Salty snacks

market trends

The BOTTOM LINE

Salty snack sales increases

Hybrid or fusion snacks

Flavor experimentation

Salty Goodness

During the pandemic, consumers turn to salty snacks for an at-home experience.

Liz Parker, Managing Editor

Unsurprisingly, salty snacks experienced a slight increase in sales over the past year, as Americans stayed home during the pandemic. Chips, popcorn, pretzels, and tortilla chips are all easily available snacks to

munch on at home, especially during movie nights, and as a result the category experienced a small uptick.

Market data

According to IRI, Chicago, for the 52 weeks ending May 16, 2021, salty snacks overall did well. The category itself was up 6.1 percent, with total sales of $28.3 billion.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

HOVER OVER CHART TO SCROLL DOWN

The ready-to-eat popcorn/caramel corn category was up 8.7 percent, with total sales of $1.6 billion. Surprisingly, private label experienced a decrease of 7.7 percent, as perhaps consumers were reaching for comforting favorites like Frito-Lay brand (up 61.3 percent) or better-for-you varieties such as SkinnyPop (up 13.4 percent).

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

HOVER OVER CHART TO SCROLL DOWN

The potato chips category was up 3.6 percent, with overall sales of $8.3 billion. The winner percentage-wise was Baked Ruffles—although it had sales of only $63.5 million, it had a tremendous growth of 169.3 percent.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

HOVER OVER CHART TO SCROLL DOWN

The tortilla/tostada chip category showed a modest increase of 5.1 percent overall, with $6.3 billion in sales. Barcel Takis, known for its spicy Takis brand snacks, brought in $70 million in sales and experienced 319.1 percent in growth.

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending May 16, 2021.

HOVER OVER CHART TO SCROLL DOWN

The hard pretzels category also had growth, with $1.4 billion in sales, a 6.0 percent uptick. Pretzel Baron had a large uptick in sales of about 172.8 percent, with $6 million in total sales. Quinn brand, formerly Quinn Snacks, had a 121.7 percent increase, with $3.7 million in sales.

Delicious and nutritious

New product development

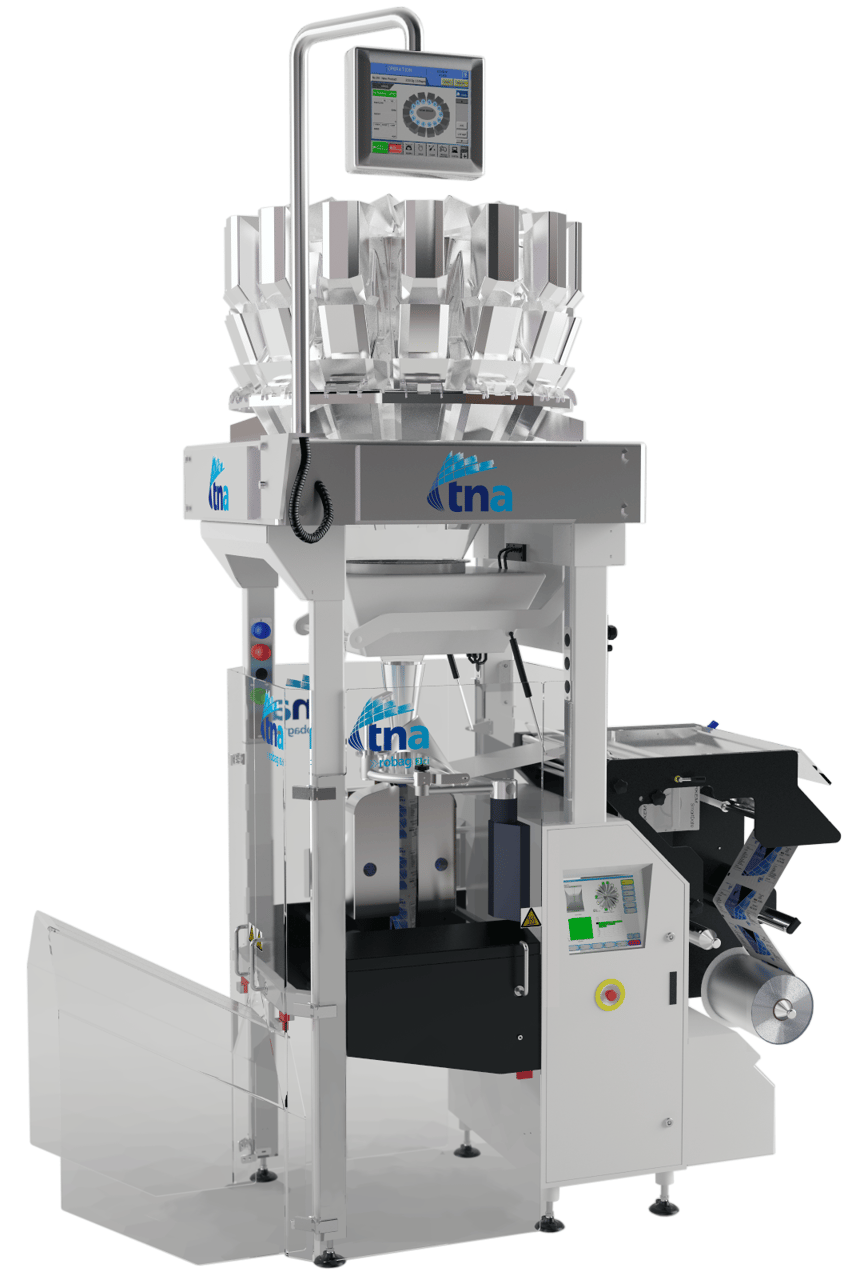

“With consumer demand for more adventurous snacking experiences on the rise, we’ve seen hybrid snacks emerge as a key trend for food producers eager to appeal to the new ‘curious consumer,’” says Teri Johnson, vice president-North America, tna solutions, Dallas. “Creating a hybrid snack can involve processing a traditional product to appear more like another—for example, popcorn snacks shaped to look like tortilla chips. Another example could be to combine two disparate products to further subvert shoppers’ expectations, as Walmart did with the launch of their exclusive ‘Crotilla,’ a croissant/tortilla crossover,” she says.

“These fusion snacks give producers an opportunity to re-energize consumers with a product that’s routed in a familiar favorite, while offering something new. To help food producers capitalize on this demand, original equipment manufacturers need to provide snack brands with versatile, high-performance processing and packaging solutions that allow for experimentation with new production methods and snack formats,” Johnson recommends.

Courtesy of tna

Jordan Timm, food technical services and applications leader, Cargill Salt, Minneapolis, says that she continues to see increased interest from snack food customers around new product formats, including innovation in extruded snacks. “Plant-based proteins are also playing a larger role in the snack category. Still, this category is called salty snacks for a reason, and [Cargill] continues to bring innovations around that key ingredient. Earlier this year, we introduced Purified Sea Salt Flour, which is a unique type of sodium chloride, sifted to the smallest and finest granulations of sea salt crystals. This ultra-fine cut adheres better to food, resulting in less fall-off, less salt waste and a more consistent flavor—all critical factors in topical snack applications,” she says.

In addition, the fine particles also provide a faster salty flavor burst by increasing the rate of dissolution in the mouth. This increased perception of saltiness may enable a reduction in sodium and helps enhance other flavors, Timm mentions. Other benefits of the new Sea Salt Flour include enhanced blendability, which results in a more consistent distribution of flavor and color and minimizes pockets of salty bursts, she says.

“The powder-like product improves texture, too, as the ultra-fine cut crystals deliver a smooth, even consistency for an undetected presence in food. Not only does Cargill Salt’s Sea Salt Flour deliver a superior performance, but it also has a compelling story. It’s harvested authentically with the power of the sun, wind, and time in at the company’s solar salt ponds in the San Francisco Bay. It’s also extremely pure, averaging about 99.9 percent NaCl,” adds Timm.

Courtney LeDrew, senior marketing manager, Cargill, says that one of the big trends she’s been seeing in the salty snack space is around 100 percent plant-based formulation. “Brands are showcasing new ingredients, like mushrooms and okra, leveraging their better-for-you image to create crunchy, salty snacks. Building on the health and wellness theme, there’s clearly an opportunity for manufacturers to infuse their salty snacks with ingredients like pea protein to support consumers’ broader nutritional goals. However, as brands amp up the nutrition, it’s important that these snacks still deliver on consumers’ taste and texture expectations,” she notes.

“Many plant proteins bring along earthy off-notes that can complicate formulation,” says LeDrew. “We advise developers to opt for products with a neutral flavor profile, like PURIS pea protein available from Cargill, which are better suited for these applications.”

Beyond protein, LeDrew says she’s beginning to see brands formulate products with other wellness-oriented benefits, from mood enhancement to energy boosts, typically fueled by natural caffeine sources. “While these benefits have traditional been associated with beverages, and to a lesser extent snack bars, they’re starting to appear in the salty snack space. The next iteration of salty snacks could well include postbiotics for immune support, plant sterols for heart health or choline for cognition.”

Another area of innovation in the salty snack space revolves around the product offerings themselves, LeDrew comments. “We also expect to see a resurgence in product development around convenience and portability. COVID-19 kept consumers close to home, so brands slowed some of those development efforts. Now as the pandemic recedes here in the U.S., look for heightened innovation in this space.”

Related to this, and as lingering fall-out from the pandemic, we may see sports venues and similar foodservice outlets continue to offer packaged snacks as way to assuage COVID-inspired concerns about sanitation and food safety, LeDrew adds. “Salty snacks can really deliver on this need—offering a tasty treat that can easily be packaged to address consumers’ health and safety concerns.”

In the popcorn category, Chuck Lepley, founding partner, Opopop, Denver, says that microwave popcorn has basically remained the same since it was invented over 40 years ago—kernels are just put in a bag with a gooey mess of ingredients. “We saw the opportunity to not only create a better experience for consumers, but also to improve upon the flavor offerings currently available in microwave popcorn. So we’re excited to shake up the category with the world’s first Flavor Wrapped Popcorn Kernels,” he says.

Courtesy of Opopop

In June 2021, Opopop released its Flavor Wrapped Popcorn Kernels. The “secret” to its taste is that each kernel is individually wrapped in flavoring and a mix of ingredients prior to popping. Flavor Wrapped Popcorn Kernels come in six flavors including reimagined classics such as Fancy Butter, and uniquely created experiences like Maui Heat and Vanilla Cake Pop.

“We use a proprietary technique that’s similar to making chocolate-coated candy,” says Lepley. “It’s not only completely different than anything else available, it has also allowed us to create evenly coated, amazing-tasting popcorn,” he says.

“We have an exciting pipeline of new Flavor Wrapped Popcorn Kernels flavors as well as other completely new popcorn products. Some of them we’ll introduce in [autumn] and the holiday season, others will be coming out next year. We’re thrilled to be bringing a much-needed injection of new flavors and products to popcorn lovers. And we think they’ll love what we’ve got coming just as much as they’ve been loving Flavor Wrapped Popcorn Kernels and the accompanying flavors that we introduced this summer,” Lepley adds.

The combo of sweet and savory in the salty snacks category can’t be overlooked. Gretchen Hadden, marketing manager, Cargill Cocoa & Chocolate, says that while health and wellness is one trend evident in the category, there’s also a countermovement, doubling down on indulgence by pairing salty snacks with sweet flavors like chocolate. “In fact, in our recent proprietary research, ChocoLogic, consumers ranked chocolate paired with a salty flavor as their third favorite chocolate pairing out of eight choices—just behind caramel and peanut butter. Whether it is crunchy potato chips dipped in smooth dark chocolate or cane sugar-glazed popcorn, these salty-sweet combinations can yield highly satisfying snacks,” she says.

“Of course, there’s also a place for chocolate in the better-for-you space, as our ChocoLogic consumer survey clearly revealed,” says Hadden. “It found nearly seven in ten consumers associate chocolate with health benefits, a characterization even more prominent among consumers of dark chocolate. That suggests plenty of opportunity for trail mixes made with chocolate, nuts, seeds and dried fruit, or yogurt or protein-rich compound coatings for enrobing pretzels, nuts and more.”

“Consumers ranked chocolate paired with a salty flavor as their third favorite chocolate pairing out of eight choices—just behind caramel and peanut butter.”

— Gretchen Hadden, marketing manager, Cargill Cocoa & Chocolate

New equipment

The continuing advancement of smart, connected technologies, and the integrated control opportunities they offer, is delivering real benefits to snack producers looking to innovate, says Johnson. “With digitally-enabled operating systems and sophisticated feedback controls, today’s processing and packaging equipment is more accurate, consistent and flexible than ever before. This gives snack brands the freedom to follow the latest trends, adapt recipes and pivot their operations, simply by adding a new pre-set recipe into their frying, seasoning, or packaging solutions system,” she says.

“And what’s more: These connected systems allow for seamless integration between line components, making it easy to add any [specialization] that equipment producers need to create the next snacking sensation,” says Johnson.

José Coelho, Americas business director, Clextral USA, Tampa, FL, says Clextral’s new Evolum+ Twin-Screw Extrusion Flex Line lines offer flexibility to run a wide variety of snack shapes and textures and ingredient formulations, from typical starchy corn bases to more elaborate formulations with proteins, fibers, and non-grain veggies. “Clextral’s new hygienic Evolum+ platform with extrusion, drying, and coating was designed to meet the growing market trends for high capacity production, efficiency, process flexibility and quick product changeover,” he says.

“Our new high efficiency dryer, Evolum+, has a built-in cleaning system to allow production to easily process both savory and sweet coated products,” says Coelho. “Our latest automation system, Fitsys+V3, is designed for operational and production efficiency by enabling quick loading of new product formulations and required process conditions, plus automatic production start/stop, monitoring, and recording of process operations. We also offer multiple ‘clip-on’ auxiliaries that are easily set in the production line to make co-filled snacks, post-cutting for wavy snacks, sticks, croutons, and many more.”

The Evolum+ twin screw extruders’ geometry enables a large operating window for torque, power and screw speed, which gives manufacturers a high level of flexibility in the processing parameters, says Julie Prost, process engineer and test plant manager, Clextral USA.

Courtesy of Clextral

“The extruders are modular and fitted with hydraulic barrel opening for quick screw and barrel reconfiguration, and the ‘clip on’ ancillaries can be moved into position as needed,” says Prost. “Our extruders have proprietary Advanced Temperature Control ATC, a self-learning technology that provides absolute precision in temperature control in each barrel module. This control is very important when working with recipes with high levels of fiber, starch, and protein,” she notes.

Prost says that clean-label protein ingredients are hot right now, and that Clextral is working with non-traditional ingredients including sorghum, quinoa, and blue corn. The company has also had requests for dairy-free vegan flavors, and these flavors can be used in many ethnic and regional flavor profiles, she expands.

Ken Schwenger, president, Bakery Concepts International, LLC, Mechanicsburg, PA, says that since the company’s Rapidojet machine hit the market, several companies have developed their own, low-pressure versions. Since corn masa contains no gluten, Bakery Concepts International is able to run it as a continuous mixer.

Schwenger notes a prominent snacks company has been using Rapidojet for more than three years for this purpose. By eliminating their mixers, the company has seen the following benefits:

Courtesy of Bakery Concepts International, LLC

90 percent less mixing energy

80 percent less labor

Increased yield due to a stronger, more-homogeneous bond between dries and liquid

No more mixers, mixing bowls, or hoist

Low maintenance costs—no gear box to replace or mixing tools to replace

Benefits for sanitation and worker safety, as Rapidojet’s Mixing Chamber replaces the normal mixing bowl and features tool-less removal for cleaning

Continuous production

No lost batches due to scaling errors