Sustainability

report

The BOTTOM LINE

Consumers consider sustainability

Transparency is expected

Recyclable packaging is key

Playing the long game

Companies cater to consumers’ preferences on packaging, including recyclable options.

Kimberly J. Decker, Contributing Writer

Lest anyone think that the pandemic pressed “pause” on campaigns for corporate sustainability, think again. If anything, COVID-19 reminded consumers—and the snack and bakery sectors—just how interconnected we are, whether we’re selecting suppliers, expanding production, or packing a protein bar into our gym bags.

Now, as the world resumes something resembling normal, there’s a good chance that attention to sustainability will only increase.

Just ask Sarah Testa, senior vice president, marketing and innovation, Flagstone Foods, Minneapolis. “Sustainability is now a critical part of the value equation, along with price and functionality,” she says. “Consumers are voting with their wallets and showing strong affinity for products and brands that support the social and environmental causes they care about.”

All of which is reason enough for snack and bakery brands to examine how far they’ve come, and to strengthen their efforts going forward.

Consumers care

After all, brands play a role here. “Food production is a major climate-change contributor, with nearly a quarter of greenhouse gas emissions coming from food, land and agriculture use,” says Shauna Sadowski, vice president of sustainability, Simple Mills, Chicago. “So food companies have a lot of power to positively impact the planet.”

Courtesy of Flagstone Foods

As do global consumers, six in 10 of whom told HealthFocus International researchers in 2020 that environmental issues impact their selection of food products.

Further, the NYU Stern Center for Sustainable Business Sustainable Market Share Index calculated that though sustainably positioned products account for just 16 percent of the CPG market, they delivered 54 percent of its growth from 2015 through 2020, growing 7.1 times faster than conventionally marketed products and 3.8 times faster than the CPG space overall.

“These trends continue and may have become more important during the pandemic, as consumers began to recognize the relationship between a healthy diet and long-term health for them and the planet,” says Inga Heinemann, head of corporate communications, Beneo, Manheim, Germany.

No wonder, adds Jamie Mavec, marketing manager, Cargill, Minneapolis, that “brands are taking note, responding with an uptick in global new-product launches that include an ethical environmental positioning.”

Evolving standards

While most of the action and awareness around those concerns come from Gen Z and Millennials, “it’s virtually impossible to escape the myriad sustainability messages associated with every brand’s communication,” notes Holly Adrian, senior marketing manager, Sensient Natural Ingredients, Turlock, CA.

Indeed, Testa says, “Millennials might lead the way on sustainability, but the greatest share of purchases actually comes from Gen Xers and boomers—so appeal truly is widespread.”

Just as widespread, though, are opinions as to what the concept actually means.

Courtesy of BENEO

As Sadowski points out, “Now that some consumers are growing more aware of and concerned about how the food system contributes to climate change, water scarcity, declining biodiversity and farmer livelihoods, their definition of sustainable is evolving to consider these factors, too.”

And don’t forget transparency: “Now more than ever,” she says, “consumers expect transparency. Leading-edge shoppers want to know where their food comes from and how it’s grown.”

Say it proud

Thus, brands and the suppliers behind them are spilling the beans.

This hasn’t always been the case. “Although we’ve built our business on sustainable principles these past 30 years,” Heinemann notes, “we only began communicating it to the wider world recently. Until that time, we felt that actions were more important than words.”

Such reticence is becoming a relic. “Leading companies have to emphasize how they’re addressing climate and other planetary challenges, whether through initiatives that address energy use, recyclable or compostable packaging, food-waste diversion and upcycling, biodiversity, or fair social and labor standards,” Sadowski declares.

Case in point: Sadowski trumpets Simple Mills’ support for regenerative practices like cover cropping, reduced tillage, diversified crop rotation and the integration of animals into the crop ecosystem. The company also avoids using ingredients made from dominant monocrops—sugarcane, corn, rice, and wheat—in favor of perennials and other diverse crops.

“Brands are taking note, responding with an uptick in global new-product launches that include an ethical environmental positioning.”

— Jamie Mavec, marketing manager, Cargill

“Through our Direct Trade program,” Sadowski continues, “we offer financial incentives that allow farmers the opportunity to break from traditional commodity markets and succeed on outcomes other than yield alone. And we establish direct grower relationships that deepen our connection to farming communities and improve traceability so we know where and how our ingredients got here and can share that with consumers.”

At Flagstone Foods, the company is “embracing sustainability in all aspects of our business, from sourcing to product assortment to packaging and manufacturing,” Testa says.

As for sourcing, their “Healthy Bees, Happy Snackers” initiative commits the company to sourcing almonds exclusively from bee-friendly farms by 2025. Noting that roughly 40 percent of the honeybee colonies that migrate to California for the annual almond bloom die off from poor nutrition, pesticides, parasites or pathogens, Testa underscores the existential importance of dedicating acreage to forage, creating bee nesting sites and reducing pesticide use not only to these crucial pollinators’ survival, but to the industry’s, as well. “We see significant demand for sustainable, traceable almonds as this topic becomes of increasing concern to consumers,” she says.

Wrap it up

On the packaging front, Flagstone Foods is working with suppliers to be among the first brands to test and commercialize a pioneering generation of recyclable flexible films, which consumers will be able to recycle through store drop-off programs.

They won’t be the last. According to its “Packaging Sustainability – A Changing Landscape” report, PMMI, The Association for Packaging and Processing Technologies, Herndon, VA, predicts the value of the global sustainable packaging market to rise from an estimated $220 billion in 2018 to $280 billion by 2025, a CAGR of almost 6 percent. “Now that millennials are the largest demographic with the most considerable buying power,” adds Sean Riley, senior director of media and industry communications, “their penchant for packaging sustainability is creating even more of a global shift.”

That means that brands will soon have their pick of renewable choices to help close the packaging loop, including plant- and bio-based options. But not every choice will suit every brand.

“When evaluating these materials,” Riley advises, “the snack and baking industries need to consider a material’s limiting effect on machine flexibility and the potential for machine modifications.” And no matter how enticing a new material, it still needs to “remain in step” with a brand’s promise, he says.

Courtesy of ChemxWorks

Better efficiency, better sanitation

Numerous factors in baking industry production can contribute to less-efficient operations. But industry suppliers continue to offer solutions to help reclaim lost efficiency and improve overall operational sustainability.

The D-CARBONATOR soak tank from ChemxWorks, San Diego, removes carbon, as well as fat, oil, and grease (FOG) from bakery equipment, including aluminum baking pans, hood filters, baking racks, floor mats, and more. The process uses heated water in combination with an eco-friendly and proprietary detergent, CarbonZyme.

“The D-CARBONATOR is unique and special because it cleans carbon buildup off baking equipment very effectively and sanitizes equipment at the same time,” said Gary Shifren, Ph.D., president, ChemxWorks, in 2019 after its D-CARBONATOR soak tank was recognized with a “Top Honors” designation as part of the 2019 IBIE Best in Baking program. “Carbon buildup in the bakery industry is a major problem, since the carbon is a barrier to heat, causes uneven baking, slows down the baking process, and carbon flakes can adhere to the baked products.”

The D-CARBONATOR operates at a temperature of 185˚F (85˚C). Equipment removed from the unit is fully sanitized and bacteria-free. ChemxWorks notes the process saves on labor, utilities, water, equipment, and chemicals. The standalone unit plugs into a regular wall outlet, and no plumbing is required. The unit is available in sizes from 25 to 500 gal. The unique 500-gal. unit is large enough to clean a double baking rack and handle very large volumes of baking pans on a daily basis.

The source of sustainability

Packaging suppliers, and ingredient suppliers more broadly, can help brands navigate these options as they pursue their sustainability promises. In fact, they have to.

“It’s essential for manufacturers to partner with their suppliers to address sustainability,” Testa says, “as we’re part of one interconnected supply chain.”

And while some brands can forge one-on-one relationships with farmers, “very few of our customers touch farmers directly,” says Kate Clancy, senior sustainability manager at Cargill. “Because we sit at the intersection of farmers and food customers, we can find solutions that address our customers’ concerns.”

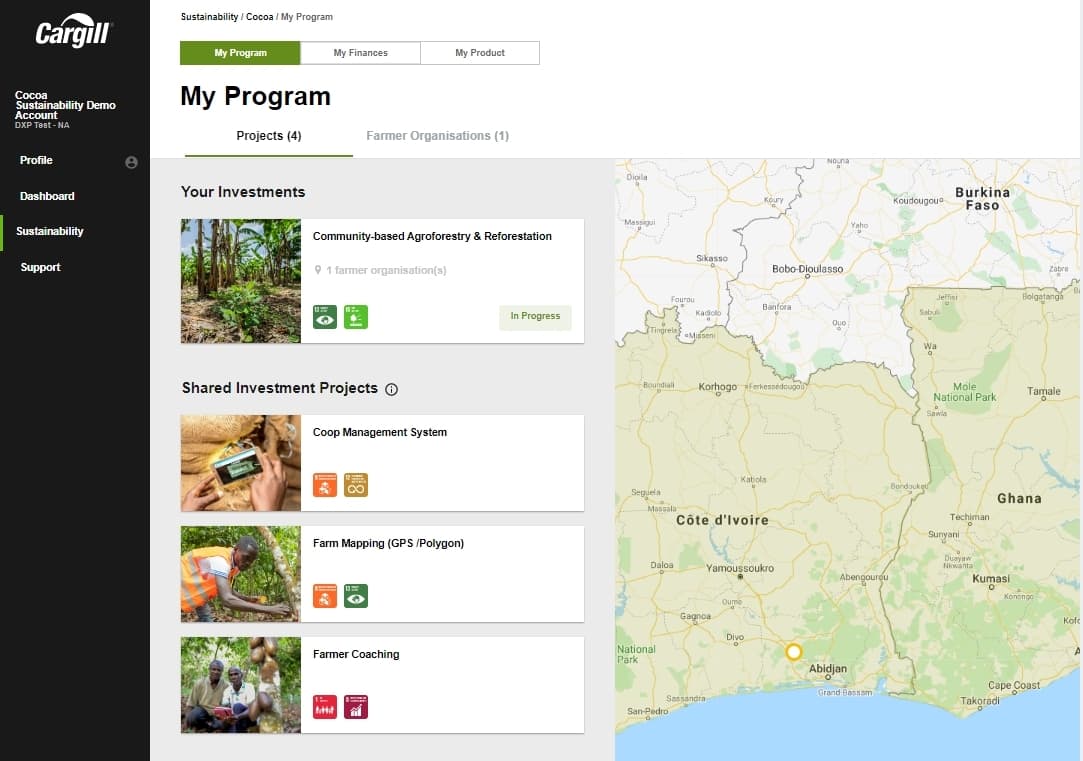

For example, Cargill joined with the PUR Project in Côte d’Ivoire to help cocoa farmers leverage agroforestry’s ability to regenerate the ecosystem and diversify farm incomes through fruit and timber sales. The company also offers customers the opportunity to invest in projects around cocoa-sector concerns like deforestation, gender inequality and child labor.

“As a final step,” Clancy says, “we connect brands to cocoa-farming communities through our CocoaWise digital portal, which provides access to data, information and storytelling around our sustainably sourced cocoa. This helps customers realize their environmental and social-welfare commitments, reinforces brand value and creates brand equity among consumers and stakeholders.”

Knowing that its snack and baking customers prioritize sustainable palm oil, Cargill also “dramatically increased” North American access to RSPO-segregated palm. The company is investing $3.5 million in forestry conservation in West Kalimantan, Indonesia, training local communities in basic business skills, harnessing natural resources, “and attracting sustainable ecotourism so that more than 700 villagers can improve their livelihoods and build a more sustainable future while conserving surrounding forests and waterways,” adds Tai Ullmann, Cargill’s sustainability manager.

Courtesy of Cargill-CocoaWise

And Cargill seeds its leaf-based stevia supply chain with sustainability, enforcing agricultural and manufacturing standards that minimize environmental impact while ensuring worker safety and welfare, says Andrew Ohmes, global product line manager for high intensity sweeteners. “Customers can trace every lot of our stevia back through the supply chain to the farmers and cooperatives that planted the crop,” he says.

While both leaf- and fermentation-derived stevia are proving to be sustainable sweeteners, cane sugar’s sustainability story hasn’t been nearly as palatable to conscious consumers.

Yet Native Organic Sugar, São Paulo, Brazil, aims to transform that perception and reality by demonstrating that large-scale sugarcane production can improve soil, water, and biodiversity while also increasing yields to supply the snack and baking industries.

According to Andrew Martino, category manager for sugar, Global Organics, Cambridge MA, the company has innovated a harvester that cuts green cane and deposits the nutrient-dense leaves back into the fields to protect soil from sun damage and build a rich level of compost. In addition, low-pressure harvester tires avert soil compaction, and hand-weeding and targeted biological controls replace toxic pesticides and herbicides. Finally, tilling soils on six- to seven-year intervals also locks in carbon, improves soil’s water-holding capacity and generates yields that beat conventional farms’ by 25 percent, Martino says, “showing that organic can be grown at scale.”

Native Organic has even built its own impact-measurement tool to demonstrate to customers the precise payoff of purchasing its organic sugar over conventional alternatives, in terms of metric tons of pesticides, herbicides, insecticides, and synthetic fertilizers kept out of waterways and ecosystems, and metric tons of CO2 pulled out of the atmosphere rather than pumped into it.

Building better

Native Organic Sugar isn’t just transforming sugar production on the farm; it’s building sustainability into facility design, too.

The company’s São Paulo manufacturing plant produces its own electricity using sugarcane fiber, or bagasse. “High-efficiency boilers combust the biomass completely, free from sulfur emissions,” Martino explains. “The boilers produce steam, which is converted to thermal, mechanical and electrical energy that drives a turbo generator to meet the plant’s electricity needs.”

The cogeneration system neutralizes greenhouse-gas emissions and produced enough electric energy in 2020—215,000 MWh—to run a Brazilian city of 500,000, Martino says, proving that “significant carbon savings are possible by sourcing cane sugar over beet,” even after accounting for transport from Brazil.

To help Beneo reach its goal of carbon neutrality by 2050, the company implemented a system for steam and electricity cogeneration, as well as multiple-effect evaporation stations that help recover energy.

“Over the years, we’ve already increased energy efficiency in our factories by up to 50 percent,” Heinemann notes. “Additionally, with increased barge transport, we make 2,500 fewer truck trips each year while delivering the same amount of raw materials and ingredients to manufacturers.”

Ullmann notes that Cargill is reducing its carbon footprint across facilities via energy-efficient equipment and LED lights, investing in green-energy projects and, “whenever possible, powering our facilities with green energy.” Renewable solar energy partially juices their cocoa and chocolate facility in Tema, Ghana, and the company’s House of Chocolate campus in Mouscron, Belgium, will tap geothermal energy to reduce its energy consumption, she says.

“In many ways, our clients are incorporating sustainability into the core design of their facilities,” adds Tony Moses, Ph.D., director, product innovation, CRB. For example, Colorado-based MycoTechnology, “a food-ingredient company with snack and bakery applications,” worked with CRB to design and build structural and processing efficiency into its new headquarters and production facilities, Moses says. That includes reusing process condensate, wash water and reverse-osmosis reject water to feed fluid coolers, potentially saving 3,600 gallons of water per day, or 1.26 million per year when operating at peak production. In Colorado, where water is dear, “this sustainable solution is also a sustainable savings opportunity,” Moses notes.

And the baking industry itself has a positive sustainability story to share, according to the American Bakers Association (ABA), Washington, D.C.: of the 95 manufacturing plants that received the Environmental Protection Agency’s 2020 ENERGY STAR certification, 44 were ABA member facilities, and every baking facility receiving the laurels held ABA membership.

Courtesy of EPA