Tortillas

CATEGORY FOCUS

The BOTTOM LINE

- Better-for-you still reigns

- Consumers are trying to recreate dining experiences at home

- There is increased interest in alternative flours like almond and cassava

Tortilla temptations

The tortilla category continues to grow.

Liz Parker, Senior Editor

Tortillas are known for their versatility—they can be used in tacos, quesadillas, burritos, and more. It’s no surprise, then, that the tortillas category has been doing well over the past year.

SPONSORED BY

Market data

Per Chicago-based market research firm Circana's data from the 52-week period ending October 8, the “Mexican foods” category is up 13.8% from last year, with $4.48 billion in sales, and the “hard/soft tortillas/taco kits” subcategory increased 14.3%, bringing in $4 billion total.

“Perimeter tortillas/wraps/flatbreads” brought in $342.8 million, a 7.3% increase in sales; “refrigerated tortilla/egg roll/wonton wraps” sales reached $214.5 million, a boost of 11.4% compared to the previous 12-month period. “Frozen foods,” including frozen tortillas, sold a total of $21.8 million, up 5.7%, and the “frozen tortillas” subcategory brought in $2 million of that, a 24.7% increase.

HOVER OVER CHART TO SCROLL DOWN

Source: Circana OmniMarket™ Total Store View | Geography : Total US - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers) | Time : Latest 52 Weeks Ending 10-8-23

trends

“We continue to see consumers trending towards healthy, low-carb, and bold flavor options,” says Ricardo Baez, president, Don Pancho. “Street tacos continue to be a growth segment in the tortilla category. This is partly due to consumers trying to recreate their dining out experience at home.”

In the low-carb area, this segment is seeing double-digit growth, while the overall tortilla category is just on the positive side of flat, he adds. Adding to this growth is the rise in “Net Zero” carb offerings.

“On the foodservice side, ‘snack wraps’ have made a large splash in the fast food and QSR segments. This has benefited from chains such as Burger King having massively successful launches on their snack wrap offerings. Also, ‘birria’-style tacos have taken off the past several years. This is in all day parts. Foodservice operators are offering birria breakfast tacos, ‘quesabirrias’ for lunch day part, and full birria tacos for the dinner day part,” Baez finishes.

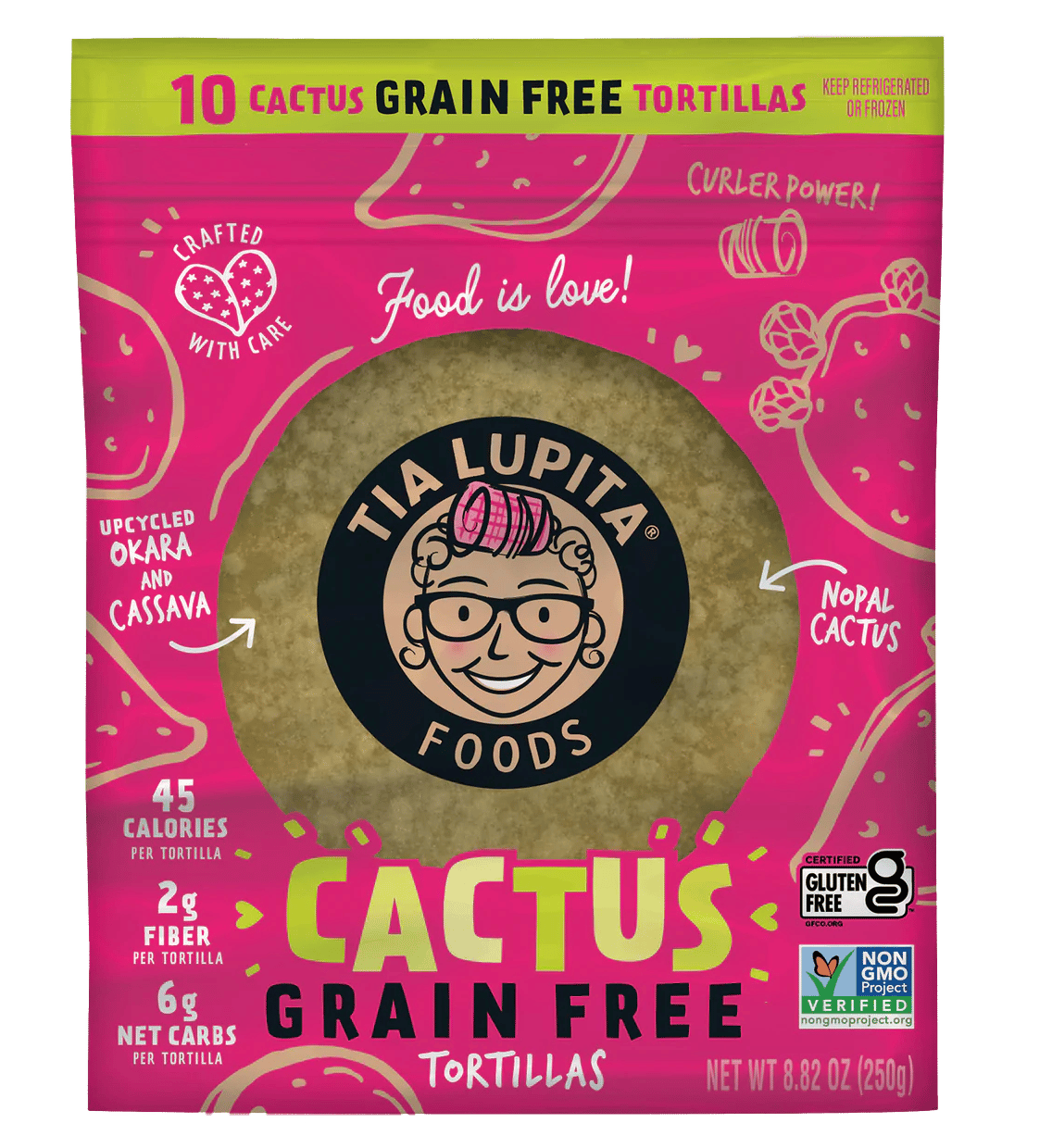

Jose Carrillo, head of marketing and strategy, Tia Lupita, says that, just like in many other categories, better-for-you has been driving a lot of growth in the tortilla category.

“There are many brands that have been innovating for a long time with gluten-free, low-carb, added fiber, etc. in their portfolio. Despite that, we believe there is still plenty of opportunity to continue evolving the category and align it with what consumers are looking for,” he predicts.

“Not only is product enhancement driving growth in the category, but also trends like Taco Tuesday, and celebrations like Cinco de Mayo and Hispanic Heritage Month, are providing opportunities to launch bigger packages, kits, etc. which are appropriate for meals with family and friends,” Carrillo shares.

Gary Brown, chief business development officer, Mama Lupe’s and La Tortilla Factory, says that it has been interesting keeping up with consumers this year.

“Traditional tortillas showed real strength last year, but this year we have seen a strong return to the ‘better-for-you’ items that we produce, and this is where the capabilities of our company really shine,” he relates.

“Our strength is that we make not only great items like our Cassava Flour Gluten Free products and our innovative ZERO Carb tortillas in a soft taco size, but we also have traditional flour tortillas in both our Mama Lupe’s brand and new lineup of products we’re calling Tradición from La Tortilla Factory. Our goal is the same as always: be ready to adapt to what consumers are buying so that our customers have the products they need on the shelf,” Brown comments.

Courtesy of Don Pancho

“We are talking with our customers specifically about opportunities in organic products and explaining how we can partner to deliver what customers are seeking with our product offerings,” he notes.

Representatives from TI Foods say that they are currently seeing a push in requests for high lime and blue corn tortillas, with 4.25 and 5 inches seemingly being most popular at the moment.

“Blue corn is popular as we use Masienda blue corn. This issue with blue corn is most customers don’t consider, and sometimes are discouraged by, is the fact that the blue will not be a dark blue (more of a light bluish/purple) as the corn loses color while cooking and cooked into tortilla and chip form. High lime is also becoming very popular because of the aroma and unique flavor. This product has no preservative so the life on this product is very short,” they explain.

Courtesy of Tia Lupita

In July and May of this year, respectively, General Mills launched Old El Paso Spicy Jalapeño Cheddar Flavored Stand 'N Stuff Crunchy Taco Shells and Old El Paso Stacked Queso Crunch Kit, a representative says.

The Spicy Jalapeño Cheddar Flavored Stand 'N Stuff Crunchy Taco Shells are hard gluten-free taco shells, retailing at $4.05, and the Stacked Queso Crunch Kit includes six Bold Nacho Flavor Stand N' Stuff hard Shells, six soft flour tortillas, a queso packet and a seasoning packet, with a SRP of $5.13.

Innovation

The TI Foods representatives say that their sales representatives keep them informed on what their chefs are searching for and what is trending.

“We also do weekly searches to see what is trending, what new restaurants and or casinos are coming, and review menus,” they say.

In terms of innovation, “as far as that goes, we like to think we are right up there with new innovative things. We did see a request for Nopale tortillas and 3” tortillas,” they elaborate.

Carrillo says that the origins of Tia Lupita are based on innovation: “Either by focusing on introducing hot sauce with simple ingredients, or launching bolder innovations like adding cactus flour to make tortillas and tortilla chips, [innovation] in a way is in our DNA. We look at other categories, we attend trade shows, we visit stores, etcetera. We are always on the lookout for things that could spark ideas,” he explains.

“The rise of alternative flours like almond, coconut, cassava, and, in our case, cactus flour, are leading the charge to deliver grain-free alternatives. There are also more unique concepts like tortillas made from eggs or cheese which are free of flour,” Carrillo adds.

Baez says that Don Pancho is continually looking at consumer data both in the retail and the foodservice space.

“This includes Circana data for retail and foodservice data such as Datasenntial. This is combined with resources within the tortilla industry and our supply partners. As mentioned, Net Zero Carbs is a space where we see a lot of innovation. Along with the net zero carbs, we’re seeing flavors being added to this offering to have a fairly broad range of options in the net zero carb space,” he predicts.

Another trend is coming back to an “authentic” flavors profile and tortilla style, Baez relates.

“’Comal’ style tortillas that the consumer heats up on a flat top or skillet is very on trend right now. This gives a bit of an authentic flavor profile to the finished tortilla,” he notes.

Brown says that Mama Lupe’s relies on a combination of internal and external sources to help the company understand what is going on in the market.

Courtesy of La Tortilla Factory

“We rely on a combination of internal and external sources to help us understand what is going on in the market,” he explains. “Internally, we source data from various places to assess trends over a long window while also looking at more current numbers so we can respond nimbly to recent, subtle shifts. Social media is also a great resource, as we look at food flavors and topics that are trending. It is more than just following a few key influencers. It is having a methodical plan to identify the ones who have shown an ability to identify new trends before they are mainstream.”

“[In addition,] we rely on our R&D team to bring us what they are hearing from our supplier community. Another really important resource is our sales team in the market,” Brown says.

Courtesy of General Mills

“Most importantly, we count on customers who reach out with questions and feedback. When they take the time to communicate, we know they have strong feelings about the subject. Moreover, our experience suggests that if it matters to one person, they are unlikely to be the only ones who feel that way,” he finishes.

New products

“We have a couple of new items poised for release in 2024 and [we] are starting to introduce our customers to these now. One interesting product will be an extension of La Tortilla Factory’s incredible Handmade Style Tortillas and be a perfect complement to a current item containing Hatch Valley Green Chiles,” Brown says.

“To continue the long legacy of leading-edge products, we also have another first-to-market item that delivers authentic taste, pure ingredients and ‘Better For You’ nutritionals. We want to tell our customers about it first, but we believe it is a real market changer and will thrill tortilla fans,” Brown continues.

“We are excited to launch our La Tortilla Factory Tradición Tortillas; they harken back to our ‘Simply Better Tortillas’ history, [giving] a nod to the brand’s “Better for You” laurels,” he adds. “Our customers will appreciate the unmistakable authenticity of the corn and flour flavor that are the backbone of the product lineup. We have commitments from nationwide retailers, and the launch is in motion. You will start seeing Tradición on the shelves in a matter of weeks and expansion will accelerate in early 2024.”

Baez says that in 2024, Don Pancho will have several exciting launches in both the retail and foodservice segment.

“These will include flour and corn tortillas as well as some additions to our fried snack offerings,” he says.

“’Comal’ style tortillas that the consumer heats up on a flat top or skillet is very on trend right now. This gives a bit of an authentic flavor profile to the finished tortilla.”

— Ricardo Baez, president, Don Pancho

TI Foods representatives reveal that the company is launching a few new items in 2024. The new launches planned for the coming year include 3-inch tortillas, pink tortillas, birria sauce, habanero corn tortillas, and spinach corn tortillas.

Carrillo says that although he can’t talk about specific product launches in the tortilla category, one thing he can say is that Tia Lupita is looking to create more awareness for its existing tortilla products by having more people try them.

“We are keeping an eye out for all consumption occasions of tortillas and thinking how Tia Lupita can be part of that. We want Tia Lupita to become a staple in people’s pantries when they are thinking of eating authentic and better-for-you Mexican food at home,” he adds. SF&WB