The BOTTOM LINE

- The hard candy category saw notable innovation

- Consumers are interested in better-for-you options

- Sour flavors continue to resonate with candy shoppers

Assorted flavors

The hard candy market has been moderate, but innovation is providing bright spots for producers.

Joyce Friedberg, Contributing Writer

Candy has played a role in cultural traditions and celebrations for thousands of years and continues to be enjoyed by most people as an occasional treat. Data from the National Institutes of Health shows that 97% of Americans report to consume candy at least once per year. As the hard candy category has evolved, we are seeing innovations influenced by health and wellness trends and the desire for new flavor experiences.

Hard candy

STATE of the INDUSTRY

SPONSORED BY

Market data

The growth in the hard candy category was moderate this year, increasing 7.4% to $1.1 billion, for the 52-week period ending May 21, 2023, according to multi outlet data from Circana. In evaluating the category performance, unit sales were down 5.4% to 560.3 million units, and inflation and price per unit was up 13.5% to $1.99, which helped offset the decline in units and helped drive the increase in dollar sales.

Interestingly, the category does not seem to have one large dominating company. The Hershey Company’s Jolly Rancher brand represents the largest player in the category with a 14.4% market share, was up slightly 0.9% to $160.0 million. This was followed by Storck, which grew 5.7% to $117.8 million, and Ferrara Candy Company’s Nerds brand, which grew 3.6% to $103.2 million.

Some notable bright spots in the category with at least $50 million in sales for the 12-month period:

- Spangler Hard Candy, $93.9 million, up 20.5%

- Tootsie Roll Hard Candy, $85.2 million, an increase of 11.6%

- Charms, $78.3 million, up 14.4%

- The Bazooka Company’s Push Pop, $60.0, up 16.7%

- Mars Wrigley’s Lifesavers brand, $52.0 million, up an impressive 21.8%

HOVER OVER CHART TO SCROLL DOWN

Source: Circana, Total U.S. Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers), latest 52 Weeks Ending 05-21-23

Looking back

Health and wellness remain top of mind for consumers across the food spectrum; this is also the case for the hard candy category. Consumers are seeking healthier ingredients and cleaner labels. According to the International Food Information Council 2023 Food and Health Survey, 72% of consumers are trying to limit or avoid sugars. In a recent study conducted by Circana and shared by Alina Morse, CEO, Zolli Candy, the data showed that zero sugar is trending:

“Looking at the largest players in arguably the most mature and dynamic category, beverage: Coke, Pepsi, and Monster have all abandoned their ‘one’ [gram of sugar] or low-sugar concepts and focused on easy-to-understand Zero Sugar,” Morse remarks. The study also showed, sugar free chocolate and non-chocolate is outpacing the category on both a dollar and volume sale basis.

Courtesy of Zolli

With its Zolli Candy and Zollipops, the company believes candy should be a delicious, fun experience that everyone can enjoy by being zero sugar, gluten-free, allergy-friendly, and made with natural flavors and no artificial or synthetic dyes. Another interesting feature of the product is that it helps clean teeth. Morse explains how this works: “When we eat, our mouth becomes acidic. This acidic environment provides energy to the bacteria (including Streptococcus mutans) that cause caries and tooth decay. The acidic environment also weakens and softens tooth enamel. Zollipops naturally help balance the pH or reduce acidity taking away the energy for the bacteria and help teeth remineralize or get stronger.”

According to Morse, the company has recently launched new products:

- Zolli Ball Popz, which feature trending flavors like Watermelon, Blue Raspberry, Green Apple, and Peach, as well as flavors like Strawberry, Tangerine, Grape, and Pineapple. They are zero sugar, gluten-free, allergy-friendly, made with natural flavors, contain no artificial/synthetic dyes, and help clean teeth.

- Zollipops Swirls: a Top New Product on the shopping channel QVC in Q1 2023, these exclusive products have zero sugar and no artificial colors or flavors. The flavors include Lemonade Blue Raspberry, Pineapple & Orange, and Mango Strawberry.

“The ongoing introduction of new flavors and captivating flavor combinations has truly expanded our perception of traditional hard candy.”

— Cynthia Thayer, CMO, Yowie Candy

Tara Bosch, founder, SmartSweets has noticed the trend of unique and fun flavors, as well as the desire for a low-sugar or better-for-you products influencing the hard candy category. “This has been the mission of the company since it was founded in 2016; ‘Kick Sugar, Keep Candy.’ This meant reinventing traditional candy into fun flavorful low-sugar options one can feel good about enjoying daily,” she shares.

Bosch’s company has recently expanded their hard candy portfolio and launched SmartSweets Jolly Gems. “SmartSweets Jolly Gems have juicy, unique flavors such as Peach and Pink Lemonade, and a sugar content of one gram per three pieces. The new product maintains the company’s dedication to utilizing high quality ingredients with zero artificial sweeteners or sugar alcohols.”

Flavor innovation is another area of growth for the hard candy category. Cynthia Thayer, CMO, Yowie Candy describes the flavor innovation she is seeing: “The ongoing introduction of new flavors and captivating flavor combinations has truly expanded our perception of traditional hard candy. Now we see ‘mints’ infused with flavors like Key Lime or lollipops that tantalize the taste buds with a hint of spice. The possibilities for flavor experimentation are truly boundless, and this limitless potential is what makes the world of hard candy so exciting.”

Courtesy of SmartSweets

Courtesy of Yowie Candy

One of the flavor trends Thayer notes is sour-flavored candies are remaining an influential force within the category across varieties. When asked why sour remains so popular, Thayer explains, “I think that ‘sour’ is more than just a flavor, it is an experience that young palettes really take to. The younger you are, the faster your taste buds regenerate. As we age, our taste buds shrink and tend to regenerate much more slowly and sometimes not at all. So, while people of any age may enjoy sour foods, kids have a much more powerful taste experience when they eat something sour. I think it’s that strong experience that made sour candies so popular.”

Looking forward

Zolli Candy will be launching a new product within the coming months. Zolli Gum Popz, a zero sugar gum-centered Zollipop, is surrounded by zero sugar hard candy that supports a healthy beautiful smile and blows great bubbles, according to Morse.

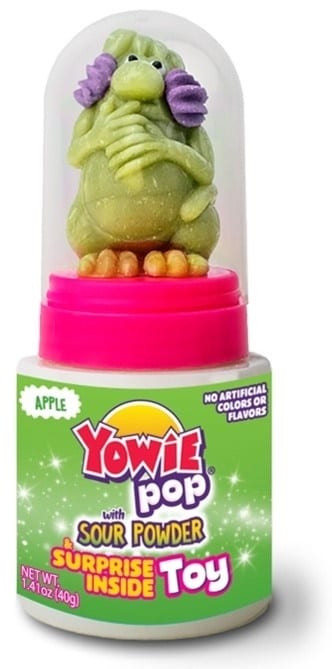

Yowie Candy Company will be introducing YowiePop later this year. Thayer describes this new product: “We’re thrilled to capitalize on the enduring popularity of sour-flavored hard candies and take it to new heights. Our innovation lies in the creation of a three-dimensional lollipop in the shape of one of our beloved Bigfoot characters. With a specifically designed compartment, you can dip the Yowie-shaped lollipop into a burst of tangy sour power.” Yowie, which is known for a surprise inside, has included an endangered animal figurine in the new product that not only offers endless playtime but also serves as an educational tool. SF&WB