and all package designs, “allowing us to focus on some new business models and new product categories, and allow us to grow,” he says.

Unique Snacks also has seen interest growing on the health side, particularly all-natural ingredients, Spannuth says. “The grain-free, gluten-free, everyone is trying to do something a little different to hit those niche areas,” he says. “In the standard snack area, seasoned products have been doing well, especially anything with a buttery note.”

In addition to high-flavor seasoned product flat pretzel crisps are doing well, according to data, Spannuth says. He adds that the category has seen other types of innovation, such as different options for filled product besides the standard peanut butter, which haven’t necessarily taken off, “but it’s great to see the innovation.”

Betsy Morreale, vice president of salty snacks, Campbell Snacks, Camden, NJ, puts numbers on the increases in different shapes and formats, citing IRI Market Advantage data for the 52 weeks ending January 3 that showed a rise in purchases of pretzel sticks (41.4 percent), pieces (17.2 percent) and nuggets (10.5 percent).

“Consumers told us that they were looking for more flavorful, indulgent snacks with complex textures, so we took that insight and ran with it.”

— Betsy Morreale, vice president of salty snacks, Campbell Snacks

Courtesy of Campbell Snacks

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

PINCH TO ZOOM IN ON CHART

Morreale, whose company produces the Snyder’s of Hanover brand, agrees that consumers are striving for flavor-forward pretzel options. “Consumers told us that they were looking for more flavorful, indulgent snacks with complex textures, so we took that insight and ran with it, crafting Twisted Pretzel Sticks, which give bold flavor all in a twisted, crispy crunch,” she says. Released in January, the sticks are available in Jalapeno and Ranch, Sour Cream and Onion, and Seasoned varieties.

Malt Products Corp., Saddle Brook, NJ, makes malted barley extract, oat extract and other natural sweeteners with antioxidants, minerals and digestible proteins that help with an improved microbiome, says Amy Targan, president. She believes the most important trend in snacking has been the increase in consumer savviness about what’s in their food.

“Clean label formulations with healthier, all-natural ingredients have been gaining steam in the snack segment for quite some time,” Targan says. “The protracted pandemic-related lockdowns only accelerated this, as it gave consumers more time to consider what they were eating [and] more thoroughly examine ingredients.”