The BOTTOM LINE

Indulgent flavors and better-for-you options

Others go back to basics

Organic, whole-grain flavors trending

Popped to perfection

Popcorn breaks out of the box—or, in this case, bag.

Liz Parker, Managing Editor

As Americans stayed home for another year during the COVID-19 pandemic, popcorn sales steadily rose, especially in the ready-to-eat popcorn/caramel corn category.

Market data

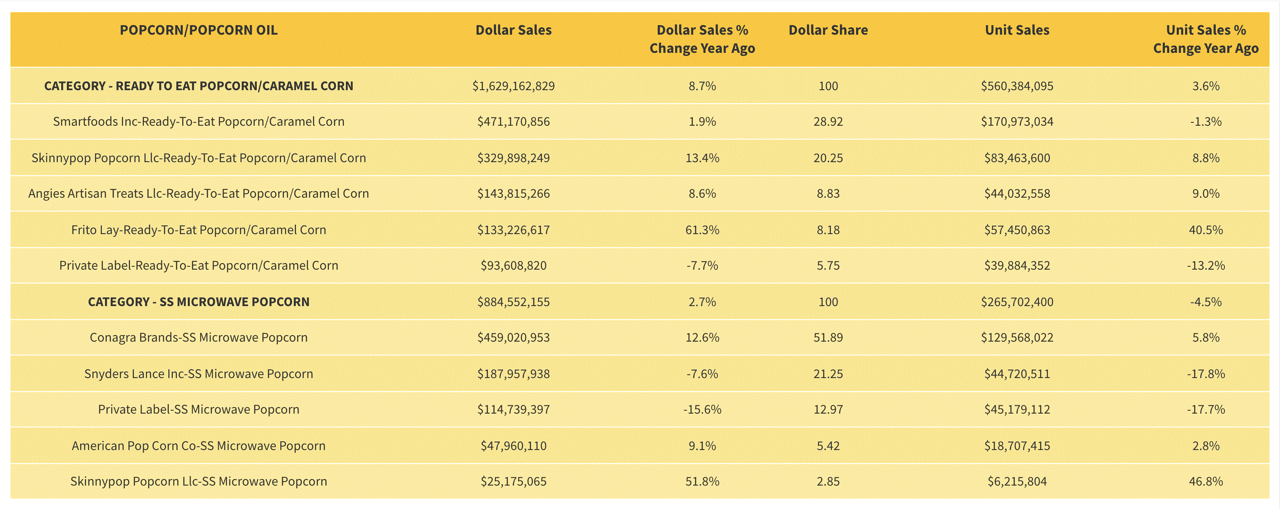

According to IRI (Chicago) data from the past 52 weeks, which ended on May 16, 2021, the ready-to-eat popcorn/caramel corn category was up 8.7 percent, with total sales of $1.6 billion.

POPCORN

STATE of the INDUSTRY

Smartfoods, Inc., a Frito-Lay brand, was the leader in the category, with $471 million in sales and a 1.9 percent increase. Skinnypop took second, with $329 million in sales and a nice increase of 13.4 percent, and Angie’s Artisan Treats LLC, which produces Angie’s BOOMCHICKAPOP, took in $143 million in sales, with an 8.6 percent increase.

Others to note in this category are Cheetos brand RTE popcorn/caramel corn, with a huge increase of 110.7 percent in sales, and Smartfood’s Smart 50 brand, with a 418.7 percent sales increase. G H Cretors, known for its caramel and cheese popcorn mixes, also showed a 32.5 percent increase in sales.

In the microwave popcorn category, the category as a whole experienced an uptick of 2.7 percent, with $884 million in sales, and Conagra Brands took the lead, with $459 million in sales and a 12.6 percent increase. Snyder’s Lance Inc. brought in $187.9 million in sales, with a small decline of 7.6 percent, and private label popcorn brought in $114 million in sales, with a 15.6 percent dip in sales.

Brands to watch are Act II’s microwave popcorn, which had a 32.4 percent increase in sales; Orville Redenbacher, which had a 17.1 percent increase in sales; and SkinnyPop, which increased its sales by 51.8 percent.

Looking back

“Lately we’ve been seeing a lot of customers going back to the basics—caramel, cheese, butter, and salted popcorn. Despite an overall trend in snacks from the past decade of ‘unique, different, and sometimes even exotic,’ lately consumers seem to return to what they know and what is comfortable,” says Michael Horn, president and CEO, AC Horn, Dallas. “In 2020 we all spent so much more time at home, so going back to the basics just makes sense.”

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

PINCH TO ZOOM IN ON CHART

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

HOVER OVER CHART TO SCROLL DOWN

On the equipment side of the business, we continue to see increased demand for automation, record keeping and cleanability, he says.

“Labor costs are on the rise, as are food safety requirements. Food manufacturers require machines that will work reliably with as little manual input as possible. Machinery must be easily cleaned easily, thoroughly, and quickly. They must be able to keep record of their machines’ daily operation for regulatory compliance.”

Joe Boesen, brand manager of innovation on popcorn & salty snacks, Conagra Brands, Chicago, says that the microwave & kernels categories have seen a period of high growth and strong household penetration gains over the last year and a half due to increased in-home snacking behavior during the COVID-19 pandemic, coupled with increased consumer adoption of home streaming options, for which popcorn is a consumer staple.

“Home entertainment and popcorn are a natural fit, so the growth in streaming created more consumption occasions at home and fueled strong retail sales growth. Versus pre-COVID sales, the microwave popcorn category grew over 17 percent, the kernel popcorn category grew over 20 percent and ready-to-eat popcorn grew over 10 percent. Household penetration also grew by about 1 percentage point in both microwave and kernels popcorn categories, which equates to nearly 1.3 million new households entering these categories,” says Boesen.

Jamie Mavec, marketing manager, Cargill, Minneapolis, says that popcorn fits many of the broader trends playing out in the food and beverage landscape, aligning with consumer desires for snacks perceived as healthy, convenient, label-friendly, and delicious.

Courtesy of carlosrojas20 via iStock / Getty Images Plus

“The category has seen a burst of flavor innovation in recent years, especially with the explosion in ready-to-eat popcorn offerings. No longer limited to plain, buttered, and cheese-dusted choices, today’s popcorn is available in an array of flavor profiles for more adventurous palettes, from sweet and savory kettle corn and spicy jalapeno ranch, to indulgent chocolate-drizzled and caramel-coated options. Seasonal flavors have also found their way to store shelves, including the obligatory pumpkin spice,” she says.

2020 was definitely a year to indulge: SNAX-Sational Brands released a few chocolate varieties in 2020, including its Snack Pop Halloween Cookie Pop, made with OREO cookie pieces and topped with orange cream drizzle, and its Candy Pop variety pack, featuring its M&M popcorn, Twix popcorn, and Snickers popcorn, served in portioned snack sizes.

SkinnyPop also released a Birthday Cake-flavored kettle popcorn last year. The popcorn combined flavors of kettle popcorn and birthday cake, and was available for a limited time at Sam’s Club in a party-sized bag.

In addition, Angie’s BOOMCHICKAPOP launched its Salted Maple Kettle Corn flavor, in 5.5 oz. bags, for consumers who want more flavor exploration beyond its Sweet & Salty Kettle Corn flavor.

However, from a nutrition perspective, consumers largely view popcorn as a guilt-free indulgence, Mavec notes.

“Lighter varieties and on-trend labels like organic, gluten-free, and whole-grain lean into that healthy image. Many leading brands have further leveraged popcorn’s better-for-you persona, with label claims featuring ‘no artificial ingredients’ and ‘non-GMO.’ Popcorn also dials into consumer desires for recognizable ingredients and minimal processing, with ingredient statements that can be as simple as popcorn kernels, oil, and salt,” she adds.

Her colleague Mike Beaverson, senior marketing manager, Cargill Salt, says that popcorn has a reputation as a satisfying and fiber-containing food, since it’s considered by many consumers as a more health-conscious snack option.

“Aligning with that better-for-you positioning, we’ve seen an uptick in brands’ use of sea salt, which our proprietary research finds consumers’ view as a healthier choice, compared to salt,” says Beaverson. “Alongside heightened interest in sea salt, we’re also fielding more requests for help with sodium reduction in popcorn. To address these concerns, we developed Potassium Salt Ultra Fine, a much finer cut of potassium chloride, which provides a superior salty flavor compared to larger particle sizes. It’s flour-like texture delivers significant functional advantages too, with stronger adherence, more rapid solubility and smoother mouthfeel.”

Courtesy of molka via iStock / Getty Images Plus