Nutrition bars

market trends

The BOTTOM LINE

- Bars for on-the-go or at home

- Innovative ingredients like chickpeas

- Grain-free, gluten-free continue their popularity

Everyday indulgences

During the pandemic, bars pivot from on-the-go to an ‘anytime’ snack.

Liz Parker, Managing Editor

Whether for breakfast, a snack, or a meal replacement, the nutrition bars category is ubiquitous, and its products can be consumed at any time of day. Sales have rebounded after a flat period, and innovation is ongoing in the category.

Market data

According to data from IRI, Chicago, for the 52 weeks ending February 20, 2022, the “snack bars/granola bars/clusters” category grew 13.3%, with $6.85 billion in total sales.

In the “nutritional/intrinsic health value bars” subcategory, CLIF lead the way, with $790 million in sales and a sizable increase of 19.8%. Atkins is second in the segment, with $302 million in sales, and KIND brought in $294 million in sales, with an 8.4% increase.

In the “breakfast/cereal/snack bars/clusters” subcategory, the category itself brought in $1.98 billion in sales, with a hefty increase of 21.5%, and Kellogg’s brought in $738 million of that, with a 13.5% increase. KIND brought in $277 million, with a 33% increase, and private label bars brought in $213 million, with a 23.4% increase.

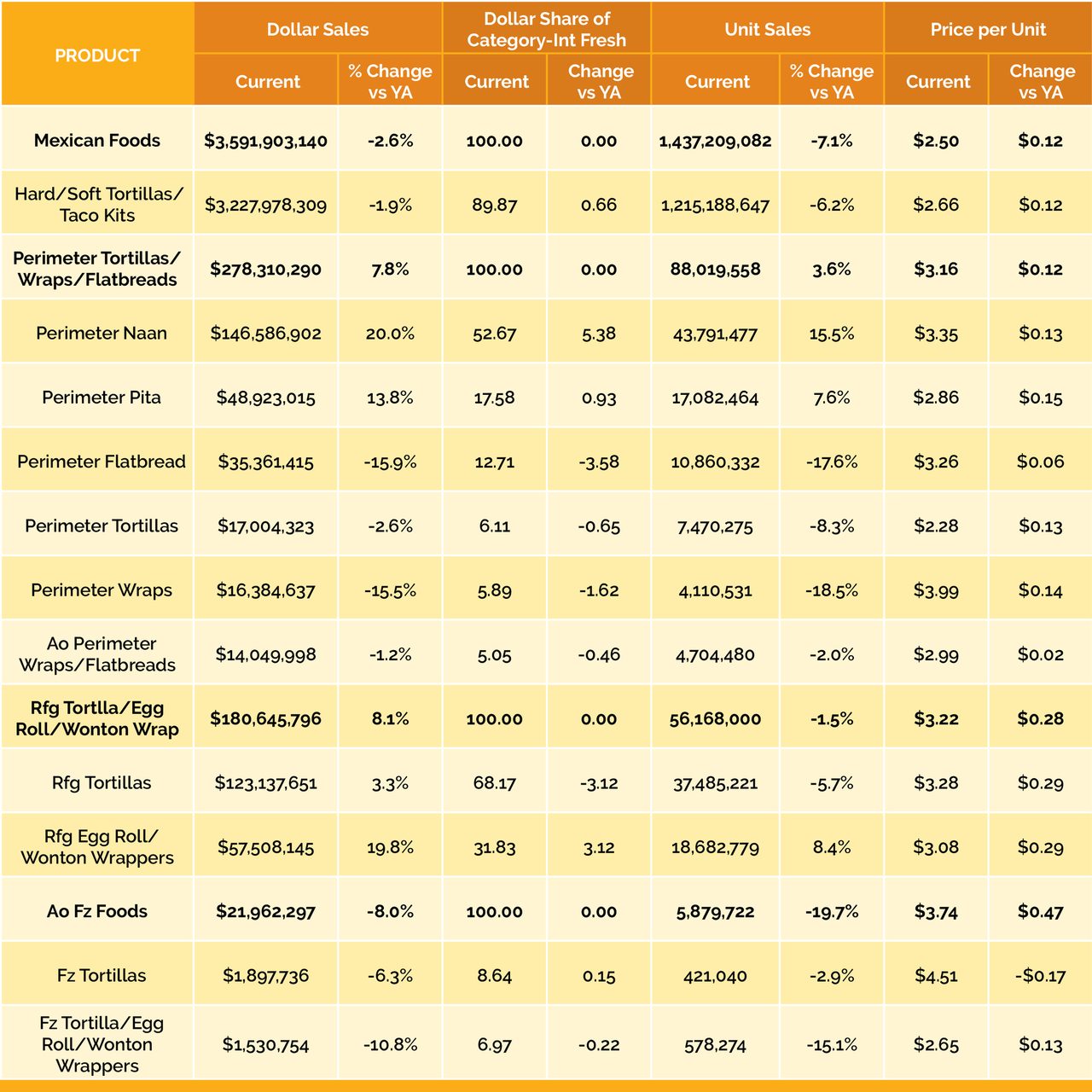

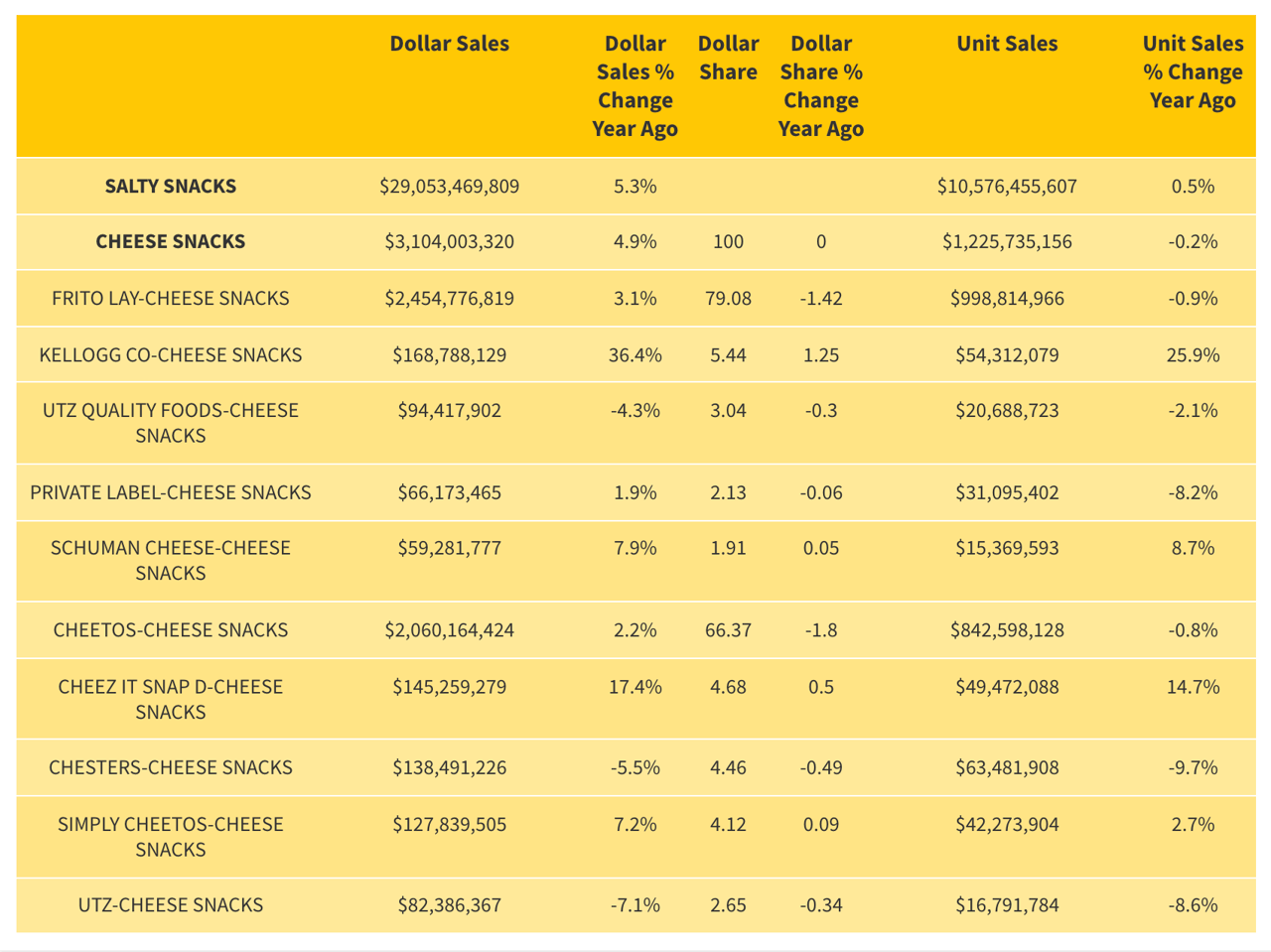

Source: IRI, Chicago, Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains), Latest 52 Weeks Ending September 5, 2021

PINCH TO ZOOM IN ON CHART

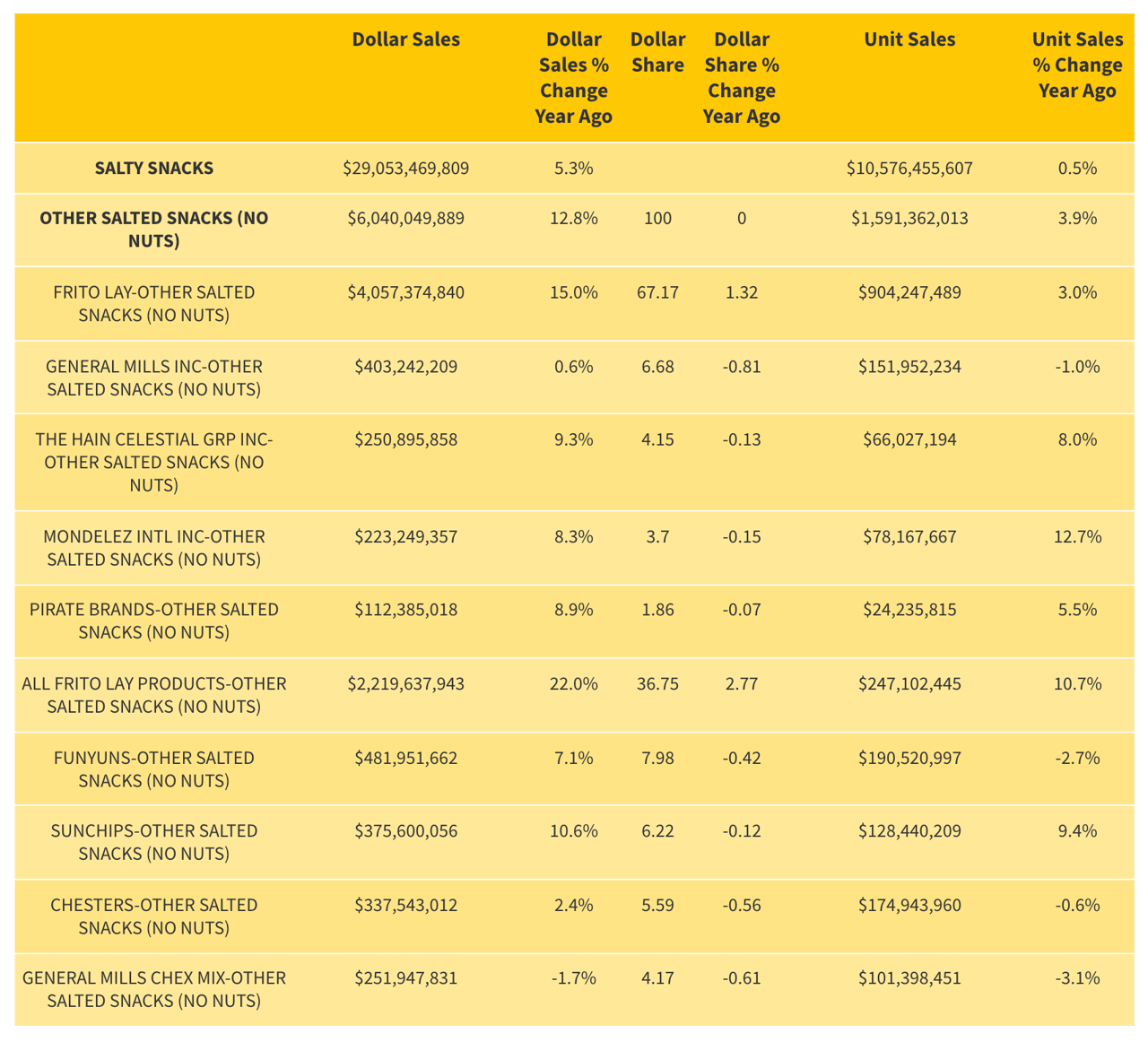

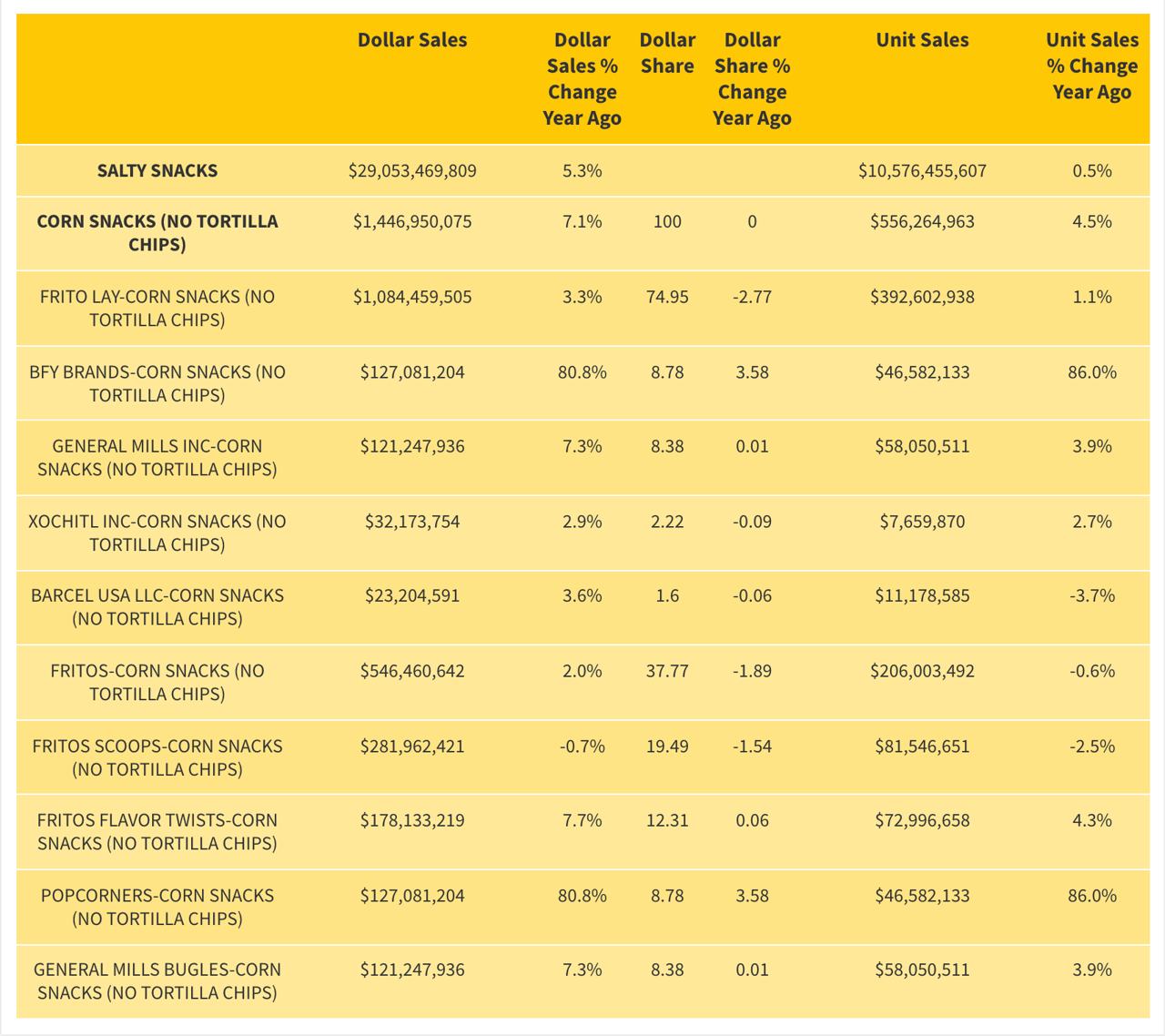

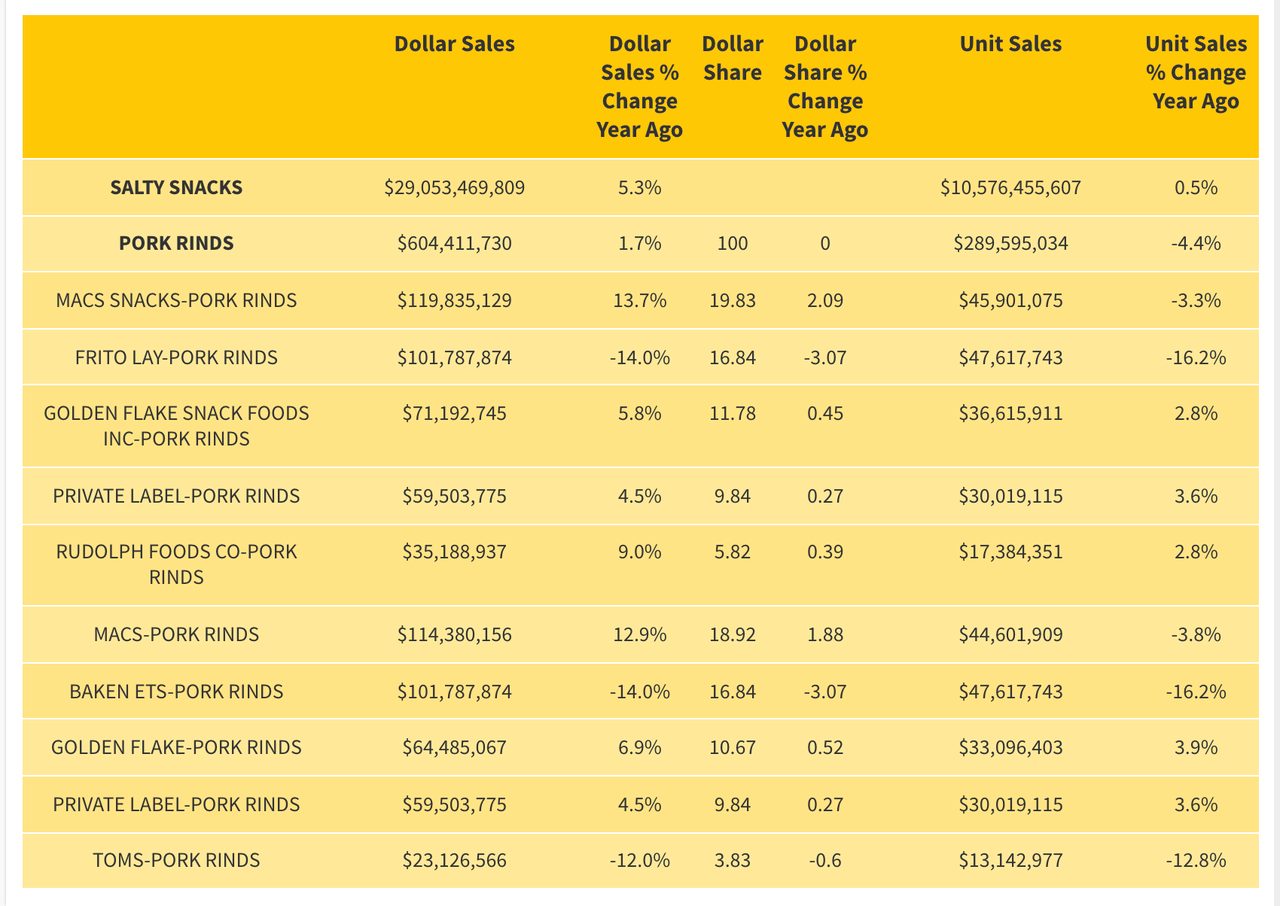

Source: IRI, Total U.S. - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers), Latest 52 Weeks Ending 10-31-21

HOVER OVER CHART TO SCROLL DOWN

HOVER OVER CHART TO SCROLL DOWN

Source: IRI Market Advantage, Integrated Fresh, Total U.S. - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers), 52 Weeks Ending 2-20-22

In the granola bars subcategory, it brought in $1.45 billion in sales with a 4% increase. Nature Valley lead the pack, with $610 million in sales and a 3.4% increase, with Quaker bringing in $397 million, with an 8.9% increase, and Sunbelt bringing in $109 million, with a slight 0.2% increase.

Finally, in the “all other snack/granola bars/clusters” subcategory, which brought in $40 million and showed an increase of 40.4%, private label was the winner, with $12.7 million in sales and an 88.4% increase. Munk Pack also brought in $5.7 million in sales, with a large increase of 444.9%, and Nature Valley showed an astonishing growth of 1595.3 percent, with $2.3 million in sales. Fulfil brand also climbed 775.9%, with $1.24 million in sales, and :ratio brand bars, from General Mills, brought in $3.17 million in sales, with a 220.3% increase.

“To pivot Quest’s protein bar relevance and consumption during this period, we had to reframe our bars for an at-home eating occasion.”

— Linda Zink, chief marketing officer, Simply Good Foods, Quest Nutrition

A changing market

“The market for bar products has changed since the start of the pandemic. Bars are typically consumed on-the-go; however, during the peak of stay-at-home, we saw the bar category take a hit,” says Linda Zink, chief marketing officer, Simply Good Foods, Quest Nutrition, Denver. “To pivot Quest’s protein bar relevance and consumption during this period, we had to reframe our bars for an at-home eating occasion. We launched a marketing communication campaign to encourage fans to heat up their favorite Quest protein bar in the microwave, oven, or air fryer and to enjoy them at home in a new (and delicious!) way,” she explains.

“Recently, the protein bar category has recovered. Consumers continue to look for convenient forms for meal replacement and snacking, whether at home or on-the-go, and protein bars are uniquely positioned to deliver both needs,” Zink adds.

Eileen Flaherty, senior brand manager, RXBAR, Kellogg Co., Battle Creek, MI, says that through the pandemic, there have been shifts in how consumers shop the category, including growth in online grocery pick-up and delivery and a shift towards bulk buying. “Between-meal-snacking at home became even more prevalent, with consumers seeking options that deliver on taste, satiety and nutrition. Additionally, as pandemic restrictions have eased, we’ve seen pick-up in on the-go-formats and nutrition bars. With our bars being a go-to for on-the-go, we’re seeing this shift as consumers resume busy, active lifestyles,” she comments.

Liz Watson, brand manager, CLIF, Emeryville, CA, says that due to the pandemic, outdoor activities have been popular, which bodes well for bars. “Outdoor activities such as hiking, running, and biking have been a welcome and safe escape for many these past couple years. Products such as our classic CLIF BARs and more protein-dense CLIF Builders have continued to be popular with consumers who have been keeping active while social distancing,” she says.

“In terms of lighter snacking options, we recently launched CLIF Thins in retailers nationwide,” continues Watson. “New research conducted by CLIF shows that 72% of Americans increased their snacking since the start of the pandemic. The past several months has also been a period of ever-evolving lifestyle changes, whether it be transitioning to a hybrid-remote work model, or finally returning to travel after years of staying put. Consumers are hungry for an on-the-go snack that won’t weigh them down, as two in three Americans report they have returned to their pre-pandemic routines.”

Top trends and new products

Zink says that consumers continue to look for products that aren’t packed with net carbs and sugar while providing significant amounts of protein—without compromising on taste. “Quest has delicious, indulgent options to support [consumers’] nutritional goals, offering both the macros and taste consumers want. In particular, texture continues to be important to consumers. We see strong sales trends on our crispy textured Quest Hero Protein Bars,” she says.

The brand is launching new Quest Protein Bar Minis to capture more snack occasions for protein bars. “These 80-calorie bars offer 8 grams of protein, 2 grams of net carbs, and less than 1 gram of sugar per mini bar—and are perfect as an anytime snack,” says Zink. “The Quest Protein Bar Minis are great to enjoy at home, on the go, between meals, or whenever you need a protein pick-me-up, and will be available in two fan favorite and best-selling Quest flavors: Chocolate Chip Cookie Dough and Cookies & Cream.”

Bar consumers often seek to fulfill multiple needs through the products. Watson says CLIF’s research shows that when choosing a snack, consumer decisions are most influenced by flavor, nutrition, and sugar content. “At CLIF, we are always working to meet the needs of consumers. That is why we work to create products available in a wide variety of flavors, containing real plant-based ingredients and offer products, like CLIF Thins, that are perfect for everyday snacking.”

Courtesy of CLIF Bar & Co

The company’s latest product launch, CLIF Thins, are mindfully made with plant-based ingredients like organic rolled oats, underlining its commitment to utilize ingredients that nourish bodies and support a healthy planet. “With 100 calories and 5 grams of sugar per pack, CLIF Thins are a crispy, crunchy snacking option for those seeking a snack with real ingredients,” Watson notes.

Flaherty says RXBAR sees consumers prioritizing different needs for different occasions—from taste and nutrition to broader benefits—opening multiple ways into new product development. “RXBAR products are meeting the trends we’re seeing drive innovation in the category. For example, as interest for bite-sized snacks and portion control grew, we introduced RXBAR Minis in a variety of flavors, like Chocolate Sea Salt, Peanut Butter Chocolate, Blueberry, and Coconut Chocolate. As we look to future innovation, we continue to prioritize the demand we’re seeing for better-for-you, benefit-led options,” she notes.

Flaherty shares that RXBAR has exciting plans for bars in 2022, including new formats and flavors, and is continuing to grow its Minis format, one of its most-highly requested product launches. “Additionally, this spring, we will be adding to the product portfolio with a delicious and satisfying option to help start the day. Lastly, we continue to see opportunity to expand our nut butter and breakfast portfolios. We’re listening to consumer feedback and honing in on trends that align to our brand purpose: to fuel your future with what you need today. RXBAR’s product lines will be able to cater to consumers’ needs throughout their daily routines,” she says.

On the indulgent side, Lena Halabi, frozen health and wellness, NPD director, KIND International, New York, NY says that consumers still want to have their cake and eat it too—rather literally. “People want tasteful indulgence, without the baggage that comes with that—and I don’t blame them! In the food world, permissible indulgence continues to rise, with a myriad of innovation in aisles like ice cream, cereal, and bars. The most successful items I have seen either offer a smaller format, in a creative way, like a “thin” version of a product, or a miniature size of it, such as the ever-popular Trader Joe’s mini ice cream cones,” she shares.

The trends of “keto” and “paleo” also continue to grow as people seek lower sugar options, says Halabi. “This has mostly manifested in cereal and bars, and is dominated by seed and nut ingredients, with either indulgent dessert flavors, or fresh flavors like matcha or cinnamon. Another similar trend that seems to be picking up is ‘grain-free’ snacks, such as pretzels made with cassava flour instead of wheat or other grains.”